Last updated: July 29, 2025

Introduction

Chlordiazepoxide, a benzodiazepine derivative approved in the 1960s, is primarily used for managing anxiety, alcohol withdrawal symptoms, and related disorders. It was among the first benzodiazepines introduced to clinical practice, revolutionizing the treatment landscape for anxiety and agitation. Despite its early prominence, the evolving regulatory environment, clinical preferences, and availability of newer therapeutic agents continue to influence its market dynamics. This article examines the current market landscape, factors shaping its financial trajectory, and future outlook amid healthcare trends.

Historical and Regulatory Context

Chlordiazepoxide, marketed initially under the brand Librium by Roche, received FDA approval in 1960, marking it as the first benzodiazepine introduced internationally[1]. Its mechanism of enhancing GABAergic neurotransmission provided an effective and safer alternative to barbiturates. As its clinical utility was established, it experienced widespread prescribing for anxiety, insomnia, and alcohol withdrawal syndrome.

Over the decades, regulatory frameworks have tightened, primarily due to concerns over dependence, abuse potential, and adverse effects. In the United States, the Drug Enforcement Administration classifies benzodiazepines as Schedule IV controlled substances, reflecting significant but manageable abuse risks. The FDA has issued warnings over long-term use, emphasizing cautious prescribing[2].

Market Dynamics

1. Market Size and Segmentation

Despite being a pioneer medication, chlordiazepoxide's market share has declined markedly over the last two decades. The global anxiolytics market, valued at approximately $5 billion in 2021, is dominated by newer agents such as diazepam, lorazepam, and alprazolam, which offer improved pharmacokinetics and safety profiles[3].

However, niche segments remain. Chlordiazepoxide retains clinical utility in alcohol withdrawal management owing to its long half-life and efficacy. The organic alcohol detoxification market is estimated at around $2 billion globally, with a significant portion attributed to benzodiazepines, including chlordiazepoxide[4].

2. Competition and Drug Substitutes

The pharmaceutical landscape for anxiety and withdrawal management has shifted towards selective benzodiazepine formulations and adjunctive therapies. General practitioners prefer medications with fewer drug-drug interactions, lower dependency potential, and better patient compliance. Thus, drugs like lorazepam and diazepam, with more flexible dosing schedules and better safety profiles, have overtaken chlordiazepoxide in many markets.

The rise of non-benzodiazepine anxiolytics, such as buspirone and certain antidepressants, has further compressed the market share historically held by chlordiazepoxide[5].

3. Prescribing Trends

Prescribing behaviors are influenced by clinical guidelines and concerns over dependence. Many institutions restrict benzodiazepine use to short-term management, especially in mental health, favoring SSRIs and SNRIs for long-term treatment. Nevertheless, in alcohol withdrawal syndrome, chlordiazepoxide remains a recommended agent, with guidelines by the American Society of Addiction Medicine endorsing its use due to its proven efficacy and safety[6].

In regions with less restrictive regulatory environments or limited access to newer drugs, chlordiazepoxide still plays a notable role. Additionally, in low- and middle-income countries, it remains a cost-effective option, influencing its presence in local formularies.

Manufacturing and Supply Considerations

The production of chlordiazepoxide involves complex synthetic pathways, with active pharmaceutical ingredient (API) costs influenced by raw material availability and process efficiencies. Patent protections expired decades ago, leading to a proliferation of generic manufacturers globally. Price competition has driven down costs, especially in generic markets.

Supply chain disruptions, such as those experienced during the COVID-19 pandemic, posed challenges but generally did not severely impact availability due to multiple manufacturing sources[7]. However, the perception of abuse potential warrants stringent manufacturing and distribution controls in many jurisdictions.

Financial Trajectory and Market Forecasts

1. Current Revenue Trends

Given the decline in prescriptions for generalized anxiety disorders and the shift toward alternative therapies, revenues generated from chlordiazepoxide formulations have sharply declined. On a global scale, estimates suggest that annual sales for chlordiazepoxide products are averagely below $100 million, predominantly driven by institutional use in alcohol withdrawal management in select markets[8].

2. Market Drivers

- Niche application in alcohol withdrawal: Continued recommendation by clinical guidelines sustains demand.

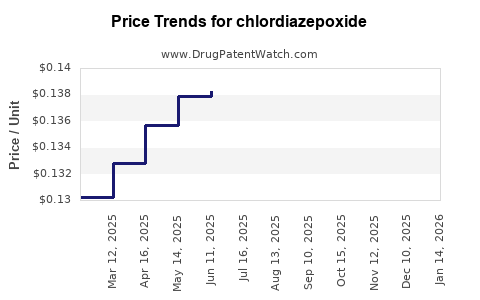

- Generic manufacturing: Multiple competing producers maintain low API costs and moderate retail prices.

- Regulatory stability: No new regulatory barriers threaten existing formulations.

3. Market Constraints

- Preferential prescribing of newer benzodiazepines: Loyalty to agents with improved safety profiles reduces chlordiazepoxide use.

- Regulatory restrictions regarding abuse potential: Efforts to limit benzodiazepine prescribing impact potential growth.

- Liability and adverse effect profile: Concerns over dependence and cognitive impairment restrain long-term use.

4. Future Outlook and Growth Potential

Looking ahead, the future of chlordiazepoxide remains predominantly in controlled environments for alcohol withdrawal. Its overall market is forecasted to contract further, with compound annual growth rates (CAGR) likely negative, estimated at -2% to -3% over the next five years. The low-cost generic nature stabilizes its niche but does not promise substantial revenue expansion.

However, in developing regions with constrained healthcare budgets, or in clinical scenarios where long-acting benzodiazepines are favored for specific indications, chlordiazepoxide might retain marginal relevance. The potential for repurposing or combination therapies appears limited, given the advent of novel agents and emerging therapies.

Legal and Regulatory Landscape Impact

The tightening of controls around benzodiazepines influences the financial trajectory by limiting prescribing flexibility and increasing oversight. Countries such as the UK and Australia have implemented stricter prescription monitoring programs, reducing access and prescribing volume[9]. Conversely, emerging markets with less stringent regulation provide limited growth prospects.

No significant patent protections or proprietary formulations exist today, which means innovations are primarily in manufacturing processes or delivery formats—none of which significantly alter the market size.

Healthcare Trends and Policy Influence

Healthcare systems are increasingly emphasizing safety, efficacy, and cost-effectiveness. The movement toward non-benzodiazepine therapies, especially for anxiety, further constrains the growth of classic agents like chlordiazepoxide. Conversely, efforts to improve alcohol withdrawal protocols and expand access in underserved regions could sustain niche demand.

The ongoing COVID-19 pandemic sheds light on mental health needs, but current data suggest preference for newer medications due to safety concerns. Telemedicine and digital health tools also influence prescribing behaviors, favoring agents with established safety evidence and ease of management.

Key Takeaways

- Chlordiazepoxide’s global market has contracted significantly since its debut, primarily due to shifts toward newer benzodiazepines and non-benzodiazepine anxiolytics.

- Its core market persists within alcohol withdrawal management, with moderate growth potential in low-resource settings.

- The marketplace is characterized by high generic competition, low API costs, and decreasing prescribing volumes.

- Regulatory restrictions on benzodiazepines influence the financial prospects, especially in developed countries with stringent controls.

- Future growth is unlikely; the drug's role remains predominantly supportive, with limited scope for significant market expansion.

FAQs

-

Is chlordiazepoxide still prescribed in the United States?

Yes, but primarily for alcohol withdrawal management in inpatient settings. Its use for generalized anxiety disorder has decreased due to newer agents and concerns over dependency.

-

What are the main alternatives to chlordiazepoxide for anxiety treatment?

Agents such as lorazepam, diazepam, and non-benzodiazepine anxiolytics like buspirone are preferred, given their improved safety profiles and prescribing flexibility.

-

How does regulation affect the market for chlordiazepoxide?

Stringent controls in many countries restrict prescribing and distribution, limiting market growth but also impeding misuse and abuse.

-

Is there potential for reformulation or new delivery formats for chlordiazepoxide?

Limited. The primary market drivers are clinical need and safety profiles; reformulations are unlikely to significantly alter the existing market trajectory.

-

What is the outlook for generic manufacturing of chlordiazepoxide?

It remains viable due to low production costs and high market demand in niche applications, but overall sales are expected to decline.

References

[1] FDA History of Benzodiazepines, U.S. Food and Drug Administration, 2010.

[2] Benzodiazepine Schedule Classification, U.S. DEA, 2021.

[3] Global Anxiolytics Market Size & Trends, Market Research Future, 2022.

[4] Alcohol Withdrawal Treatments Overview, WHO, 2019.

[5] Clinical Guidelines for Anxiety Disorders, APA, 2010.

[6] American Society of Addiction Medicine, Alcohol Withdrawal Management, 2021.

[7] Impact of COVID-19 on Pharmaceutical Supply Chains, PhRMA, 2021.

[8] Pharmaceutical Market Data, IQVIA, 2022.

[9] Prescription Monitoring Program Reports, UK MHRA, 2022.