Last updated: July 27, 2025

Introduction

Ambrisentan, marketed under the brand name Letairis among others, is a selective endothelin receptor antagonist primarily approved for the treatment of pulmonary arterial hypertension (PAH). Since its approval, Ambrisentan has established itself within a niche but growing therapeutic market. Its dynamics are shaped by regulatory, clinical, competitive, and economic factors, influencing its market positioning and financial prospects.

Pharmacological Profile and Therapeutic Indication

Ambrisentan functions by blocking endothelin-1, a potent vasoconstrictor implicated in PAH pathophysiology. Approved by the U.S. Food and Drug Administration (FDA) in 2007, it offers a targeted approach with demonstrated efficacy in improving exercise capacity and delaying disease progression in PAH patients. Its safety profile, characterized by risks such as peripheral edema and hepatotoxicity, aligns with other drugs in its class (e.g., bosentan, macitentan), but with a favorable selectivity profile that has influenced prescribing patterns.

Market Dynamics

Growth Drivers

-

Increasing Prevalence of PAH:

The global prevalence of PAH is estimated at 15-50 cases per million inhabitants, with higher incidences among females and certain genetic predispositions. With advancements in diagnostics, early detection has increased, expanding the eligible patient population for Ambrisentan.

-

Expanding Treatment Guidelines:

Recommendations increasingly favor endothelin receptor antagonists (ERAs) as first-line therapy, especially in combination regimens, promoting sustained demand for drugs like Ambrisentan. The 2022 ESC/ERS guidelines endorse ERAs, reinforcing its market position.

-

Growing Awareness and Diagnosis:

Enhanced clinician awareness, coupled with improved diagnostic tools such as echocardiography and right heart catheterization, boosts prescription rates of targeted therapies.

-

Combination Therapy Acceptance:

Ambrisentan’s compatibility with phosphodiesterase-5 inhibitors and prostacyclin analogs enables its integration into combination regimens, which are associated with better clinical outcomes and are favored in both guidelines and payer systems.

Market Limiters

-

Biomarker Limits and Patient Stratification:

Identification of responders versus non-responders remains challenging; this uncertainty may restrict utilization in certain populations.

-

Safety and Side Effect Concerns:

The risks of hepatotoxicity and potential teratogenicity necessitate stringent monitoring, possibly limiting physical and geographic patient access.

-

Pricing and Reimbursement Challenges:

As patent protections mature, generic formulations and biosimilars could erode market share. Payer restrictions based on cost-effectiveness thresholds also impact sales.

-

Competition Within Class:

Other ERAs such as bosentan and macitentan have comparable efficacy and safety profiles. Market share shifts depend heavily on physician preference, formulary access, and pricing strategies.

Financial Trajectory

Revenue Trends and Forecasts

-

Historical Performance:

Since its launch, Ambrisentan has experienced steady growth driven by increasing prevalence and adoption in PAH management. Global sales reached approximately $600 million in 2022, with North America comprising roughly 50% of this revenue, reflecting high penetration rates and reimbursement coverage.

-

Regional Variations:

North America remains the largest market due to advanced healthcare infrastructure and regulatory approvals. European markets are also significant, with a growing foothold in Asia-Pacific driven by expanding healthcare access.

-

Projection Outlook:

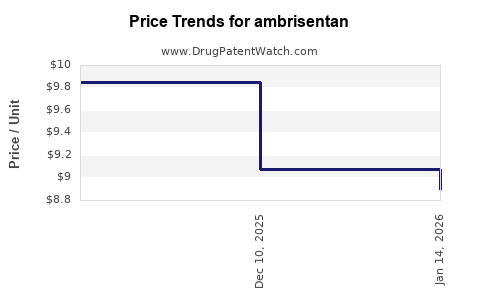

Analysts project a compounded annual growth rate (CAGR) of 4-6% over the next five years, driven by increasing diagnosis and combination therapy use. Patent expirations in select markets from 2025 onward could suppress revenues unless offset by biosimilar entrants or alternative formulations.

R&D and Pipeline Influence

-

Pipeline Developments:

While no direct chemical modifications or new indications have currently been announced, pipeline candidates aiming for better safety profiles or novel mechanisms may influence future positioning.

-

Regulatory Changes:

Approval of generic or biosimilar versions could significantly reduce pricing power, influencing the upward revenue trajectory.

Competitive Landscape

Ambrisentan faces competition primarily from bosentan (Tracleer) and macitentan (Opsumit), both of which possess similar efficacy with differing safety profiles and dosing regimens. The competitive edge of Ambrisentan lies in its selective receptor targeting, which reduces certain adverse effects, but cost considerations and clinician familiarity heavily influence market share.

Regulatory Environment and Its Impact

Regulatory bodies have implemented strict monitoring programs and risk evaluation mitigation strategies (REMS), especially for teratogenic effects, impacting prescribing flexibility. These regulatory constraints influence market dynamics by necessitating adherence to comprehensive monitoring, which can raise healthcare costs and affect patient access.

Economic and Market Challenges

-

Pricing Pressures:

Increasing prevalence algorithms and competitive pricing from generics will compel manufacturers to optimize pricing strategies.

-

Healthcare Policy Impact:

Cost-effectiveness analyses and value-based pricing models are expected to shape payer coverage decisions.

-

Emerging Technologies:

The development of novel therapies, such as prostacyclin receptor antagonists and gene therapies, could disrupt the existing PAH treatment paradigm, with potential implications on Ambrisentan's market share.

Conclusion and Future Outlook

Ambrisentan’s market trajectory is poised for moderate growth, buoyed by increasing disease awareness and evolving treatment landscapes favoring targeted therapies. Nonetheless, generics, competitive ERAs, and regulatory challenges constitute potential headwinds. The company's strategic focus on demonstrating real-world efficacy, safety, and cost-effectiveness will be essential for maintaining and expanding its market position.

Key Takeaways

- Growing Prevalence and Better Diagnostics drive demand, supporting steady revenue growth for Ambrisentan over the next five years.

- Combination Therapy adoption enhances its clinical utility and market penetration.

- Patent expirations and the introduction of biosimilars could pressure prices, requiring strategic pricing and marketing to preserve margins.

- Competitive ERAs and emerging therapies necessitate ongoing innovation and clinical differentiation.

- Regulatory and reimbursement policies significantly influence access and profitability, emphasizing the need for continuous compliance and value demonstration.

FAQs

1. What are the primary advantages of Ambrisentan over other ERAs?

Ambrisentan's selectivity for endothelin-a receptors offers a favorable safety profile, especially reduced hepatotoxicity compared to bosentan, and less frequent dosing, improving patient adherence.

2. How will patent expirations affect Ambrisentan’s market share?

Patent cliffs could lead to generic entries, significantly reducing prices and revenues unless the manufacturer secures new patents or develops next-generation formulations.

3. What are the main safety concerns associated with Ambrisentan?

Hepatotoxicity and teratogenic risk necessitate regular liver function monitoring and strict pregnancy prevention programs, impacting prescribing patterns and patient compliance.

4. How is combination therapy influencing Ambrisentan’s market?

Its compatibility with other PAH drugs promotes its role in multifaceted treatment regimens, enhancing its outlook amid guidelines favoring combination approaches.

5. What emerging factors could reshape Ambrisentan’s market?

Advances in gene therapy, novel drug classes, and more personalized medicine approaches could reduce reliance on current ERAs, altering long-term market dynamics.

Sources

- [1] U.S. Food and Drug Administration. Letairis (Ambrisentan) Prescribing Information.

- [2] European Society of Cardiology/European Respiratory Society Guidelines on Pulmonary Hypertension, 2022.

- [3] IQVIA, Global Pulmonary Hypertension Market Data, 2022.

- [4] EvaluatePharma, Market Outlook for Pulmonary Hypertension Drugs, 2023.

- [5] Drug Patent & Market Exclusivity Data, Drugs.com, 2023.