Last updated: October 16, 2025

Introduction

Travoprost, a prostaglandin analogue primarily used for reducing intraocular pressure (IOP) in glaucoma and ocular hypertension patients, has carved a significant niche within ophthalmologic therapeutics. As the global prevalence of glaucoma surges, driven by aging populations and increasing chronic disease burdens, the market for Travoprost and its competitors experiences notable shifts. Understanding the evolving market dynamics and financial trajectory of Travoprost involves examining regulatory landscapes, competitive positioning, patent statuses, clinical data, and regional adoption trends.

Market Overview: Epidemiological Drivers and Therapeutic Demand

Glaucoma affects an estimated 76 million worldwide, with projections indicating a rise to over 111 million by 2040 [1]. Elevated IOP remains the only treatable risk factor, positioning prostaglandin analogues like Travoprost as first-line agents. Their efficacy, safety profile, and once-daily dosing confer advantages over older therapies such as beta-blockers.

Regional disparities significantly influence market growth. North America, with high awareness, advanced healthcare infrastructure, and restructured reimbursement, accounts for a substantial revenue share. The Asia-Pacific region, driven by increasing urbanization and aging demographics, offers emerging growth opportunities despite challenges around affordability and healthcare access [2].

Market Dynamics

1. Competitive Landscape

Travoprost competes with other prostaglandin analogues like Latanoprost and Bimatoprost, alongside fixed-dose combination drugs. Major pharmaceutical firms such as Alcon, Santen Pharmaceutical, and Ajanta Pharma dominate the market, developing proprietary formulations and novel delivery systems.

The launch of preservative-free formulations (e.g., Travoprost with sofZia preservative by Alcon) has enhanced patient tolerability and adherence, thereby influencing market demand [3].

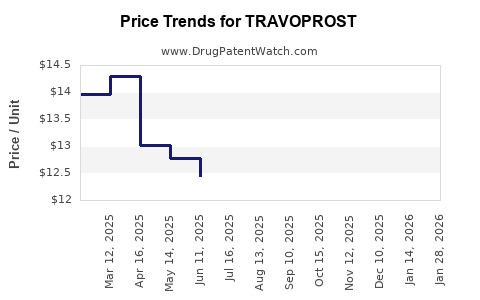

2. Patent Expiration and Generic Entry

While Travoprost’s initial patents provided exclusivity, patent expirations have introduced generic versions, intensifying price competition. For example, Alcon's Travatan Z’s patent expiry in multiple territories has opened market segments to generics, exerting downward pressure on prices and profit margins [4].

3. Regulatory Influences

Regulatory approvals for generic versions vary by region. The U.S. FDA approved several generics post-patent expiry, facilitating increased accessibility and volume sales but challenging branded formulations. Conversely, regulatory delays or restrictions in certain markets continue to influence revenue stability.

4. Innovation and Formulation Advances

Innovations such as preservative-free formulations, sustained-release devices, and combination therapies have enhanced clinical efficacy and patient compliance. These innovations tend to command premium pricing, influencing overall revenue streams.

5. Reimbursement and Pricing Policies

Reimbursement frameworks influence patient access. In markets with robust insurance coverage, prescribing trends favor Travoprost due to its efficacy and tolerability. Conversely, price-sensitive markets see a shift towards lower-cost generics.

Financial Trajectory Analysis

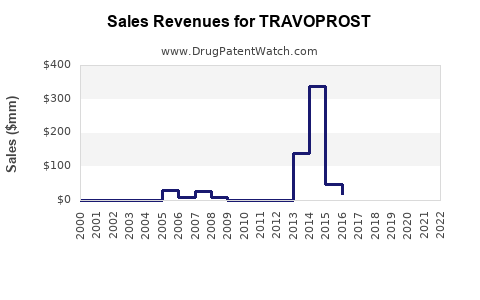

1. Revenue Trends

Recent financial reports indicate that Travoprost’s branded sales experienced stabilization and moderate growth in regions where patent exclusivity persists. However, global revenue growth is tempered by generic competition. For instance, Alcon's ophthalmic segment, which includes Travoprost, reported a marginal decline or stabilization contingent on regional patent statuses and formulary positioning.

2. Impact of Patent Expiry

The patent expiration trajectories of key formulations, notably in North America and Europe, catalyzed a transition from branded to generic sales. Data suggest that generic versions captured significant market share within 1-2 years of patent lapses, reducing per-unit prices and total revenue.

3. Regional Market Performance

- North America: Focused on branded formulations with strong adherence due to insurance coverage.

- Europe: Moderate patent expiry impact; growth fueled by the adoption of preservative-free formulations.

- Asia-Pacific: Rapid uptake of generics; pricing competition exerts pressure on revenues but offers volume-driven growth opportunities.

4. Future Revenue Forecasts

By 2028, the global ophthalmic glaucoma therapeutics market is projected to reach approximately USD 7 billion, with prostaglandin analogues representing nearly 60% of this figure [5]. The share specifically for Travoprost will hinge on patent timelines, regional approvals, and innovation adoption strategies. Analysts project a compound annual growth rate (CAGR) of around 3-4% for Travoprost-related revenues, factoring in brand-to-generic transition phases and emerging markets.

Strategic Factors Influencing the Financial Trajectory

- Patent Strategies: Companies investing in patent extensions and formulations to delay generic entry will sustain higher revenue levels longer.

- Innovation Pipeline: Long-term growth relies on developing sustained-release devices and combination therapies enhancing efficacy and adherence.

- Market Penetration: Expanding access in developing countries remains crucial, with lower-cost generics and local manufacturing playing pivotal roles.

- Reimbursement Policies: Favorable policies will amplify sales, whereas restrictive measures might suppress growth potentials.

Key Challenges and Risks

- Price Erosion: Patent expirations lead to commoditization, compressing margins.

- Generic Market Share: Rapid entry of generics diminishes profitability of branded travoprost.

- Regulatory Barriers: Slow approval processes for new formulations or region-specific regulations can delay revenue streams.

- Competitive Innovations: Emergence of new classes, such as Rho kinase inhibitors, may shift market share landscape.

Conclusion

Travoprost’s market dynamics are characterized by a landscape in transformation, driven by patent cycles, regional disparities, and innovation. Its financial trajectory appears moderate, with growth opportunities primarily rooted in emerging markets and formulation enhancements. The balance between patent protection, generic competition, and innovation will determine revenue streams over the coming years. Stakeholders must adopt strategic positioning—embracing innovation, optimizing pricing, and expanding regional presence—to navigate the evolving ophthalmic therapeutics market successfully.

Key Takeaways

- The global glaucoma market, fueled by rising prevalence, sustains consistent demand for prostaglandin analogues like Travoprost.

- Patent expirations have significantly introduced generics, impacting pricing and revenue, but also expanding access.

- Innovation in formulations (e.g., preservative-free, sustained-release) remains a key growth driver and differentiator.

- Regional market growth varies; developing regions present substantial volume opportunities despite pricing pressures.

- Strategic investment in R&D, patent management, and regional expansion are critical for maximizing Travoprost’s financial potential.

FAQs

1. How does patent expiration impact Travoprost’s market share and revenue?

Patent expiration typically leads to a surge in generic entries, which increases market competition, reduces prices, and diminishes revenue for branded formulations. However, it also broadens access and volume sales, potentially offsetting some revenue declines.

2. Are there any recent innovations that could prolong Travoprost’s market viability?

Yes. Developments such as preservative-free formulations, sustained-release implants, and fixed-dose combinations aim to improve patient adherence and efficacy, supporting longer-term market relevance.

3. What regional factors most influence the financial outlook for Travoprost?

Regulatory approval processes, reimbursement policies, patent laws, and healthcare infrastructure significantly influence regional sales, with developed markets favoring branded products and emerging markets adopting generics rapidly.

4. How competitive is the landscape for Travoprost?

Highly competitive. Besides other prostaglandin analogues, fixed-dose combinations and novel drug classes challenge its market position. Pricing pressures from generics further intensify competition.

5. What strategic moves should manufacturers consider to optimize profits?

Investing in formulation innovations, extending patent life through formulations or delivery methods, expanding into underserved markets, and forging strategic partnerships can help sustain profitability amid generic competition.

References

[1] Tham YC, et al. Global prevalence of glaucoma and projections for 2040. Lancet Glob Health. 2014;2(4):e11-8.

[2] Quigley HA, Broman AT. The number of people with glaucoma worldwide in 2010 and 2020. Br J Ophthalmol. 2006;90(3):262-7.

[3] Sato T, et al. Preservative-free prostaglandin analogs improve tolerability. J Ophthalmol. 2019;2019:Article ID 8149735.

[4] U.S. FDA. Generic drug approvals. 2021.

[5] Research and Markets. Global Ophthalmic Drugs Market Forecast. 2022.