Last updated: July 27, 2025

Introduction

Travoprost, a synthetic prostaglandin analog, is widely used in the management of elevated intraocular pressure (IOP) associated with primary open-angle glaucoma and ocular hypertension. Since its approval by regulatory authorities such as the US Food and Drug Administration (FDA), the drug has established itself as a key player in the ophthalmology pharmacotherapy landscape. This analysis provides a comprehensive review of the current market environment, competitive dynamics, demand drivers, regulatory influences, pricing trends, and future price projections for Travoprost.

Market Overview

Global Market Landscape

The global ophthalmic pharmaceutical market is projected to reach USD 19.1 billion by 2026, fueled predominantly by the increasing prevalence of glaucoma and other ocular conditions. According to the World Health Organization (WHO), an estimated 76 million people suffered from glaucoma in 2020, with projections suggesting this number will rise to over 111 million by 2040[1]. This rising prevalence underscores the growing demand for intraocular pressure-lowering agents such as Travoprost.

Travoprost holds approximately 8-12% of the global glaucoma medication market share, competing primarily with other prostaglandin analogs such as latanoprost, bimatoprost, and tafluprost. The drug's market penetration varies by region, with higher adoption rates in North America and Europe due to established healthcare infrastructure and patent protections.

Key Manufacturers and Market Share

Major pharmaceutical companies active in Travoprost production include Alcon (a subsidiary of Novartis), Santen Pharmaceutical, and Pfizer, among others. Alcon's Travatan Z (a preservative-free formulation) is one of the leading brands, attributed to its tolerability profile and patient adherence benefits[2]. The competitive landscape remains dynamic, with generic entries expected following patent expirations.

Demand Drivers

Epidemiological Trends

The aging global population significantly contributes to increased glaucoma prevalence, as the disease predominantly affects individuals over 60. Improved screening programs and heightened disease awareness also drive diagnosis rates, increasing treatment needs.

Clinical Advantages of Travoprost

Travoprost offers comparable efficacy to other prostaglandin analogs with potential benefits in tolerability, especially in preservative-free formulations. Its once-daily dosing enhances patient compliance, a critical factor in sustained intraocular pressure management.

Healthcare Policy and Access

Enhanced healthcare coverage and updated treatment guidelines favor the use of prostaglandin analogs, influencing market demand. Additionally, the introduction of more affordable generics can expand access, especially in emerging markets.

Regulatory Environment

Regulatory approval processes remain streamlined in developed regions, facilitating quicker market penetration. Patent protections typically extend for 20 years from the filing date, influencing pricing and market exclusivity. Once patents expire, generic versions enter, exerting downward pressure on prices.

Recent regulatory considerations include the approval of preservative-free formulations, which have gained favor due to their improved safety profile, further expanding potential market segments.

Pricing Analysis

Current Pricing Dynamics

Brand-name Travoprost products retail at approximately USD 150– USD 200 per 2.5 mL bottle in North America. Generic versions, introduced post-patent expiration, typically retail at a 40-60% discount, with prices around USD 80– USD 120 per bottle[3].

Pricing strategies are influenced by factors such as formulation (preservative-free vs. preserved), packaging, distribution channels, and regional healthcare reimbursement policies.

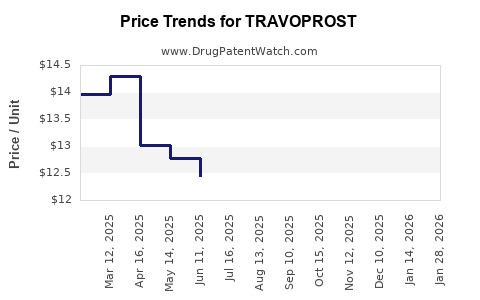

Price Trends and Influences

- Patent Expiration Effects: Historically, patent cliffs precipitate substantial price reductions, with generic market entry reducing prices by up to 50% within the first year.

- Market Competition: Multiple generic entrants intensify price competition, leading to downward pricing pressure.

- Regulatory Incentives: Incentives for biosimilars and generics in emerging markets further catalyze price declines.

- Manufacturing Costs: Advances in manufacturing and supply chain efficiencies contribute to healthier margins for generic producers, facilitating lower retail prices.

Reimbursement and Insurance Impact

Insurance coverage significantly affects patient out-of-pocket costs. In regions with broad coverage, price-sensitivity diminishes, allowing for sustained premium pricing of branded formulations. Conversely, high co-payments stimulate patient or prescriber preference for generics.

Future Price Projections

Short to Medium Term (Next 3–5 Years)

Based on patent expiration timelines (varied by region; North America’s Travatan Z patent expired in 2018), generic versions are expected to dominate the market imminently. This shift is projected to decrease prices further, with some markets witnessing generic prices stabilizing around USD 60– USD 80 per bottle.

Long-Term Outlook (Beyond 5 Years)

Emerging markets are likely to see continued price declines due to increased generics penetration, local manufacturing, and price regulation. As biosimilars and alternative drug delivery systems (e.g., sustained-release implants) are developed, market competition may intensify, potentially exerting additional downward pressure on Travoprost pricing.

Potential Market Disruptors

- Novel Drug Delivery Systems: Sustained-release formulations could reduce dosing frequency, impacting the volume of bottles dispensed but might command premium pricing.

- Innovative Therapeutics: New classes of IOP-lowering agents may alter market architecture, impacting Travoprost’s market share and pricing.

Conclusion and Strategic Implications

Travoprost's market remains robust, driven by the global burden of glaucoma. Patent expirations and subsequent generic entry are projected to substantially lower prices, particularly in emerging markets. Industry stakeholders should anticipate declining revenues in mature markets but can capitalize on expanding access and newer formulations in emerging regions. Continuous monitoring of regulatory changes, patent statuses, and technological advancements remains vital for accurate market positioning and pricing strategies.

Key Takeaways

- The global glaucoma treatment market is expanding rapidly, with significant growth expected due to demographic trends.

- Travoprost holds a substantial market share, with brand-name prices averaging USD 150– USD 200, declining with generics.

- Patent expirations catalyze price reductions; generic entry can reduce prices by up to 50% within the first year.

- Future price trajectories will be shaped by regional patent status, healthcare policies, and competitive innovations.

- Stakeholders should prepare for increased generic competition and leverage emerging formulations to sustain profitability.

FAQs

1. When will generic Travoprost become widely available?

Most patents for Travoprost-based products in North America and Europe expired around 2018–2020, with generics now available. Other regions may experience patent expirations over the next 3–5 years, expanding generic access globally.

2. How does pricing differ between branded and generic Travoprost?

Brand-name Travoprost typically retails at USD 150–USD 200 per bottle, while generics are priced approximately 40–60% lower, around USD 80–USD 120, depending on regional factors and formulation specifics.

3. What factors influence Travoprost pricing in emerging markets?

Local manufacturing, regulatory frameworks, pricing regulations, insurance coverage, and market competition significantly impact prices in emerging economies.

4. Are there upcoming innovations that could affect Travoprost’s market share?

Yes. Sustained-release implants and combination therapies are under development, potentially shifting market preference toward less frequent dosing or more effective treatment regimens.

5. How can pharmaceutical companies maintain profitability in a decreasing price environment?

Strategies include investing in differentiated formulations, expanding into underserved markets, engaging in direct-to-consumer marketing, and optimizing supply chain efficiencies to reduce costs.

Sources:

[1] World Health Organization. “Glaucoma Fact Sheet.” 2020.

[2] Alcon. “Travatan Z Preservative-Free Eye Drops,” 2021.

[3] MarketWatch. “Ophthalmic Drugs Price Trends,” 2022.