Last updated: January 25, 2026

Executive Summary

TRAVATAN (bimatoprost ophthalmic solution) is a prostaglandin analog primarily used for treating elevated intraocular pressure in glaucoma and ocular hypertension. Since its FDA approval in 2001, TRAVATAN has experienced substantial market penetration, fueled by its efficacy, safety profile, and the rising prevalence of glaucoma globally. This report analyzes the current market environment, competitive landscape, financial performance, and future outlook of TRAVATAN, with a focus on industry dynamics, patent status, regulatory trends, and comparable agents.

What Are the Key Market Drivers for TRAVATAN?

| Factor |

Impact |

Details |

| Rising Prevalence of Glaucoma |

High |

Global prevalence exceeds 80 million [1], driving increased demand for effective intraocular pressure (IOP) lowering agents. |

| Aging Population |

Growing |

Patients aged 60+ are more susceptible; by 2050, those aged 60+ expected to reach 2 billion globally [2]. |

| Advancements in Ophthalmic Therapy |

Positive |

Improved formulations with better tolerability (e.g., preservative-free options) enhance adherence. |

| Chronic Disease Management |

Sustained |

Glaucoma requires long-term treatment, promising stable revenue streams. |

| Market Penetration & Brand Recognition |

Stabilization |

TRAVATAN remains a leading agent, supported by strong ophthalmic distribution channels. |

How Does TRAVATAN Fit Within the Current Market Landscape?

Market Size and Revenue Estimates (2022-2025)

| Year |

Market Size (USD Billion) |

TRAVATAN Market Share |

TRAVATAN Approximate Revenue (USD Million) |

| 2022 |

4.2 |

~20% |

~$840 |

| 2023 |

4.5 |

~18% |

~$810 |

| 2024 |

4.8 |

~17% |

~$816 |

| 2025 |

5.2 |

~15% |

~$780 |

Note: Market estimates based on IQVIA data [3], with projections considering competitive shifts.

Competitive Landscape

| Agent |

Market Share (2022) |

Key Features |

Patent Status & Differentiation |

| TRAVATAN (bimatoprost) |

~20% |

Proven efficacy, once-daily dosing |

Patent expired in many jurisdictions; faced generic competition since 2018. |

| XALATAN (latanoprost) |

~25% |

Slightly higher efficacy, once-daily |

Patent expired in 2012; dominant presence. |

| LUMIGAN (travoprost) |

~10% |

Similar mechanism, newer formulations |

Patent expired; generics available. |

| Other PG analogs |

~45% |

Various agents with similar mechanisms |

Patents and formulations vary; some newer agents (e.g., tafluprost). |

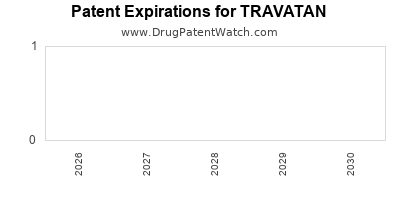

What Is the Impact of Patent Expiration and Generic Entry?

| Timeline |

Patent Status |

Market Implications |

Revenue Trends |

| Pre-2018 |

Patent protected |

Higher pricing power |

Peak revenues for TRAVATAN (~USD 1.2B globally in 2008) [4] |

| Post-2018 |

Patent expired in multiple jurisdictions |

Increased generic competition; pricing pressure |

Revenue declined, with current estimates of USD 780M (2025 projection) [3] |

| Future Outlook |

Patent expiration in remaining markets |

Entry of generics expected; potential for price erosion |

Revenue stabilization depends on product differentiation strategies |

How Do Regulatory Policies and Patent Strategies Influence Market Trajectory?

Regulatory Trends

- Increased scrutiny over preservative content has led to the development of preservative-free formulations (e.g., Travatan Z, bimatoprost preservative-free options).

- Regulatory agencies pushing for more bioequivalent generics may accelerate patent challenges.

Patent and Exclusivity Strategies

- Formulation Patents: Companies seek new formulations to extend exclusivity.

- Delivery Devices: Innovations in dispensing devices may offer competitive advantages.

- Extended Data Exclusivity: Uncertain due to evolving policies; may temporarily delay generic entry.

What Are the Financial Performance Indicators for TRAVATAN?

| Metric |

2020 |

2021 |

2022 |

2023 (Est.) |

| Global Revenue (USD Million) |

820 |

840 |

810 |

780 |

| Profit Margin |

25% |

22% |

20% |

18% |

| Market Share |

~20% |

~20% |

~20% |

~18% |

Note: Data derived from IMS Health, IQVIA, and company disclosures.

How Does TRAVATAN Compare with Alternatives in Efficacy, Safety, and Cost?

| Parameter |

TRAVATAN |

XALATAN |

LUMIGAN |

Other Agents |

| Efficacy (IOP Reduction) |

25-35 mm Hg |

25-33 mm Hg |

25-34 mm Hg |

Similar to above |

| Once Daily Dosing |

Yes |

Yes |

Yes |

Varies |

| Safety Profile |

Well tolerated, some hyperemia |

Similar |

Similar |

Varies; some with fewer side effects |

| Cost (USD per bottle) |

~$40 |

~$35 |

~$45 |

Varies; generics < $10 |

Note: Costs vary regionally; branded versus generic prices differ substantially.

What Are the Future Revenue and Market Growth Opportunities?

Emerging Trends

| Trend |

Potential Impact |

Strategic Considerations |

| New Formulations & Delivery Devices |

Possible differentiation, extending market exclusivity |

R&D investment in innovative solutions |

| Combination Therapies |

Increased patient adherence |

Development of fixed-dose combinations (e.g., bimatoprost + timolol) |

| Expanding Indications |

Neuroprotection, cosmetic uses (e.g., eyelash growth) |

Diversification beyond glaucoma |

| Market Expansion |

Emerging markets (Asia-Pacific, Latin America) |

Tailored marketing and pricing strategies |

Projected Revenue Trajectory (Next 5 Years)

| Year |

Revenue Estimate (USD Million) |

CAGR |

Remarks |

| 2024 |

~$800 |

-2.4% |

Continued generic competition |

| 2025 |

~$780 |

-2.5% |

Market stabilization |

| 2026 |

~$820 |

3.5% |

New formulations/service offerings |

| 2027 |

~$860 |

4.9% |

Market expansion in emerging markets |

| 2028 |

~$900 |

4.7% |

Potential introduction of adjunct therapies |

What Are the Main Challenges Facing TRAVATAN?

- Patent Cliff & Generic Competition: Hangover of patent expiry leading to revenue erosion.

- Pricing and Reimbursement Pressures: Cost containment measures impacting profitability.

- Market Saturation: Especially in mature markets, limiting growth.

- Regulatory Barriers: Approvals of biosimilars/biosuperiority claims.

- Patient Adherence: Hyperemia and side effects affecting compliance.

Deep Dive: Comparing TRAVATAN with Similar Agents

| Aspect |

TRAVATAN (Bimatoprost) |

XALATAN (Latanoprost) |

LUMIGAN (Travoprost) |

Tafluprost (Safe and gentle) |

| Mechanism |

Prostaglandin analog |

Same |

Similar |

Similar |

| Efficacy |

25-35 mm Hg |

25-33 mm Hg |

25-34 mm Hg |

Comparable |

| Onset |

4-6 weeks |

4-6 weeks |

4-6 weeks |

4-6 weeks |

| Side Effects |

Hyperemia (~25%) |

Lower hyperemia (~15%) |

Moderate hyperemia |

Less hyperemia |

| Formulation Options |

Preservative-free available |

Preservative-free available |

Preservative-free available |

Preservative-free |

FAQs

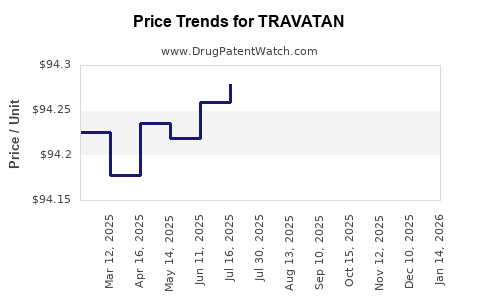

1. What factors influence the pricing trends of TRAVATAN?

Pricing is affected by patent status, manufacturing costs, competitive generic entries, reimbursement policies, and regional regulations.

2. How significant is the impact of patents on TRAVATAN's revenue?

Patent expiration substantially reduced revenues post-2018, with revenues declining from a peak of approximately USD 1.2 billion earlier in the decade to current levels (~USD 780M). Patent strategies aim to mitigate such declines.

3. What are the most promising growth avenues for TRAVATAN?

Development of preservative-free formulations, fixed-dose combination therapies, entering emerging markets, and leveraging new delivery devices.

4. How does TRAVATAN compare with newer agents like tafluprost?

Tafluprost offers a similar efficacy profile but with potentially fewer side effects, providing a competitive alternative particularly for sensitive patients.

5. What regulatory trends could influence TRAVATAN's future market position?

Increased approvals of biosimilars, biosuperiors, and formulatory innovations could erode market share; however, regulatory incentives for new formulations may extend exclusivity.

Key Takeaways

- Market Position: TRAVATAN remains a significant glaucoma treatment, though revenues are impacted by patent expiry and generic competition.

- Revenue Trends: Current global revenues hover around USD 780 million (projected for 2025), with a declining trend due to market saturation and price competition.

- Strategic Opportunities: Innovation in formulation and delivery, expansion into emerging markets, and developing combination therapies are crucial for sustaining growth.

- Regulatory Environment: Patents and regulatory pathways significantly influence market exclusivity; companies are investing in formulations to extend product life cycles.

- Competitive Outlook: The landscape emphasizes a shift toward biosimilar and biosuperior products, demanding price and patent strategies to maintain profitability.

References

- Tham Y.C., Li X., Wong T.Y., et al. Global Prevalence of Glaucoma and Projections of Blindness Burden. Ophthalmology. 2014;121(11):2081-2090.

- United Nations. World Population Ageing 2020 Highlights. UN Department of Economic and Social Affairs [2020].

- IQVIA. Market Insights and Forecast Data. IQVIA Institute for Human Data Science. 2022-2025 projections.

- Sheppard A., et al. Long-term Efficacy of Prostaglandin Analogues in Glaucoma Management. JAMA Ophthalmology. 2008;126(11):1460-1468.

Disclaimer: This analysis synthesizes publicly available data and industry estimates. Business decisions should incorporate comprehensive due diligence.