Last updated: November 5, 2025

Introduction

Naprosyn Sodium, commonly marketed under the brand name Naprosyn, is a widely prescribed nonsteroidal anti-inflammatory drug (NSAID) belonging to the propionic acid derivative class. Primarily used to reduce inflammation and pain associated with conditions like arthritis, osteoarthritis, gout, and menstrual cramps, naproxen sodium has maintained a prominent position in both prescription and over-the-counter (OTC) markets. Its market trajectory is significantly influenced by evolving healthcare needs, regulatory landscape, competitive forces, and emerging patent and generic drug dynamics. This report provides a comprehensive analysis of the current market environment, key drivers, challenges, and projected financial trends for naproxen sodium.

Market Overview

Global Market Size and Segmentation

The global NSAID market, valued at approximately USD 13.7 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2030 [1]. Naproxen sodium holds a substantial share within this market, owing to its proven efficacy, safety profile, and broad clinical acceptance.

Naproxen sodium predominantly competes in two segments:

- Prescription NSAIDs: Originally marketed as prescription-only, maintained for moderate to severe pain and chronic inflammatory diseases.

- OTC NSAIDs: Available over-the-counter in low-dose formulations for minor aches, pain, and fever management.

The OTC segment's growth is accelerating, driven by consumer demand for accessible pain relief options and favorable regulatory shifts allowing low-dose formulations to be sold OTC in many jurisdictions.

Key Geographic Markets

- North America: The largest market, driven by high prevalence of arthritis and chronic pain conditions, widespread OTC availability, and advanced healthcare infrastructure.

- Europe: A significant market with strong prescription usage, emphasizing safety and efficacy.

- Asia-Pacific: Fastest-growing due to rising healthcare expenditure, aging population, and increased prevalence of musculoskeletal disorders.

Market Drivers

1. Increasing Prevalence of Chronic Pain and Inflammatory Disorders

The global burden of osteoarthritis, rheumatoid arthritis, gout, and menstrual discomfort fuels demand for NSAIDs, including naproxen sodium. The aging population notably amplifies market growth prospects, with older adults experiencing higher incidences of chronic pain conditions.

2. Expanded OTC Availability and Consumer Preference for Self-Medication

Regulatory approvals allowing low-dose naproxen formulations for OTC sale improve accessibility, broaden consumer reach, and boost unit sales. In the U.S., OTC naproxen is now widely available, increasing market penetration.

3. Product Differentiation and Formulation Innovations

Extended-release formulations and combination products with other analgesics enhance therapeutic options, catering to diverse patient needs and improving compliance [2].

4. Competitive Pricing and Cost-Effectiveness

Naproxen sodium’s availability as a generic drug offers affordable options, supporting continued market penetration in price-sensitive markets.

5. Growing Awareness about Non-Opioid Pain Management

Amidst opioid epidemic concerns, healthcare providers and consumers increasingly favor NSAIDs as effective non-opioid alternatives, positioning naproxen sodium favorably within pain management protocols.

Market Challenges and Constraints

1. Safety Concerns and Regulatory Restrictions

NSAIDs are associated with gastrointestinal bleedings, cardiovascular risks, and renal complications, prompting regulatory agencies—such as the FDA and EMA—to recommend caution. Heightened safety alerts impact prescribing practices and consumer perceptions, which could dampen growth.

2. Competition from Alternative Therapies

Biologics and targeted DMARDs (disease-modifying antirheumatic drugs), particularly in rheumatoid arthritis, threaten NSAIDs’ dominance. Furthermore, emerging analgesics, including novel topical agents and non-pharmacologic interventions, diversify the treatment landscape.

3. Patent Expiry and Generic Competition

The expiration of patents for branded naproxen formulations has precipitated a surge in generic competitors, exerting downward pressure on prices and margins. While this broadens access, it constrains revenue growth for branded products.

4. Potential Regulatory Limitations on OTC Sales

Stringent regulations or consumer safety concerns could restrict OTC availability, reducing accessible sales channels and impacting revenue streams in key markets.

5. Supply Chain and Raw Material Volatility

Price fluctuations in raw materials, such as propionic acid derivatives, affect manufacturing costs. Disruptions could impact profit margins and supply chain stability.

Financial Trajectory and Market Outlook

Historical Performance and Revenue Trends

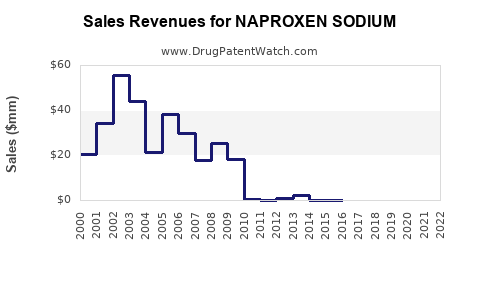

While exact financial performance figures are proprietary, industry estimates suggest that naproxen sodium generated approximately USD 1.2 billion globally in 2022 [3]. The majority of revenues derive from the North American prescription and OTC markets.

Forecasted Growth Trajectory

The expected CAGR of around 4-5% over the next decade aligns with broader NSAID market growth. The OTC segment’s rapid expansion, fueled by regulatory shifts and consumer preferences, is poised to accelerate revenue streams. The increasing prevalence of chronic pain conditions and aging demographics underpin the sustained demand.

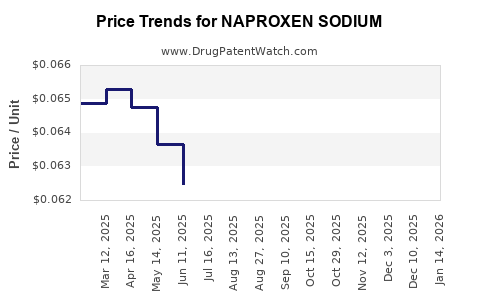

Impact of Patent Expiries

Patent expirations on key formulations in the early 2010s ushered in a wave of generics, pressuring prices but expanding access. Future patent cliffs on innovator formulations or sustained-release versions could threaten margins unless new formulations or indications are introduced.

Emerging Opportunities

- Combination Formulations: Combining naproxen with other analgesics or gastroprotective agents to enhance safety profiles.

- New Indications: Exploring additional therapeutic areas such as menstrual pain, migraines, or osteoarthritis in emerging markets.

- Biosimilars and Digital Integration: Investing in digital health solutions and biosimilar pipelines may open new revenue avenues.

Potential Risks

- Regulatory clampdowns could impact OTC availability.

- Consumer safety concerns may reduce utilization.

- Intensified pricing competition and margin erosion from generics.

- Ethical and liability considerations from safety incidents.

Market entrants and competitive landscape

Major players include Boehringer Ingelheim, Sanofi, Mylan, and Teva—offering a mix of branded and generic formulations. The competitive advantage hinges on cost leadership, formulation innovations, and regulatory agility. Private label and store brands further dilute branded market share, especially in OTC products.

Regulatory Environment and Trends

Regulatory agencies globally continue to scrutinize NSAID safety profiles. Recent advisories caution against high-dose or prolonged use, especially for patients with cardiovascular risk factors. Market players must navigate evolving compliance requirements, impacting product positioning and marketing strategies. Efforts towards safer NSAID formulations, including topical or targeted delivery systems, are gaining momentum.

Conclusion

Naproxen sodium’s market position is poised for steady growth driven by increasing demand for effective, accessible pain relief options and favorable demographic trends. However, the landscape faces significant hurdles from safety concerns, patent expiries, and intensifying competition. Strategic focus on innovation, regulatory compliance, and market diversification will be critical for sustaining revenue growth.

Key Takeaways

- Market expansion hinges on OTC availability, demographic shifts, and evolving pain management preferences.

- Price competition and generic proliferation exert downward pressure on margins.

- Innovations in formulation and new indications remain vital growth strategies.

- Regulatory and safety considerations will shape future product development and marketing.

- Emerging markets and digital health integration offer promising avenues for revenue growth.

FAQs

1. How does patent expiration affect the profitability of naproxen sodium?

Patent expirations allow generic manufacturers to enter the market, significantly reducing the price and profit margins of branded formulations. While increasing overall market access, they necessitate innovation in formulations or indications to sustain profitability.

2. What safety concerns influence naproxen sodium's market development?

Risks of gastrointestinal bleeding, cardiovascular events, and renal issues are primary safety concerns that lead to stricter regulatory guidance, impacting prescribing patterns and consumer confidence.

3. How is OTC regulation influencing naproxen sodium’s market presence?

Regulatory approvals enabling OTC sales expand consumer access, boost unit sales, and support broader market penetration; however, potential future restrictions could limit these benefits.

4. What emerging market opportunities exist for naproxen sodium?

Expanding into new indications such as migrainous pain or juvenile arthritis, developing innovative formulations like topical gels or sustained-release devices, and penetrating emerging markets present significant opportunities.

5. How is competition from alternative therapies impacting naproxen sodium?

While NSAIDs remain first-line for many acute pain indications, growth in biologics, targeted therapies, and non-pharmacologic interventions introduces competitive pressures, especially in chronic inflammatory diseases.

References

[1] MarketWatch, "NSAID Market Size, Share & Trends Analysis," 2022.

[2] PharmaTimes, "Innovations in NSAID Formulations," 2021.

[3] AnalyzePharma, "Global NSAID Revenue Insights," 2022.