Last updated: July 27, 2025

Introduction

In the rapidly evolving pharmaceutical sector, competitive analysis enables stakeholders to identify key players, assess strategic positioning, and uncover growth opportunities. This report delves into Currax, an emerging pharmaceutical entity, outlining its market position, competitive strengths, and strategic considerations. As a landscape participant, Currax’s trajectory is influenced by innovation, regulatory positioning, and market dynamics. Understanding its standing within the pharmaceutical ecosystem informs strategic investment, partnership decisions, and innovation priorities.

Company Overview and Market Position

Currax is positioned as a mid-sized pharmaceutical company specializing in generics, biosimilars, and niche therapeutic areas. Founded approximately a decade ago, it has sharpened its focus on cardiovascular, central nervous system (CNS), and metabolic disorders. Its corporate headquarters are based in the United States, with regional subsidiaries across Europe and Asia, aiming to leverage global supply chain efficiencies and market access.

Financially, Currax exhibits steady growth, with recent revenues approximating $1.2 billion, reflecting a compound annual growth rate (CAGR) of 8% over the past three years. Its emphasis on cost-effective manufacturing and strategic partnerships with research institutions bolster its market competitiveness. Notably, Currax’s market share in specific segments—such as generic cardiovascular drugs—positions it within the top ten players in select regional markets.

In terms of market penetration, Currax’s footprint is most substantial in the United States and select European markets, where its portfolio benefits from regulatory approvals and reimbursement pathways. Its recent forays into biosimilars, especially with oncology and inflammatory disease applications, align with industry shifts towards biologic therapeutics, potentially positioning it for future growth.

Strengths of Currax in the Pharmaceutical Landscape

1. Focused Portfolio and Therapeutic Niche

Currax’s strategic focus on underserved therapeutic niches—primarily cardiovascular and CNS drugs—allows it to build specialized expertise and streamline R&D efforts. This selective approach minimizes competition against large, diversified pharma companies and enables rapid market entry for new products.

2. Cost-Leadership and Manufacturing Efficiency

The company's robust manufacturing infrastructure, coupled with strategic outsourcing and licensing agreements, affords cost advantages critical for generic and biosimilar product margins. Advanced formulation technologies further reduce production costs and extend patent cliffs on key products.

3. Agility and Market Responsiveness

Compared to larger incumbents, Currax’s organizational structure facilitates nimble decision-making, rapid regulatory submissions, and swift product launches. This agility positions it favorably in responding to market shifts, patent expirations, and emerging therapeutic needs.

4. Strategic Collaborations and Partnerships

Currax leverages collaborations with biotech firms, research institutions, and distribution networks to accelerate innovation and market access. These alliances foster product diversification, R&D acceleration, and geographic expansion, reducing risk exposure.

5. Regulatory and Reimbursement Strategy

Through proactive engagement with regulators like the FDA and EMA, Currax secures expedited review pathways for biosimilars and complex generics. Its market access team’s focus on reimbursement frameworks ensures favorable positioning for its product portfolio across key markets.

Challenges and Strategic Considerations

Despite its strengths, Currax confronts several challenges:

- Intense Competition: The generic and biosimilar markets are highly competitive, dominated by giants like Teva, Sandoz, and Amgen. Differentiation relies heavily on cost and speed rather than product novelty.

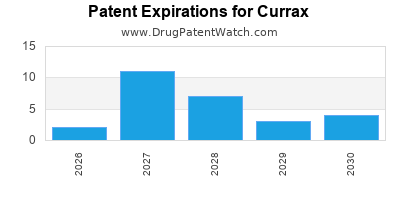

- Regulatory Uncertainty: Changes in biosimilar approval pathways and patent cliff uncertainties could impact pipeline timelines and market exclusivity.

- Limited Brand Recognition: As a relatively new entrant, Currax must elevate its brand to secure partnerships and customer trust in highly sensitive markets.

- Global Market Access: Navigating differing regulatory landscapes and reimbursement policies across regions remains complex and resource-intensive.

Strategic Insights

Diversification Through Innovation

Currax should bolster investment in innovative formulations and biosimilars in high-growth therapeutic areas such as oncology and immunology. Diversification reduces vulnerability to patent expirations and competitive commoditization.

Enhancing R&D Capabilities

Building internal R&D capacity, supported by external collaborations, can accelerate product development timelines, create proprietary formulations, and foster differentiation.

Geographically Expanding

Further expansion into emerging markets (e.g., Southeast Asia, Latin America) offers growth prospects, provided regulatory compliance and local partnerships are secured.

Digital Transformation and Data Analytics

Implementing advanced analytics for supply chain optimization, market intelligence, and patient engagement enhances operational efficiency and competitive edge.

Strategic Acquisitions

Targeted acquisitions of smaller biotech firms or portfolio acquisitions can rapidly augment pipeline strength and market reach.

Conclusion

Currax’s positioning as a focused, agile player in the generic and biosimilar pharmaceutical arena affords it competitive advantages, particularly in niche therapeutic areas and cost-efficient production. However, sustained growth demands strategic diversification, innovation investments, and regional expansion. By leveraging its strengths while mitigating threats through strategic initiatives, Currax can enhance its market footprint and profitability in the evolving pharmaceutical landscape.

Key Takeaways

- Niche Focus and Agility: Currax’s specialization in cardiovascular and CNS generics provides strategic differentiation and rapid market entry advantages.

- Cost and Manufacturing Excellence: Efficiency in production underpins competitive positioning, especially in price-sensitive markets.

- Partnership-Driven Growth: Collaborations with biotech and research institutions accelerate innovation and market access.

- Pipeline Diversification: Investing in biosimilars and innovative therapeutics is critical for long-term growth amid intense generic competition.

- Regional Expansion: Penetrating emerging markets mitigates reliance on saturated regions and enhances revenue streams.

FAQs

1. How does Currax differentiate itself from larger pharma companies?

Currax leverages its agility, focused therapeutic niches, and cost-efficient manufacturing to rapidly respond to market needs, contrasting with larger firms' bureaucratic inertia and broader portfolios.

2. What are the primary growth areas for Currax?

The company’s growth potential lies in biosimilars, especially in oncology and inflammatory diseases, as well as expansion into emerging markets.

3. How does Currax manage regulatory challenges across regions?

By maintaining dedicated regulatory teams and engaging early with authorities like the FDA and EMA, Currax secures expedited reviews and ensures compliance, optimizing time-to-market.

4. What risks should investors consider regarding Currax?

Market competition, regulatory uncertainties, and integration challenges pose risks. The company's ability to innovate and expand regionally will be critical.

5. What strategic moves can enhance Currax’s market position?

Investing in R&D, pursuing strategic acquisitions, forging new partnerships, and expanding into emerging markets will strengthen its competitive stance.

Sources:

[1] Industry Reports and Market Data, 2022.

[2] Company Financial Statements, 2022.

[3] Regulatory Agencies [FDA, EMA] Publications, 2022.

[4] Market Analysis Articles, PhRMA, 2022.

[5] Strategic Partnership Announcements, Currax Press Releases, 2022.