Last updated: July 27, 2025

Introduction

Fentanyl, a synthetic opioid approximately 50 to 100 times more potent than morphine, has garnered significant attention due to its dual role as a critical pain management medication and a substance of abuse linked to a soaring opioid crisis. Its complex market dynamics, driven by clinical utility, regulatory scrutiny, illicit trafficking, and evolving treatment paradigms, shape its economic trajectory. This analysis explores these factors, projecting the fiscal outlook within an increasingly regulated and volatile landscape.

Pharma Market Overview of Fentanyl

Fentanyl, marketed across various formulations—injectable, transdermal patches, lozenges, and nasal sprays—domains primarily in acute and chronic pain management, particularly among cancer patients and post-surgical care. Major pharmaceutical companies such as Johnson & Johnson (via Janssen), Teva Pharmaceuticals, and Sandoz have historically dominated the legitimate market segment, supported by extensive distribution networks and R&D pipelines.

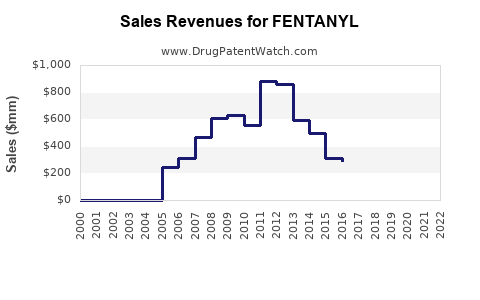

The global fentanyl market was valued at approximately USD 2.3 billion in 2021, with projections suggesting a compound annual growth rate (CAGR) of around 7% through 2028 [1]. This growth parallels broader trends in analgesic demand, advancements in drug delivery systems, and increasing adoption in anesthetic procedures. Nevertheless, the market faces a multifaceted threat landscape, including regulatory hurdles and illicit manufacturing, which markedly influence its financial trajectory.

Market Drivers

1. Clinical Demand and Therapeutic Efficacy

Fentanyl remains a frontline agent in pain management due to its high potency, rapid onset, and versatility. Its applications extend to anesthesia, managing breakthrough pain in cancer patients, and as part of multimodal pain control strategies. As global populations age and the prevalence of chronic pain escalates, demand for potent analgesics sustains growth. The WHO and American Medical Association continue to endorse fentanyl formulations under strict medical supervision, reinforcing market stability.

2. Innovation in Delivery Systems

Recent advancements in drug delivery are expanding fentanyl's therapeutic reach. Innovations like long-acting transdermal patches (e.g., Duragesic), nasal sprays, and buccal systems enhance compliance and therapeutic efficacy, opening avenues for increased revenue. R&D investments target minimally invasive, abuse-deterrent formulations, promising resilience against misuse while supporting market expansion.

3. Regulatory Frameworks and Patent Protections

Stringent regulatory controls aim to balance accessibility with abuse mitigation. Patents on novel formulations and abuse-deterrent technologies (e.g., embedded aversive agents or physical barriers) allow pharmaceutical firms to maintain exclusivity, fostering revenue streams. However, patent expirations are likely to introduce generic competition, potentially constraining profit margins.

Market Challenges and Risks

1. Illicit Use and OD Epidemic

Fentanyl's proliferation in illegal markets remains the defining challenge. The Drug Enforcement Administration (DEA) estimates that illicitly manufactured fentanyl accounts for approximately 60% of opioid overdose deaths in the U.S. alone [2]. As criminal entities use clandestine labs to produce fentanyl analogues, the risk of adverse events escalates, prompting regulatory agencies to enforce tighter controls on prescriptions, which could curtail legitimate sales and impact revenues.

2. Regulatory and Legislative Constraints

Governments worldwide, especially in North America and Europe, have enacted laws to curb opioid abuse. These include prescribing limits, enhanced tracking systems (e.g., Prescription Drug Monitoring Programs), and scheduling classifications (e.g., Schedule II in the U.S.). While these measures reduce misuse, they can also impede legitimate market growth, affecting long-term sales potential.

3. Public and Political Sentiment

Increasing public awareness and political pressure to combat the opioid crisis have led to restrictive policies that slow market expansion. The backlash against opioids, driven by high-profile overdose incidents, influences regulatory landscapes, and limits promotional activities for new fentanyl formulations.

4. Competition from Alternative Therapies

The rise of non-opioid pain management options, including cannabinoids, nerve blocks, and non-addictive analgesics, threaten fentanyl's market share. Additionally, developments in non-addictive therapeutics may diminish the reliance on opioids altogether, transforming the landscape in favor of safer options.

Illicit Market Influence on Financial Trajectory

The illegal fentanyl trade profoundly disrupts the legitimate pharmaceutical sector. Illicit fentanyl production in countries like China and Mexico leverages clandestine manufacturing facilities, often circumventing regulatory oversight, leading to inflated supply and suppressed legitimate market prices. This illicit influx depresses legal sales, hampers profitability, and escalates risks for manufacturers and healthcare providers involved in supply chain management.

Conversely, law enforcement efforts to dismantle clandestine labs and the implementation of border controls impact the clandestine trade but often result in a reactive rather than proactive effect, as traffickers innovate in synthesis and distribution networks. The net effect on financial performance includes increased compliance costs and heightened liability concerns.

Regulatory Trajectory and its Financial Implications

Regulatory agencies globally are tightening controls over supply chains, prescribing stricter coding, monitoring, and reporting requirements. The U.S. DEA’s reclassification of fentanyl-related substances to a higher schedule exemplifies this trend. Such regulation:

- Increases compliance costs for legitimate manufacturers and distributors.

- Delays in approval processes for new formulations, impacting revenue streams.

- Fosters market exclusivity for innovator firms willing to invest in abuse-resistant products, potentially encouraging premium pricing strategies.

Pharmaceutical companies investing in abuse-proof formulations—such as abuse-deterrent formulations (ADFs)—can derive a competitive advantage and command higher margins. Market forecasts indicate that the ADF segment of fentanyl might grow at an annual rate exceeding 10%, driven by regulatory mandates and market demand [3].

Emerging Opportunities and Market Outlook

1. Non-Addictive Analgesic Development

Investments in developing non-addictive alternatives could redefine pain management, potentially reducing reliance on fentanyl. While promising, these innovations are still in early stages, and widespread adoption may take years, thereby constraining near-term market growth.

2. Biosimilars and Generics

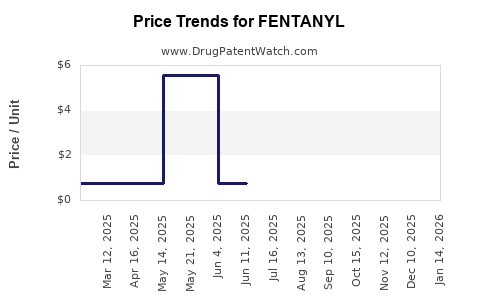

Awaiting patent expirations, generic manufacturers are poised to enter the market, potentially leading to price erosion. However, companies that pioneer abuse-deterrent and delivery innovation can sustain premium pricing.

3. Geographical Expansion

Regions with burgeoning healthcare infrastructure, such as Asia-Pacific, present significant growth opportunities. Governments investing in palliative care and surgical capacities increase demand, assuming regulatory harmonization.

4. Digital and Data-Driven Monitoring

Integration of digital health tools for prescription monitoring can reduce misuse, secure legitimate sales, and reinforce brand trust, contributing to sustained revenues.

Financial Outlook Summary

The overarching financial trajectory for fentanyl is characterized by:

- Stable, moderate growth supported by legitimate medical use, with CAGR estimates around 5-7% in the coming five years.

- Revenue shifts driven by patent protections, formulation innovations, and regulatory compliance costs.

- Potential declines or stagnation in key markets if illicit trafficking remains unmitigated or regulatory frameworks tighten further.

- Expansion prospects in emerging markets, where healthcare infrastructure investments drive demand.

- The profitability of firms heavily investing in abuse-deterrent technologies and novel delivery systems will likely see an increase.

However, the volatile interplay of regulatory, legal, and illicit factors necessitates vigilant scenario planning for pharmaceutical investors and stakeholders.

Key Takeaways

- Fentanyl's legitimate market sustains steady growth due to its clinical efficacy and ongoing innovation in delivery systems, with projected CAGR of approximately 7%.

- The illegal fentanyl trade poses a significant risk to OEM revenues, complicating market stability and elevating compliance costs.

- Regulatory tightening aims to curb abuse but may limit growth opportunities; firms investing in abuse-deterrent formulations can capitalize on favorable policies.

- Emerging markets, particularly in Asia and Latin America, present scalable demand, subject to regulatory and infrastructural developments.

- Continued R&D in non-addictive alternatives remains crucial but will likely influence demand against fentanyl in the long term.

FAQs

1. How does illicit fentanyl production impact legitimate pharmaceutical markets?

Illicit fentanyl undermines legitimate sales by flooding markets with cheap, unregulated supply, which depresses prices and complicates efforts to control distribution. It also increases legal and compliance costs for manufacturers who must implement stricter controls and monitoring.

2. What innovations are influencing fentanyl's market trajectory?

Abuse-deterrent formulations, novel delivery systems (e.g., non-invasive patches, nasal sprays), and digital prescription monitoring tools are driving growth while aiming to reduce misuse, thus shaping the financial outlook favorably for responsible manufacturers.

3. How do regulatory policies affect fentanyl’s profitability?

Stringent regulations increase compliance costs and may delay product approvals, reducing short-term revenue but strengthening market exclusivity for innovative, abuse-resistant formulations, potentially leading to premium pricing opportunities.

4. What are the growth prospects in emerging markets?

Rapid infrastructural development, increased healthcare access, and expanding surgical and palliative care services make emerging markets attractive for legitimate fentanyl sales, though success depends on regulatory integration and addressing illicit trafficking risks.

5. Will non-opioid pain therapeutics replace fentanyl?

While research into non-addictive analgesics is advancing, these alternatives are unlikely to fully substitute fentanyl in the immediate future due to its potent efficacy. Long-term, such innovations could reduce fentanyl dependence, impacting its market share.

References

[1] MarketWatch, "Global Fentanyl Market Size, Share & Trends," 2022.

[2] DEA National Drug Threat Assessment, 2022.

[3] IQVIA, "Analgesic Market Report," 2022.