SUBSYS Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Subsys, and when can generic versions of Subsys launch?

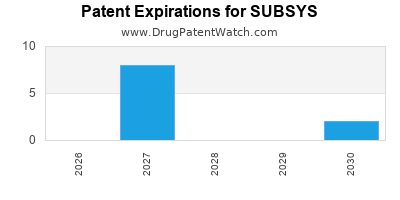

Subsys is a drug marketed by Btcp Pharma and is included in one NDA. There are ten patents protecting this drug and two Paragraph IV challenges.

This drug has thirty-three patent family members in seventeen countries.

The generic ingredient in SUBSYS is fentanyl. There are thirty-one drug master file entries for this compound. Eight suppliers are listed for this compound. Additional details are available on the fentanyl profile page.

DrugPatentWatch® Generic Entry Outlook for Subsys

There have been nine patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There are two tentative approvals for the generic drug (fentanyl), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for SUBSYS?

- What are the global sales for SUBSYS?

- What is Average Wholesale Price for SUBSYS?

Summary for SUBSYS

| International Patents: | 33 |

| US Patents: | 10 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 38 |

| Clinical Trials: | 5 |

| Drug Prices: | Drug price information for SUBSYS |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for SUBSYS |

| What excipients (inactive ingredients) are in SUBSYS? | SUBSYS excipients list |

| DailyMed Link: | SUBSYS at DailyMed |

Recent Clinical Trials for SUBSYS

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| INSYS Therapeutics Inc | N/A |

| Loyola University | Phase 3 |

| INSYS Therapeutics Inc | Phase 3 |

Paragraph IV (Patent) Challenges for SUBSYS

US Patents and Regulatory Information for SUBSYS

SUBSYS is protected by ten US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Btcp Pharma | SUBSYS | fentanyl | SPRAY;SUBLINGUAL | 202788-005 | Jan 4, 2012 | DISCN | Yes | No | 9,289,387 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Btcp Pharma | SUBSYS | fentanyl | SPRAY;SUBLINGUAL | 202788-004 | Jan 4, 2012 | DISCN | Yes | No | 8,486,973 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Btcp Pharma | SUBSYS | fentanyl | SPRAY;SUBLINGUAL | 202788-006 | Aug 30, 2012 | DISCN | Yes | No | 8,486,973 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Btcp Pharma | SUBSYS | fentanyl | SPRAY;SUBLINGUAL | 202788-007 | Aug 30, 2012 | DISCN | Yes | No | 9,642,797 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Btcp Pharma | SUBSYS | fentanyl | SPRAY;SUBLINGUAL | 202788-005 | Jan 4, 2012 | DISCN | Yes | No | 10,610,523 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Btcp Pharma | SUBSYS | fentanyl | SPRAY;SUBLINGUAL | 202788-006 | Aug 30, 2012 | DISCN | Yes | No | 9,289,387 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Btcp Pharma | SUBSYS | fentanyl | SPRAY;SUBLINGUAL | 202788-006 | Aug 30, 2012 | DISCN | Yes | No | 9,642,844 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for SUBSYS

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Kyowa Kirin Holdings B.V. | PecFent | fentanyl | EMEA/H/C/001164PecFent is indicated for the management of breakthrough pain in adults who are already receiving maintenance opioid therapy for chronic cancer pain. Breakthrough pain is a transitory exacerbation of pain that occurs on a background of otherwise controlled persistent pain.Patients receiving maintenance opioid therapy are those who are taking at least 60 mg of oral morphine daily, at least 25 micrograms of transdermal fentanyl per hour, at least 30 mg of oxycodone daily, at least 8 mg of oral hydromorphone daily or an equi-analgesic dose of another opioid for a week or longer. | Authorised | no | no | no | 2010-08-31 | |

| Takeda Pharma A/S | Instanyl | fentanyl | EMEA/H/C/000959Instanyl is indicated for the management of breakthrough pain in adults already receiving maintenance opioid therapy for chronic cancer pain. Breakthrough pain is a transitory exacerbation of pain that occurs on a background of otherwise controlled persistent pain. Patients receiving maintenance opioid therapy are those who are taking at least 60 mg of oral morphine daily, at least 25 micrograms of transdermal fentanyl per hour, at least 30 mg oxycodone daily, at least 8 mg of oral hydromorphone daily or an equianalgesic dose of another opioid for a week or longer. | Authorised | no | no | no | 2009-07-20 | |

| Teva B.V. | Effentora | fentanyl | EMEA/H/C/000833Effentora is indicated for the treatment of breakthrough pain (BTP) in adults with cancer who are already receiving maintenance opioid therapy for chronic cancer pain., , BTP is a transitory exacerbation of pain that occurs on a background of otherwise controlled persistent pain., , Patients receiving maintenance opioid therapy are those who are taking at least 60 mg of oral morphine daily, at least 25 micrograms of transdermal fentanyl per hour, at least 30 mg of oxycodone daily, at least 8 mg of oral hydromorphone daily or an equianalgesic dose of another opioid for a week or longer. , | Authorised | no | no | no | 2008-04-04 | |

| Incline Therapeutics Europe Ltd | Ionsys | fentanyl | EMEA/H/C/002715Ionsys is indicated for the management of acute moderate to severe post-operative pain in adult patients. | Withdrawn | no | no | no | 2015-11-18 | |

| Eli Lilly and Company Limited | Recuvyra | fentanyl | EMEA/V/C/002239For the control of pain associated with orthopaedic and soft tissue surgery in dogs. | Withdrawn | no | no | no | 2011-10-06 | |

| Janssen-Cilag International NV | Ionsys | fentanyl | EMEA/H/C/000612Management of acute moderate to severe post-operative pain for use in a hospital setting only | Withdrawn | no | no | no | 2006-01-24 | 2008-07-25 |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for SUBSYS

See the table below for patents covering SUBSYS around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Spain | 2668366 | ⤷ Get Started Free | |

| World Intellectual Property Organization (WIPO) | 2009017837 | ⤷ Get Started Free | |

| Japan | 2013056928 | SUBLINGUAL FENTANYL SPRAY | ⤷ Get Started Free |

| Brazil | PI0707235 | formulação de fentanil sublingual, dose unitária de uma formulação de fentanil sublingual, métodos para tratar dor e para tratar a manifestação súbita da dor, dispositivos de dose unitária ou dose dupla e de dose múltipla para a administração sublingual de um medicamento, método para preparar uma composição farmacêutica para a administração sublingual, formulação farmacêutica sublingual, dose unitária de uma formulação farmacêutica sublingual, e, método para tratar um paciente humano | ⤷ Get Started Free |

| Russian Federation | 2008130763 | СУБЛИНГВАЛЬНЫЙ АЭРОЗОЛЬ НА ОСНОВЕ ФЕНТАНИЛА | ⤷ Get Started Free |

| Australia | 2008282743 | Sublingual fentanyl spray | ⤷ Get Started Free |

| Russian Federation | 2432950 | ПОДЪЯЗЫЧНЫЙ СПРЕЙ НА ОСНОВЕ ФЕНТАНИЛА (SUBLINGUAL FENTANYL-BASED SPRAY) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for SUBSYS

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 0836511 | CA 2006 00019 | Denmark | ⤷ Get Started Free | PRODUCT NAME: FENTANYL HYDROCHLORID |

| 1635783 | CA 2014 00016 | Denmark | ⤷ Get Started Free | PRODUCT NAME: FENTANYL I EN HVILKEN SOM HELST AF DE FORMER, DER ER BESKYTTET AF GRUNDPATENTET; REG. NO/DATE: EU/1/10/644/001-006 20100831 |

| 1769785 | C300522 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: FENTANYL EN DOSERINGSAPPLICATOR; REG. NO/DATE: EU/2/11/127/001 20111006 |

| 0383579 | C960030 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: REMIFENTANYLUM, DESGEWENST IN DE VORM VAN EEN ZUURADDITIE-ZOUT, IN HET BIJZONDER HET HYDROCHLORIDE; NAT. REGISTRATION NO/DATE: RVG 20601 - RVG 20603 19961015; 36335.00.00, 36335.01.00, 36335.02.00 19960517 |

| 0975367 | 122011000009 | Germany | ⤷ Get Started Free | PRODUCT NAME: FENTANYL IN ALLEN DEM SCHUTZ DES GRUNDPATENTS UNTERLIEGENDEN FORMEN; REGISTRATION NO/DATE: EU/1/10/644/001-004 20100831 |

| 0836511 | SPC/GB06/022 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: FENTANYL HYDROCHLORIDE; REGISTERED: UK EU/1/05/326/001 20060124 |

| 0901368 | C300523 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: FENTANYL; REGISTRATION NO/DATE: EU/2/11/127/001 20111006 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: SUBSYS

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.