Last updated: September 22, 2025

Introduction

Cephalon, a prominent player in the pharmaceutical industry, has carved a niche within the neuro-oncology, pain management, and rare disease segments. Acquired by Teva Pharmaceutical Industries Ltd. in 2011, Cephalon’s portfolio includes innovative therapeutics targeting unmet medical needs. This analysis offers a comprehensive overview of Cephalon’s current market position, core strengths, challenges, and strategic outlook within the highly competitive pharmaceutical landscape.

Company Overview and Market Position

Founded in 1987, Cephalon established its reputation through the development and commercialization of specialty therapeutics. Its acquisition by Teva in 2011 for approximately $6.8 billion marked a significant shift, integrating Cephalon’s innovative pipeline into Teva’s broader generics and specialty medicine platform. As of 2023, Cephalon remains a critical component of Teva’s strategic offerings, especially in central nervous system (CNS) drugs, oncology, and rare disease treatments.

Cephalon's market influence predominantly rests on its flagship products such as Provigil (modafinil), used for narcolepsy and shift work sleep disorder, and Nuvigil (armodafinil). These drugs hold a dominant position in the wakefulness-promoting agent market. Additionally, Cephalon's portfolio encompasses products for chemotherapy-induced nausea, acute pain, and central nervous system disorders, positioning it as a specialist within niche therapeutic segments.

Despite intense competition from both big pharmaceutical companies and emerging biotech firms, Cephalon’s integration into Teva has enhanced its market reach, particularly as part of Teva’s broader strategy to bolster specialty pharmaceuticals.

Market Positioning and Competitive Advantages

1. Niche Therapeutic Focus

Cephalon's specialization in CNS disorders, sleep disorders, and oncology provides a competitive edge by targeting unmet medical needs within these high-margin segments. Its flagship drugs, notably Provigil and Nuvigil, command significant market share due to proven efficacy and brand recognition among clinicians and patients.

2. Proprietary Product Portfolio

Cephalon holds a suite of drugs with patent protection, such as Ceplene (histamine dihydrochloride) for myeloma maintenance therapy, providing a moat against generic competition. The company's concentrated portfolio allows for focused marketing efforts and regulatory strategies to extend exclusivity.

3. Strategic Partnership and Acquisition Dynamics

Post-acquisition, Teva’s extensive distribution channels, combined with Cephalon’s specialized products, enable rapid market penetration and geographic expansion, especially in emerging markets. Moreover, Teva’s investment in research and development complements Cephalon’s pipeline of innovative therapies, reinforcing its leadership stance.

4. Clinical and Regulatory Expertise

Cephalon’s focus on clinical trials for CNS and oncology indications enhances its product pipeline’s credibility. Its ability to navigate complex regulatory pathways in North America and Europe sustains its competitive edge in launching new indications or generic derivatives.

Strengths and Opportunities

1. Robust Product Lifecycle Management

Cephalon benefits from strategic patent protections and lifecycle management strategies, such as reformulations and new indications. The longstanding market presence of Provigil and Nuvigil grants branding advantages that newer entrants struggle to replicate.

2. Expanding Market for Sleep and CNS Disorders

The rising prevalence of sleep disorders, including narcolepsy and shift work sleep disorder, positions Cephalon favorably. The expanding aging population amplifies demand for neuropsychiatric therapeutics, offering growth avenues.

3. Evidence-Based Clinical Programs

Cephalon’s investment in rigorous clinical research fosters evidence-based prescribing, ensuring sustained market penetration and eligibility for reimbursement in key markets.

4. Growing Portfolio in Oncology and Rare Diseases

The company’s development pipeline and acquisitive growth, including targeted therapies and biologics, give it access to high-growth segments. As precision medicine gains momentum, Cephalon’s focus on rare and genetically defined diseases aligns well with market trends.

Challenges and Strategic Risks

1. Intensified Competition from Generics and Biosimilars

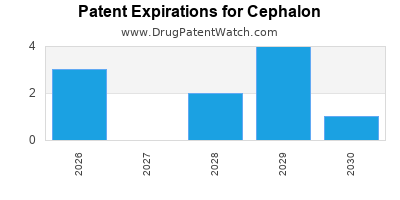

Patent expirations threaten the profitability of Cephalon’s flagship drugs, especially Provigil, with multiple generic formulations already launched or imminent. Biosimilars and alternative therapies threaten to erode market share, necessitating ongoing innovation.

2. Regulatory and Pricing Pressures

Stringent regulatory environments and pricing pressures in markets like the U.S. and Europe pose risk factors. Government-led drug discounts and price caps could diminish revenue flows from established products.

3. Pipeline Development and Innovation Risks

Reliance on pipeline success injects inherent risks. Clinical trial failures, regulatory delays, or unmet outcomes can adversely impact future revenue streams.

4. Market Saturation in Core Segments

In mature CNS and oncology markets, growth potential diminishes as competition consolidates and innovation plateaus. Diversification into emerging therapeutic areas is necessary for resilient growth.

Strategic Insights and Recommendations

1. Accelerate Pipeline Innovation

Cephalon should prioritize accelerated development of novel therapies, especially in biologics and gene therapies, to offset patent cliffs. Strategic acquisitions and partnerships with biotech firms can catalyze innovation.

2. Expand in Emerging Markets

Capitalizing on Teva’s global infrastructure, Cephalon can expand sales in emerging territories with rising healthcare spending. Tailored regulatory strategies can facilitate accelerated approvals in these regions.

3. Diversify Revenue Streams

To mitigate reliance on flagship products, Cephalon should diversify into adjacent therapeutic areas, such as immuno-oncology and neurology, supported by targeted R&D investments.

4. Enhance Strategic Collaborations

Forming alliances with biotech innovators, academic institutions, and technology firms can accelerate drug discovery and clinical development processes.

5. Focus on Value-Based Healthcare

Aligning product offerings with reimbursement models emphasizing outcomes can enhance market access and sustain profitability amidst pricing pressures.

Conclusion

Cephalon’s strategic positioning as a leader in niche CNS and oncology markets, under the umbrella of Teva, furnishes it with unique strengths that can sustain competitive advantages. Its legacy products offer enduring revenue streams, while targeted pipeline development and geographic expansion are key to future growth. Remaining vigilant against patent expirations, competitive pressures, and regulatory challenges, Cephalon must prioritize innovation and diversification to retain its relevance in a rapidly evolving pharmaceutical landscape.

Key Takeaways

- Cephalon’s market dominance hinges on its flagship CNS medications, which face looming generic threats.

- Strategic diversification through innovation, emerging markets, and partnerships can mitigate patent cliff risks.

- Emphasizing gene therapy, biologics, and targeted therapies aligns with industry trends and provides growth opportunities.

- Continued investment in clinical evidence and value-based healthcare partnerships boosts market credibility.

- Staying ahead of regulatory developments and pricing pressures is vital to maintaining profitability.

FAQs

1. How does Cephalon’s integration into Teva influence its competitive strategy?

Teva’s global distribution channels and R&D resources enhance Cephalon’s ability to market existing products internationally and develop new therapies, reinforcing its competitive edge in specialty pharmaceuticals.

2. What are the primary risks facing Cephalon’s flagship products?

Patent expirations and the proliferation of generic versions threaten revenue streams. Additionally, competitive entrants and regulatory price controls compound these risks.

3. What growth avenues exist for Cephalon beyond its current portfolio?

Expanding into biologics, gene therapies, and personalized medicine, alongside emerging markets, presents significant growth opportunities aligned with industry trends.

4. How critical is pipeline development for Cephalon’s future?

Pipelined innovation is vital to offset patent cliffs and maintain market relevance, especially by targeting high-growth areas like immuno-oncology and rare diseases.

5. How can Cephalon sustain its market position amid rising competition?

By accelerating innovation, strategic acquisitions, geographic expansion, and value-based healthcare partnerships, Cephalon can reinforce its competitive stance.

Sources

- [1] Teva Pharmaceutical Industries Ltd. Annual Report 2022.

- [2] IQVIA Pharmaceutical Market Data, 2023.

- [3] U.S. Food and Drug Administration (FDA) Drug Approval Records, 2022-2023.