Last updated: July 27, 2025

Introduction

Fentanyl, a potent synthetic opioid analgesic, plays a critical role in pain management, especially in clinical settings requiring rapid and intense analgesia. However, its high potency—approximately 50 to 100 times stronger than morphine—has also rendered it a central figure in the ongoing opioid crisis. As a result, the market for fentanyl encompasses both legitimate pharmaceutical uses and illicit trafficking, creating a complex landscape for investors and policymakers alike. This analysis explores current market trends, regulatory influences, manufacturing dynamics, and future price projections for fentanyl.

Market Overview

Clinical and Pharmaceutical Market

Pharmaceutical-grade fentanyl is primarily marketed as transdermal patches, lozenges, and injectable formulations. Its medical use remains vital in anesthesiology and pain management, especially for cancer patients and post-surgical care. According to IQVIA data, the global opioid market growth has been steady, with an increasing demand for potent painkillers driven by aging populations and expanding healthcare access in emerging markets [1].

The main players include Johnson & Johnson (via its Janssen division), Teva Pharmaceuticals, and Hospira (a Pfizer subsidiary). These companies maintain a substantial share in the legitimate fentanyl market, which is expected to grow modestly at a compound annual growth rate (CAGR) of approximately 3-4% over the next five years, reflecting steady demand in clinical settings.

Illicit Market Dynamics

The illicit fentanyl market, driven largely by clandestine laboratories in China, Mexico, and increasingly in North America, remains a significant concern. Unregulated production has led to a surge in overdose deaths, with fentanyl involved in nearly 60% of opioid-related fatalities in the U.S. as of 2021 [2].

Demand for illicit fentanyl has been reinforced by its low cost and high potency, making it attractive for traffickers and drug users seeking intense effects. The rising infiltration of illicit fentanyl into traditional drug supplies—especially heroin—has fueled a surge in overdoses, prompting increased enforcement and regulatory clampdowns worldwide.

Market Drivers

- Medical Necessity and Aging Populations: The growing prevalence of chronic pain conditions necessitates effective analgesics, maintaining demand for pharmaceutical fentanyl.

- Regulatory Environment: Stricter controls on prescription opioids aim to curb misuse, but inadvertently encourage illicit supply chains.

- Illicit Trafficking and Fentanyl Analogues: The proliferation of fentanyl analogs—such as carfentanil—has expanded the scope of the market, impacting law enforcement and healthcare sectors.

- Technological Advances: Innovations in drug formulation and distribution methods could alter supply chain efficiencies and impact prices.

Pricing Mechanisms and Factors

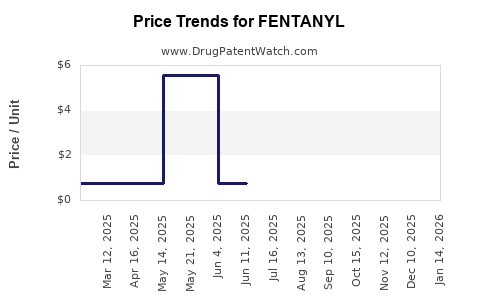

Pharmaceutical Fentanyl Pricing

The retail price of pharmaceutical fentanyl formulations varies by region, formulation type, and regulatory environment. For instance, transdermal patches can range from $5 to $20 per patch, depending on dosage and brand. Overall, the cost structure is influenced by manufacturing expenses, patent protections, and distribution costs.

Illicit Market Price Trends

Illicit fentanyl's street prices are markedly lower—typically around $3 to $10 per street dose—attributable to unregulated production and distribution costs. This low-cost, high-potency synthetic creates a profitable but dangerous market, with prices influenced by law enforcement efforts, seizure data, and supply chain disruptions.

Regulatory and Legal Influences

Regulations significantly impact fentanyl’s market dynamics. The Drug Enforcement Administration (DEA) in the U.S., the European Medicines Agency (EMA), and other global regulators classify fentanyl as a controlled substance, imposing strict manufacturing, distribution, and prescription controls.

Increased scrutiny has led to reduced legitimate supplies in some markets, pushing demand toward illicit sources. Conversely, government initiatives like the CDC guidelines and international cooperation aim to reduce misuse while ensuring medical access.

Future Price Projections

Pharmaceutical Market Projections

The global fentanyl market is projected to grow at a CAGR of 3-4% over the next five years, driven by ongoing demand for effective pain management. Prices for pharmaceutical formulations are expected to remain relatively stable, with slight increases attributable to inflation, regulatory compliance costs, and patent expirations.

The entry of biosimilars or generic versions could further influence prices, promoting competition. However, stringent regulations and supply chain complexities could temper significant price reductions.

Illicit Market Outlook

Illicit fentanyl prices are subject to volatility driven by enforcement measures, manufacturing scale, and international trade policies. As interdiction efforts tighten in North America, the supply of illicit fentanyl may decline temporarily, leading to price surges. Conversely, new trafficking routes or clandestine labs could replenish supplies swiftly.

Long-term projections suggest that illicit fentanyl prices may fluctuate marginally within a range of $3 to $12 per street dose, with the potential for dramatic spikes during law enforcement crackdowns. The illegal market's profitability sustains its resilience, complicating eradication efforts.

Impact of Synthetic Analogs

The proliferation of fentanyl analogs adds complexity. Some analogs, such as carfentanil—used primarily as a tranquilizer for large animals—command higher street prices but pose significant overdose risks. As authorities develop targeted regulations against specific compounds, pricing and market behaviors are likely to shift accordingly.

Key Market Challenges

- Supply Chain Disruptions: Trafficking interdictions, especially in North America and Asia, can temporarily reduce illicit supplies, causing short-term price volatility.

- Regulatory Constraints: Stricter controls on both legitimate and illicit markets may elevate manufacturing costs and increase prices.

- Public Health Measures: Increased naloxone distribution and treatment programs may reduce demand for potent opioids, affecting pharmaceutical sales.

- Ethical and Legal Risks: Companies involved in manufacturing or trafficking illicit fentanyl face significant legal and reputational exposure.

Emerging Trends and Innovations

- Novel Delivery Systems: The development of new fentanyl delivery methods (e.g., patches with sustained or controlled-release mechanisms) could influence market prices via improved efficacy and manufacturing costs.

- Decriminalization and Legalization: Policy shifts may impact demand and supply dynamics, especially in jurisdictions contemplating reduced penalties for opioid possession.

- Digitization of Trafficking: The rise of darknet marketplaces and cryptocurrencies facilitates illicit fentanyl transactions, potentially lowering transaction costs and impacting street prices.

Conclusion

The fentanyl market exhibits a bifurcated landscape: a steady, regulated pharmaceutical sector and a volatile, illicit trade that continues to fuel the opioid crisis. While legitimate sales growth remains modest, regulatory measures and technological advancements are poised to influence prices over the coming years. Conversely, illicit fentanyl prices are affected by enforcement actions, supply chain dynamics, and the proliferation of synthetic analogs.

Investors and policymakers must navigate these complexities, understanding that the pharmaceutical market’s trajectory is relatively predictable, whereas the illicit market remains unpredictable but profoundly impactful on public health and safety.

Key Takeaways

- The pharmaceutical fentanyl market is expected to grow modestly at 3-4% CAGR over the next five years, with prices stabilizing amid patent and formulation innovations.

- Illicit fentanyl prices remain low but volatile, heavily influenced by enforcement efforts and trafficking routes.

- Regulatory crackdowns are likely to increase manufacturing and distribution costs, exerting upward pressure on pharmaceutical prices.

- The proliferation of fentanyl analogs complicates pricing and enforcement strategies, necessitating ongoing surveillance.

- Innovations in delivery systems and digital trafficking platforms will continue influencing market dynamics and price fluctuations.

FAQs

1. How does regulatory change impact fentanyl prices?

Tighter regulations increase manufacturing and compliance costs, which can elevate pharmaceutical prices and reduce illicit supply, causing street prices to fluctuate based on enforcement efficacy.

2. Are generic fentanyl products expected to reduce prices?

Yes, the entry of generic versions post-patent expiry can increase competition, potentially decreasing prices for pharmaceutical formulations.

3. What is the future outlook for illicit fentanyl supply?

Illicit supply will remain resilient due to clandestine manufacturing and evolving trafficking routes, but law enforcement efforts may temporarily constrain availability, causing price volatility.

4. How might new delivery technologies influence the market?

Innovations such as sustained-release patches could increase manufacturing costs but also improve efficacy, potentially stabilizing prices and expanding clinical use.

5. What are the broader implications of fentanyl price trends for public health?

Price fluctuations in illicit fentanyl can influence overdose rates and trafficking patterns, underscoring the need for integrated regulation, harm reduction strategies, and global cooperation.

Sources:

[1] IQVIA, "Global Opioid Market Analysis," 2022.

[2] National Institute on Drug Abuse, "Opioid Overdose Data," 2021.