Last updated: July 28, 2025

Introduction

Citalopram hydrobromide, marketed primarily under the brand name Celexa among others, is a widely prescribed selective serotonin reuptake inhibitor (SSRI) for major depressive disorder and anxiety-related conditions. Its global market presence, growth prospects, and financial trajectory are shaped by evolving clinical guidelines, regulatory pathways, competitive landscape, and societal health trends. This analysis provides an in-depth overview of the current market dynamics, projected financial trajectory, and strategic considerations relevant for stakeholders involved in citalopram hydrobromide.

Market Overview and Global Demand

Citalopram's global sales have historically benefited from its efficacy, favorable safety profile, and established patent status until patent expiry, which fostered widespread generic adoption. As of 2022, the global antidepressant market was valued at approximately USD 17 billion, with SSRIs accounting for over 70% of prescriptions, driven by increasing awareness and acceptance of mental health treatment [1].

The primary demand drivers include:

-

Prevalence of depression and anxiety disorders: According to WHO, over 264 million people suffer from depression globally, with a consistent upward trend in diagnosis rates [2].

-

Healthcare access and insurance coverage: Enhanced mental health coverage in developed economies facilitates continued prescription rates for citalopram and similar agents.

-

Off-label and adjunct uses: Subclinical depression and comorbid conditions sustain demand, while ongoing clinical research explores expanded indications.

Market Dynamics

Patent Expiry and Generic Competition

Citalopram’s patent expired in major jurisdictions such as the US (2017) and Europe (2012), transforming the market landscape. The advent of numerous generic manufacturers led to significant price erosion, impacting revenue streams for originators. Generic competition has driven the average wholesale price (AWP) of citalopram down by approximately 60-70% since patent expiry [3].

Pricing and Reimbursement Policies

Reimbursement frameworks increasingly favor generics, further constraining profit margins. Payer-driven formulary restrictions and the emphasis on cost-effective therapies have resulted in price negotiations and tiered formulary placements.

Regulatory Environment and Approvals

Regulatory pathways have remained stable; however, ongoing safety monitoring influences formulary decisions. Evolving guidelines for depression management recommend SSRIs as first-line therapy, sustaining substantial prescription volumes.

Market Penetration and Competition

Citalopram's competitive landscape includes other SSRIs such as sertraline, escitalopram, and fluoxetine. Among these, escitalopram (Lexapro) has gained market share due to perceived superior tolerability. Nonetheless, citalopram remains a mainstay in many global markets owing to established prescribing habits and cost advantages [4].

Emerging Trends and Challenges

-

Generic market stabilization: Continued patent loss in multiple regions increases the proliferation of low-cost generics.

-

Potential for biosimilars and new formulations: No biosimilar pathways are relevant for small molecules like citalopram, but extended-release formulations and combination therapies could influence future dynamics.

-

Safety concerns: QT prolongation risks have prompted regulatory warnings, influencing prescribing patterns.

Impact of COVID-19 Pandemic

The pandemic heightened mental health burdens, leading to increased antidepressant prescriptions. However, supply chain disruptions and prioritization of urgent medications temporarily affected procurement and distribution channels.

Financial Trajectory and Revenue Forecast

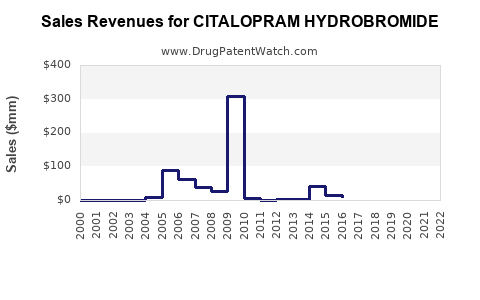

Historical Revenue Performance

Between 2010 and 2017, branded sales of citalopram declined sharply post-patent expiry. Global revenues for citalopram, predominantly from generics markets, peaked in 2016 at an estimated USD 1.2 billion (excluding off-label sales) before declining due to market saturation and competitive pricing pressures [5].

Current Market Outlook

Based on recent prescriptions, the global citalopram market is estimated to generate approximately USD 500-700 million annually, primarily from generic sales. Growth projections indicate a compound annual decline rate (CAGR) of approximately 3-4% over the next five years, primarily driven by increasing generic penetration and price competition.

Forecast Scenarios

-

Optimistic Scenario: Introduction of new formulations or indications could stabilize or temporarily boost revenues, particularly if healthcare providers favor citalopram over newer antidepressants due to cost advantages.

-

Conservative Scenario: Continued generics-driven price declines and competition from newer antidepressants such as vortioxetine and vilazodone could suppress revenues by 10-15% annually.

Strategic Implications for Manufacturers

Brand owners focusing on premium formulations or seeking to expand indications may leverage clinical research and regulatory approvals to maintain market share. Conversely, generic manufacturers prioritize cost leadership, volume sales, and regional market expansion.

Regulatory and Legal Factors

The regulatory landscape influences market timing and profitability. Notably:

-

Safety warnings: Regulatory advisories for QT prolongation have prompted label changes, potentially impacting prescribing habits.

-

Patent litigations and exclusivities: Careful monitoring is necessary despite patent expirations to prevent patent-litigation barriers in diverse markets.

-

Pricing regulations: Price controls in markets like India and parts of Europe constrain revenue potential for both patent-holders and generics.

Future Outlook and Market Opportunities

-

Market Expansion: Increasing insulin and mental health awareness can extend citalopram’s reach in developing countries through strategic licensing and distribution channels.

-

Innovation: Although small molecules have limited innovation pathways, formulations with improved bioavailability or reduced side effects could offer differentiation.

-

Digital and Pharmacovigilance Initiatives: Platforms that enhance adherence and safety monitoring might foster brand loyalty and reduce adverse event-related liabilities.

Key Takeaways

-

Post-patent expiry, citalopram faces significant price erosion driven by generic competition, with global revenues declining at a CAGR of approximately 3-4%.

-

The medication remains essential in depression management, supported by societal need and clinical guideline recommendations, ensuring steady prescription volumes.

-

Market consolidation and formulating strategies aligned with regulatory, safety, and reimbursement landscapes are critical for maximizing financial outcomes.

-

Emerging markets and potential formulations present growth avenues, whereas pricing pressures necessitate a focus on cost-efficiency.

-

Continuous monitoring of safety warnings and regulatory decisions is vital for strategic planning and risk mitigation.

FAQs

1. What factors led to the decline in citalopram's market share since patent expiry?

The primary factors include the proliferation of generic competitors, consequent price reductions, and the rise of alternative SSRIs with perceived better safety or tolerability profiles, such as escitalopram.

2. How do safety concerns influence citalopram's market dynamics?

Regulatory warnings about QT prolongation have led to label updates and cautious prescribing, potentially reducing usage among certain patient subsets and influencing clinician preferences toward other antidepressants.

3. What are the opportunities for revenue growth for citalopram manufacturers?

Opportunities include expanding into emerging markets, developing novel formulations or combination therapies, and gaining regulatory approval for new indications, which can justify higher price points and market share stability.

4. How does insurance reimbursement affect citalopram sales?

Reimbursement policies favoring generics and cost-effective treatments amplify volume-based sales, but strict formulary restrictions and tiered pricing can limit revenues.

5. What is the outlook for citalopram in the next five years?

The outlook predicts a continued decline in revenues due to generics’ proliferation, though steady prescription rates driven by its clinical utility ensure moderate ongoing demand, especially in markets prioritizing cost-efficiency.

References

[1] IMS Health. "The Global Use of Medicines in 2022."

[2] World Health Organization. "Depression and Other Common Mental Disorders." 2022.

[3] IQVIA. "Antidepressant Market Analysis," 2022.

[4] FDA. "Summary Review of Escitalopram," 2017.

[5] EvaluatePharma. "2017 Top Drugs by Revenue."