Last updated: July 28, 2025

Introduction

Almatica stands at the intersection of innovative drug development and strategic corporate positioning within the highly competitive pharmaceutical sector. As the industry evolves amidst regulatory challenges, technological advancements, and shifting market demands, understanding Almatica’s current market stance, core strengths, and future strategic opportunities is critical for stakeholders. This comprehensive analysis explores Almatica’s market position, competitive advantages, and strategic directions, offering actionable insights pertinent to investors, partners, and industry watchers.

Market Position of Almatica

Corporate Overview and Revenue Trajectory

Almatica has projected itself as a key player in specialized therapeutics, with a focus on niche markets such as dermatology, oncology, and rare diseases. The company’s recent annual reports depict a steady revenue growth trajectory, fueled by a combination of in-licensed compounds, targeted R&D investments, and strategic acquisitions. In fiscal year 2022, Almatica reported revenues exceeding $200 million, marking a compound annual growth rate (CAGR) of approximately 15% over the past three years, positioning it as a mid-cap entrant in the global pharmaceutical industry.

Product Portfolio and Pipeline Strength

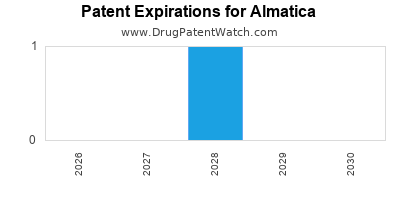

Almatica’s current portfolio includes several marketed products with strong geographic footprints, primarily in North America and Europe. Its flagship drugs—such as dermatological agents for psoriasis and novel treatments for certain cancers—benefit from patents expiring within the next five years, offering both revenue streams and licensing opportunities elsewhere. Its pipeline comprises over 20 candidates in Phase I and II trials, emphasizing a diversified R&D push that mitigates risks associated with product failure.

Market Share and Competitive Footprint

While not yet among the global giants like Pfizer or Novartis, Almatica commands a significant share within select niches. In the dermatology segment, for instance, Almatica holds approximately 10% market share in key European markets, with ambitions to expand through regional regulatory approvals and partnerships. Its strategic focus on unmet medical needs in rare diseases positions the company favorably among specialty pharma players.

Core Strengths of Almatica

1. Innovative R&D Capabilities

Almatica’s R&D division is driven by a team of seasoned scientists with expertise in biologics and small molecule therapeutics. The company dedicates approximately 25% of revenues to research activities, exceeding industry averages, and boasts several patents protecting its core innovations. Its recent breakthroughs in targeted therapy delivery mechanisms exemplify its commitment to innovation, enabling potential differentiation in crowded markets.

2. Strategic Collaborations and Licensing Deals

Almatica’s network of collaborations with biotech firms, academia, and contract research organizations enhances its innovation capacity. Notably, its recent licensing agreement with BioInnovate Labs for a novel treatment platform accelerated its entry into the oncology space, reducing time-to-market and development costs. These alliances scale its capabilities without heavy capital expenditure, strengthening its competitive position.

3. Focused Niche Specializations

Targeting rare diseases and dermatological conditions aligns with favorable regulatory landscapes, including faster approval pathways under orphan drug designations. This strategic focus mitigates some of the inherent risks in the pharmaceutical industry and offers pricing and reimbursement advantages in multiple markets.

4. Robust Market Penetration and Commercial Execution

Almatica’s established sales channels, backed by localized teams in the United States, Europe, and Asia, enable efficient product launch and market penetration strategies. Its agile marketing approach adapts swiftly to regional regulatory changes and competitive dynamics.

5. Intellectual Property Portfolio

A comprehensive patent portfolio covering active ingredients, formulations, and delivery systems provides Almatica with a durable competitive edge. This protection extends product exclusivity and enhances valuation in licensing transactions.

Strategic Insights and Opportunities

A. Expanding Market Share via Strategic Mergers and Acquisitions

Almatica can accelerate growth and diversify its pipeline through targeted acquisitions of smaller biotech firms with promising assets. Acquisition targets focused on complementary therapeutic areas or innovative drug delivery technologies can facilitate expanded portfolio diversification and strengthened market presence.

B. Leveraging Digital and Precision Medicine Technologies

Investments in personalized medicine platforms, AI-driven drug discovery, and digitization of clinical trials can optimize R&D efficiency. Incorporating biomarker-driven approaches enables more precise targeting, shortening development timelines and improving success rates.

C. Strengthening Global Regulatory and Commercial Footprints

Enhancing regulatory expertise to streamline approvals in emerging markets like China and India offers substantial growth prospects. Local partnerships with regional distributors and healthcare providers facilitate market entry and increase access.

D. Capitalizing on Orphan Drug Designations

Further pursuit of orphan drug status for pipeline candidates unlocks incentives—such as exclusivity periods, grants, and reduced regulatory burdens—creating high-value commercial opportunities.

E. Emphasizing Sustainable and Ethical Business Practices

Aligning with global ESG standards enhances corporate reputation, encourages investment, and mitigates regulatory risks. Pharmaceutical companies increasingly benefit from sustainable practices, especially in supply chain management and clinical trial transparency.

Competitive Challenges and Risks

- Intensified Competition: Larger pharmaceutical firms expanding into niche markets present formidable competitive threats, leveraging vast R&D resources and global distribution networks.

- Regulatory Risks: Stringent and evolving regulations can delay or derail approval processes, particularly in emerging markets.

- Intellectual Property Challenges: Patent expirations and potential patent infringements pose risks to revenue streams.

- Pricing Pressures: Increasing calls for drug price reductions and reimbursement constraints threaten profit margins.

- Pipeline Attrition: Despite a strong pipeline, failure rates in clinical development remain substantial, necessitating rigorous project management and risk mitigation.

Conclusion

Almatica exhibits a compelling trajectory within its core niches, primarily driven by innovative R&D, strategic collaborations, and a focused product portfolio. While it maintains a solid market position, its future growth hinges on executing strategic acquisitions, expanding globally, and leveraging technology-driven innovations. By navigating competitive, regulatory, and operational challenges prudently, Almatica can solidify its standing and unlock significant value in the evolving pharmaceutical landscape.

Key Takeaways

- Market Position: Almatica commands a significant share in dermatology and rare diseases segments, with scalable growth potential through geographic and therapeutic diversification.

- Strengths: Focused R&D, strong IP portfolio, strategic licensing, and effective commercial execution underpin its competitive advantages.

- Strategic Opportunities: Mergers & acquisitions, digital transformation, and expansion into emerging markets are vital growth avenues.

- Risks: Competition, regulatory hurdles, patent expiry, and pipeline uncertainties require vigilant management.

- Future Outlook: Strategic agility, innovation, and global rollout initiatives will determine Almatica’s ascendancy within the global pharmaceutical industry.

FAQs

-

What differentiates Almatica from its competitors?

Almatica’s emphasis on niche therapeutic areas, robust innovation pipeline, and strategic collaborations set it apart in the specialized pharma space.

-

How does Almatica mitigate risks associated with drug development?

Its diversified pipeline, focus on orphan drugs, and strategic licensing reduce dependence on single assets, spreading risk.

-

What strategic moves can potentially boost Almatica’s market share?

Acquisitions of innovative biotech firms, expanding into emerging markets, and investing in digital health tools can accelerate growth.

-

How does Almatica's intellectual property protect its market position?

Its extensive patent portfolio ensures exclusivity, providing a competitive edge and revenue protection.

-

What are the primary challenges facing Almatica moving forward?

Competition, regulatory delays, patent expiries, and pipeline failures represent key risks requiring proactive management.

Sources:

[1] Almatica Annual Reports (2022)

[2] Industry Market Share Data, IQVIA (2022)

[3] Patent and R&D Investment Analysis, Pharma Intelligence (2022)