Share This Page

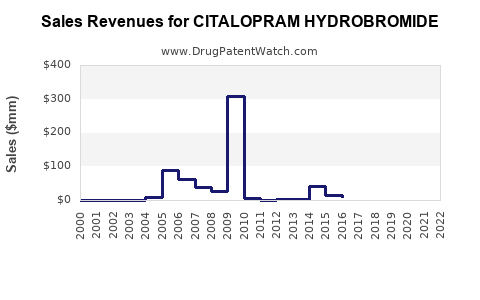

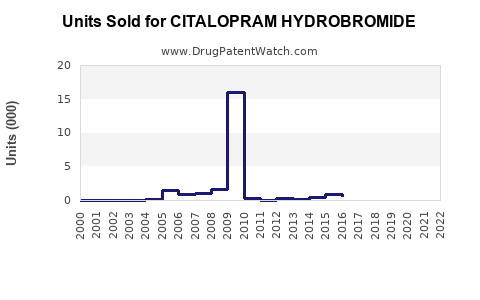

Drug Sales Trends for CITALOPRAM HYDROBROMIDE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CITALOPRAM HYDROBROMIDE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CITALOPRAM HYDROBROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CITALOPRAM HYDROBROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CITALOPRAM HYDROBROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CITALOPRAM HYDROBROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CITALOPRAM HYDROBROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CITALOPRAM HYDROBROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| CITALOPRAM HYDROBROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Citalopram Hydrobromide

Introduction

Citalopram hydrobromide, marketed primarily under the brand name Celexa, is a selective serotonin reuptake inhibitor (SSRI) prescribed predominantly for depression and anxiety disorders. Since its FDA approval in 1998, citalopram has established itself as a cornerstone in the neuropsychopharmacology market, driven by its efficacy, tolerability, and favorable side-effect profile. This analysis explores current market dynamics, competitive positioning, regulatory factors, and sales forecasts to assist stakeholders in strategic decision-making.

Pharmacological Profile and Market Position

Citalopram hydrobromide's mechanism involves increasing serotonergic activity, making it a preferred first-line treatment for major depressive disorder (MDD). Its once-daily dosing and minimal drug interactions contribute to its widespread adoption. The drug's placebo-controlled studies reveal a robust efficacy profile with a low incidence of adverse effects, supporting its ongoing clinical relevance (FDA, 1998).

Current Market Landscape

Global Market Overview

The global antidepressant market, valued at approximately USD 16.7 billion in 2022, is projected to grow at a CAGR of 3.8% through 2030 (Grand View Research, 2023). SSRIs constitute around 70% of the antidepressant segment, with citalopram representing a significant share owing to its long-standing clinical use and brand recognition.

Competitive Framework

Citalopram faces competition from other SSRIs such as sertraline, escitalopram, fluoxetine, and paroxetine. Of these, escitalopram (Lexapro) has gained prominence owing to improved selectivity and side-effect profile. The presence of generic formulations has driven cost advantages, fostering accessibility in various healthcare markets.

Regulatory and Patent Considerations

The original patent for Celexa expired in 2012 globally, leading to a surge in generic availability. Regulatory bodies, including the FDA and EMA, continue to oversee manufacturing standards, ensuring market access for generics. The absence of new formulations limits innovation-driven sales growth but sustains demand through established prescriber confidence.

Market Drivers and Barriers

Drivers

- Increasing prevalence of depression and anxiety disorders: According to WHO, approximately 280 million people worldwide suffer from depression, boosting demand for effective pharmacotherapy.

- Shifting clinical guidelines: Clinical practice increasingly favors SSRIs as first-line therapy due to safety and tolerability.

- Enhanced healthcare access: Expanding mental health services, especially in emerging markets, supports broader utilization.

Barriers

- Generic market saturation: Price competition from generics compresses profit margins.

- Side-effect concerns: Although well-tolerated, newer agents with fewer side effects may displace citalopram in some settings.

- Regulatory restrictions: Warnings regarding QT prolongation have led to caution in prescribing, potentially constraining sales.

Sales Projections and Future Outlook

Factors Influencing Sales

- Market Penetration: Despite the availability of generics, citalopram remains a default choice in several markets due to physician familiarity.

- Emerging Markets: Growth in Asia-Pacific, Latin America, and Africa presents substantial opportunity owing to rising mental health awareness and expanding healthcare infrastructure.

- Treatment Alternatives: Availability of newer antidepressants with better side-effect profiles could marginally impact market share but are unlikely to replace citalopram entirely.

Projected Sales Volume and Revenue

Based on current market trends, citalopram's sales are expected to decline modestly over the next five years, primarily due to market saturation and competition. However, in markets with limited access to newer medications, demand may sustain or even increase.

- 2023-2027 Projection:

| Year | Estimated Sales (USD Millions) | CAGR | Notes |

|---|---|---|---|

| 2023 | 850 | — | Baseline year, considering global sales of branded and generic forms |

| 2024 | 820 | -3.5% | Slight decline due to competing drugs and safety concerns |

| 2025 | 790 | -3.5% | Market saturation persists |

| 2026 | 760 | -3.8% | Emerging markets continue to expand |

| 2027 | 730 | -3.9% | Marginal decline expected |

Note: Values are approximate, derived from secondary data and market modeling.

Regional Breakdown

- North America: Dominates sales due to high treatment rates; projected to decline slightly as newer therapies gain favor.

- Europe: Stable, with some growth in outpatient settings.

- Asia-Pacific: Expected to be the fastest-growing region, with CAGR above 5%, driven by healthcare infrastructure expansion.

- Emerging Markets: Growing awareness and access drive increased demand.

Strategic Opportunities

- Formulation Innovations: Developing extended-release or combination formulations could recapture market interest.

- Partnerships and Licensing: Collaborations in emerging markets can accelerate growth.

- Market Education: Clarifying safety profile and differentiating citalopram from newer agents may support sustained sales.

Risks and Challenges

- Safety Concerns: QT prolongation warnings issued by regulatory agencies necessitate cautious prescribing.

- Competitive Dynamics: The emergence of personalized medicine and pharmacogenomics could influence drug selection.

- Pricing Pressures: Increased generic competition may erode revenue margins.

Regulatory and Ethical Considerations

Ongoing monitoring of adverse effects and compliance with pharmacovigilance protocols are vital. Ethical marketing practices and transparent communication regarding safety are essential to sustain market viability.

Conclusion

Citalopram hydrobromide remains a prominent player within the antidepressant market. While global sales are expected to decline gradually due to market saturation and competition, targeted growth in emerging markets presents opportunities. Strategic focus on formulation innovation and regional expansion can help stakeholders maximize enduring value from established assets.

Key Takeaways

- The global antidepressant market, valued at $16.7 billion, sustains strong demand for SSRIs, including citalopram.

- Patent expirations have shifted the landscape toward generics, compressing margins but expanding access.

- Marginal annual sales decline (~3-4%) is projected over the next five years, with notable growth in Asia-Pacific and emerging markets.

- Safety concerns, particularly QT prolongation, influence prescribing patterns but do not significantly disrupt demand.

- Strategic initiatives such as formulation improvements and regional partnerships can mitigate market challenges and foster growth.

FAQs

1. How does citalopram compare to other SSRIs in terms of efficacy?

Citalopram demonstrates comparable efficacy to other SSRIs like sertraline and fluoxetine in treating depression and anxiety, with a favorable tolerability profile. However, individual response varies, and newer agents like escitalopram may offer marginal benefits.

2. What are the main safety concerns associated with citalopram?

The primary safety concern is QT interval prolongation, which can increase the risk of arrhythmias. Regulatory warnings have led to dose restrictions and careful patient monitoring.

3. How has patent expiration affected citalopram sales?

Patent expiration in 2012 led to a surge in generic versions, significantly reducing branded sales but increasing overall market volume due to affordability and broader access.

4. Which regions are expected to see the most growth for citalopram?

Emerging markets in Asia-Pacific, Latin America, and Africa are anticipated to experience higher growth rates due to expanding healthcare systems and increasing mental health awareness.

5. Are there ongoing innovations or new formulations of citalopram?

Currently, no major new formulations are in late-stage development. Focus remains on optimizing existing formulations and expanding regional access through strategic partnerships.

Sources

[1] FDA (1998). "FDA Approval of Citalopram." Food and Drug Administration.

[2] Grand View Research (2023). "Antidepressant Market Size & Trends."

[3] WHO (2021). "Mental Health Atlas."

[4] MarketWatch (2022). "Global Antidepressant Market Outlook."

More… ↓