PADAGIS US Company Profile

✉ Email this page to a colleague

What is the competitive landscape for PADAGIS US, and what generic alternatives to PADAGIS US drugs are available?

PADAGIS US has eighty-seven approved drugs.

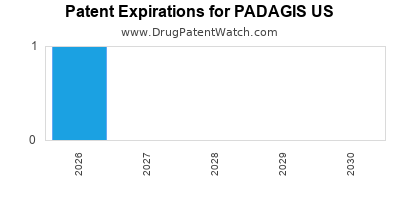

There is one US patent protecting PADAGIS US drugs.

There are twenty-two patent family members on PADAGIS US drugs in fourteen countries and one hundred and twenty-two supplementary protection certificates in fifteen countries.

Drugs and US Patents for PADAGIS US

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Padagis Us | LEVOCETIRIZINE DIHYDROCHLORIDE | levocetirizine dihydrochloride | SOLUTION;ORAL | 091263-001 | Nov 7, 2011 | AA | RX | No | Yes | ⤷ Sign Up | ⤷ Sign Up | ||||

| Padagis Us | CLOTRIMAZOLE | clotrimazole | TROCHE/LOZENGE;ORAL | 076763-001 | Oct 28, 2005 | AB | RX | No | No | ⤷ Sign Up | ⤷ Sign Up | ||||

| Padagis Us | NYSTATIN | nystatin | CREAM;TOPICAL | 062225-001 | Approved Prior to Jan 1, 1982 | AT | RX | No | No | ⤷ Sign Up | ⤷ Sign Up | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for PADAGIS US

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Padagis Us | BUTOCONAZOLE NITRATE | butoconazole nitrate | CREAM;VAGINAL | 019881-001 | Feb 7, 1997 | 5,993,856 | ⤷ Sign Up |

| Padagis Us | EVAMIST | estradiol | SPRAY;TRANSDERMAL | 022014-001 | Jul 27, 2007 | 6,923,983 | ⤷ Sign Up |

| Padagis Us | EVAMIST | estradiol | SPRAY;TRANSDERMAL | 022014-001 | Jul 27, 2007 | 6,299,900 | ⤷ Sign Up |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

Paragraph IV (Patent) Challenges for PADAGIS US drugs

| Drugname | Dosage | Strength | Tradename | Submissiondate |

|---|---|---|---|---|

| ➤ Subscribe | Enteric Coated Capsules | 3 mg | ➤ Subscribe | 2008-02-01 |

| ➤ Subscribe | Vaginal Cream | 2% | ➤ Subscribe | 2015-02-05 |

International Patents for PADAGIS US Drugs

Supplementary Protection Certificates for PADAGIS US Drugs

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1304992 | C01304992/01 | Switzerland | ⤷ Sign Up | PRODUCT NAME: CLINDAMYCINI PHOSPHAS ET TRETINOINUM; REGISTRATION NO/DATE: SWISSMEDIC 62513 28.03.2014 |

| 2049079 | LUC00006 | Luxembourg | ⤷ Sign Up | PRODUCT NAME: CYCLOSPORINE (GOUTTES OCULAIRES SOUS FORME D'EMULSION); AUTHORISATION NUMBER AND DATE: EU/1/15/990 20150323 |

| 0253310 | SPC/GB95/010 | United Kingdom | ⤷ Sign Up | PRODUCT NAME: 2-N-BUTYL-4-CHLORO-1-((2'-(1H-TETRAZOL-5-YL)BIPHENYL-4-YL) METHYL) -5-(HYDROXYMETHYL) IMIDAZOLE, OPTIONALLY IN THE FORM OF A PHARMACEUTICALLY ACCEPTABLE SALT, IN PARTICULAR A POTASSIUM SALT; REGISTERED: SE 12209 19940902; UK 0025/0324 19941215; UK 0025/0336 19941215 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Similar Applicant Names

Here is a list of applicants with similar names.