Last updated: July 27, 2025

Introduction

Clotrimazole, a broad-spectrum antifungal agent, has established itself as a foundational medication within the pharmaceutical landscape. Since its initial approval in the 1970s, the drug has become a mainstay in treating dermatophyte infections, candidiasis, and various other fungal conditions. This article examines the current market dynamics, factors influencing growth, competitive landscape, and future financial trajectory for clotrimazole.

Market Overview

Clotrimazoles belong to the imidazole class of antifungals, targeting ergosterol synthesis critical for fungal cell membrane integrity. The Global Market for topical antifungal agents, estimated at USD 3.7 billion in 2022, underscores the sustained demand for drugs like clotrimazole. Its widespread over-the-counter (OTC) availability in numerous countries underpins its significant market share, especially in dermatological applications.

Key Market Drivers

1. Increasing Incidence of Fungal Infections

Urbanization, immunosuppression, and aging populations contribute to rising fungal infection rates. The World Health Organization estimates that superficial fungal infections affect approximately 20-25% of the global population [1]. As these conditions become more prevalent, demand for effective, accessible antifungal agents like clotrimazole escalates.

2. Over-the-Counter Accessibility and Patient Preference

Clotrimazole’s OTC status across many jurisdictions facilitates its widespread use. Patients prefer self-medication for minor fungal infections, reducing healthcare expenditure and boosting sales volumes. Such accessibility has propelled the drug's dominance in the topical antifungal segment.

3. Expanding Therapeutic Indications

Recent research suggests potential in novel formulations and combination therapies utilizing clotrimazole, targeting resistant strains or broader dermatological conditions. Such innovations can catalyze market growth and extend clotrimazole’s therapeutic reach.

4. Generic Drug Market Expansion

The expiration of patents in multiple regions has led to an influx of generic formulations, significantly reducing treatment costs. The proliferation of generics enhances affordability, especially in developing countries, thus broadening market penetration.

Market Constraints and Challenges

1. Competition from Newer Antifungal Agents

Innovations like terbinafine and efinaconazole offer alternative mechanisms with improved efficacy and shorter treatment durations. These newer options challenge clotrimazole’s market share, particularly in refractory cases.

2. Limitations in Efficacy for Systemic Infections

Clotrimazole’s topical application limits its use to superficial infections. The absence of systemic formulations curtails its role in severe or disseminated fungal diseases, potentially capping its overall market size.

3. Resistance Development

Emerging resistance among certain fungal strains underscores a potential threat to long-term efficacy, although resistance to topical azoles like clotrimazole remains relatively low compared to systemic counterparts.

Regional Market Dynamics

North America

The U.S. and Canada dominate the market due to high OTC sales, established healthcare infrastructure, and widespread consumer awareness. The prevalence of skin fungal infections and the presence of numerous generic options foster a robust market environment.

Europe

European markets benefit from stringent regulations and high healthcare standards. The integration of clotrimazole in clinical guidelines sustains demand, especially in countries with high fungal infection rates.

Asia-Pacific

This region exhibits the fastest growth, fueled by population expansion, urbanization, and increasing healthcare accessibility. Countries like India and China increasingly adopt generic formulations, making antifungal therapy more affordable.

Latin America and Africa

While growth potential exists, economic constraints and limited healthcare infrastructure pose challenges. However, the expansive OTC market and high infection prevalence contribute to incremental growth.

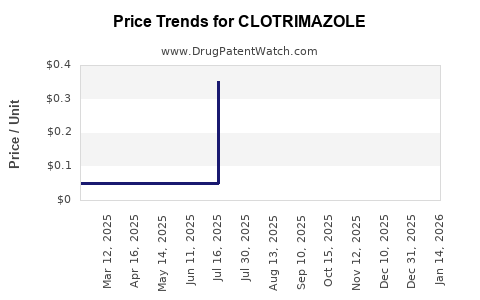

Financial Trajectory and Future Outlook

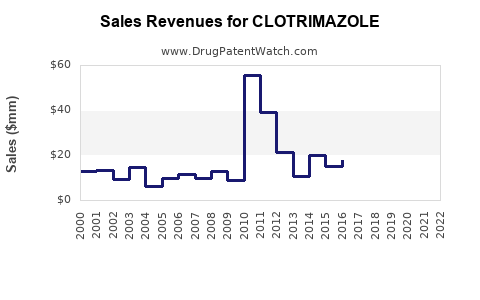

Current Revenue Streams

Clotrimazole products generate an estimated USD 600-800 million annually globally, primarily through topical formulations (creams, lotions, solutions). The OTC segment contributes over 70% of the revenue.

Growth Projections (2023-2030)

Forecasts indicate a compound annual growth rate (CAGR) of approximately 3-4% (2023-2030), driven by expanding regional markets, generic proliferation, and emerging applications. The Asia-Pacific region is expected to witness doubling of revenues due to increased adoption.

Impact of Innovation and Formulation Advances

Future growth hinges on formulations that improve bioavailability, reduce treatment duration, and address resistant fungal strains. Patented combination therapies or novel delivery mechanisms (e.g., liposomal formulations) could create premium segments, elevating revenue margins.

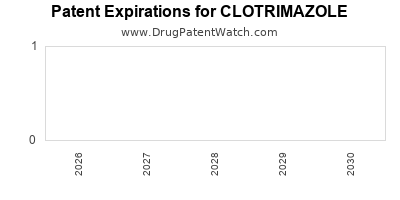

Regulatory and Patent Landscape

Patent expirations have catalyzed generic competition, enhancing affordability but compressing margins for branded formulations. Regulatory approvals for new formulations or combination products could rejuvenate market share for innovators.

Potential Market Risks

The primary risks include non-compliance with evolving regulatory requirements, rising resistance, and competition from systemic antifungals in selected indications. Additionally, shifts in consumer behavior towards natural or alternative therapies could impact sales.

Strategic Recommendations

- Innovation in Formulation: Invest in advanced delivery systems to enhance efficacy and patient compliance.

- Geographic Expansion: Focus on emerging markets with high infection rates and low treatment costs.

- Combination Therapies: Develop combination products to address resistant strains and broaden indications.

- Regulatory Vigilance: Monitor and adapt to changing regulatory landscapes to maintain market access.

- Pricing Strategies: Leverage generic markets to optimize volume while exploring premium formulations for niche markets.

Key Takeaways

- Clotrimazole maintains a dominant position in topical antifungal markets owing to OTC accessibility, affordability, and widespread infections.

- The growth trajectory is steady, with regional variations driven by demographic factors, healthcare infrastructure, and regulatory policies.

- Competition from newer agents and resistance concerns pose challenges, necessitating innovation and strategic positioning.

- Expansion into emerging markets presents significant revenue opportunities, especially through generic formulations.

- Future revenues depend heavily on formulation improvements, geographic expansion, and successful navigation of patent landscapes.

FAQs

1. How does the patent landscape influence clotrimazole’s market?

Patent expirations allow for generic manufacturing, increasing supply and reducing prices. However, it also intensifies competition, potentially compressing profit margins for brand-name products. Innovations or new formulations can be patent-protected, offering premium pricing and market differentiation.

2. What are the main competitors to clotrimazole in the antifungal segment?

Primary competitors include terbinafine, efinaconazole, ciclopirox, and butenafine. These agents often provide faster action or broader indications, challenging clotrimazole's market share.

3. Can clotrimazole treat systemic fungal infections?

No, clotrimazole is primarily a topical agent. Severe or systemic infections require systemic antifungals like fluconazole or itraconazole.

4. What role does OTC availability play in the drug’s market?

OTC access significantly boosts sales volume by enabling self-treatment, especially in low-resource settings. It reduces healthcare costs and accelerates market penetration globally.

5. What emerging trends could impact future demand for clotrimazole?

Development of novel formulations, combination therapies targeting resistant strains, and increasing adoption in emerging markets are key trends. Conversely, preference for natural or alternative remedies could temper growth.

References

[1] World Health Organization. Global fungal infection statistics. 2021.