Last updated: July 27, 2025

Introduction

Nystatin, an antifungal pharmaceutical agent discovered in the late 1950s, remains a significant drug in the treatment of fungal infections, primarily candidiasis. As an effective topical and oral antifungal, nystatin's market presence has persisted over decades, driven by its efficacy, safety profile, and broad application spectrum. This report analyzes the evolving market dynamics and financial trajectory of nystatin, considering factors such as manufacturing trends, regulatory influences, competitive landscape, emerging alternatives, and regional market growth.

Historical Context and Market Overview

Initially developed by American Cyanamid (later merged into Pfizer), nystatin revolutionized fungal infection management by addressing limitations of previous treatments. Its status as a first-line topical agent for oral and cutaneous candidiasis kept it relevant through the 20th century. Despite the advent of newer antifungals, such as azoles and echinocandins, nystatin maintains a niche role, especially in pediatric applications, pregnancy-safe treatments, and resource-constrained settings (e.g., India, Africa).

The global antifungal market, valued at approximately USD 13.6 billion in 2022, reflects growing fungal infection rates and expanding indications. Nystatin's market share, though relatively small compared to broader classes like fluconazole or amphotericin B, exhibits stability due to its unique benefits and favorable safety profile.

Market Drivers

Increasing Incidence of Fungal Infections

The prevalence of fungal infections continues to rise globally, driven by increased immunocompromised populations, including HIV/AIDS patients, cancer chemotherapy recipients, organ transplant patients, and diabetics. The WHO estimates millions suffer from candidiasis annually, fueling demand for effective antifungal agents like nystatin.

Preference for Topical and Safer Alternatives

Nystatin’s minimal toxicity—primarily limited to gastrointestinal discomfort and rare hypersensitivity—makes it a preferred choice for pediatric and pregnant populations, where systemic antifungals pose risks. Its status as an over-the-counter (OTC) medication in several regions further sustains its demand.

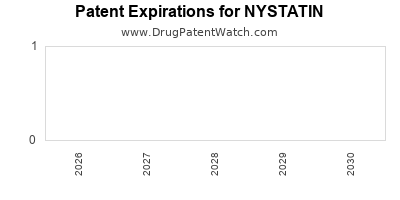

Regulatory Approvals and Patent Status

Nystatin is off-patent and available as a generic, which influences pricing dynamics and accessibility. Its established safety profile has led to consistent regulatory approvals across many jurisdictions, facilitating continuous market presence.

Market Challenges

Emergence of Resistance and Limited Spectrum

One of the primary concerns is the development of resistance in some Candida species, notably non-albicans strains, which can diminish nystatin's efficacy. Moreover, nystatin's limited systemic absorption restricts its scope, rendering it ineffective against disseminated fungal infections.

Competitive Landscape

The antifungal market faces intense competition from newer agents with broader spectra, improved bioavailability, and systemic activity, such as fluconazole, voriconazole, and echinocandins. These alternatives often replace nystatin in systemic or refractory infections, constraining growth in those segments.

Manufacturing and Supply Chain Factors

Nystatin's complex production, involving fermentation processes with Streptomyces noursei, can impact supply consistency and cost. The availability of raw materials and the aging of manufacturing facilities in certain regions may threaten supply security.

Regional Market Dynamics

North America and Europe

Market maturity defines these regions. Nystatin remains available in OTC formulations, especially in dermatological preparations and oral suspensions. However, its utilization is decreasing in hospital settings where systemic agents dominate.

Asia-Pacific

This region exhibits the most promising growth prospects. Factors include expanding healthcare infrastructure, rising prevalence of fungal infections, and high OTC use. Countries like India heavily rely on generic manufacturing, with local companies producing cost-effective formulations.

Africa and Latin America

In resource-limited settings, nystatin maintains a vital role due to affordability and safety. Government procurement policies often favor generics, bolstering consistent demand.

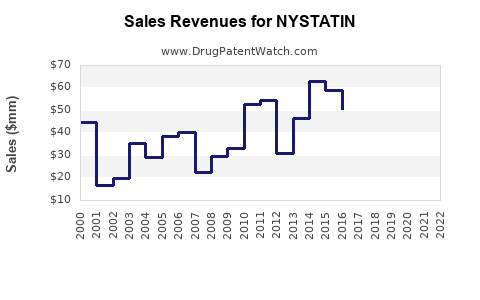

Financial Trajectory and Market Forecast

Current Revenue Streams

Estimated global sales of nystatin are forecasted to hover around USD 100-150 million annually, with a stable or modest decline in developed markets. Major revenue stems from OTC sales, compounded by a steady prescription and compounded formulations in hospitals.

Projected Growth and Trends

The compounded annual growth rate (CAGR) for nystatin is projected at approximately 2-3% over the next five years, driven by:

- Increasing infection rates in developing regions

- Growing awareness of antifungal therapies

- Continued use in pediatric and obstetric care

- Expansion of OTC availability

Conversely, market contraction could occur in mature economies due to substitution by newer systemic antifungals.

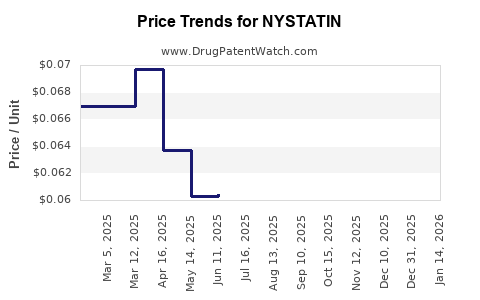

Profitability and Investment Outlook

Given its patent expiration, nystatin’s profit margins depend heavily on manufacturing efficiencies and regional pricing. The low-cost, off-patent nature fosters high-volume sales but limits profitability compared to newer, patented agents. Investments into formulation innovation (e.g., better delivery systems) could enhance market position.

Emerging Trends and Future Outlook

Formulation Innovations

Nanoformulations, mucoadhesive patches, and sustained-release suspensions are under exploration to enhance efficacy, compliance, and shelf-life. Such innovations could rejuvenate market interest.

Regulatory Developments

Accelerating approval pathways and regional registration efforts are anticipated, particularly in emerging markets, expanding access and sales channels.

Digital and Market Access Strategies

E-pharmacies and health awareness campaigns expand OTC distribution, especially in Asia and Africa, maintaining nystatin’s relevance.

Competitive Strategies

Manufacturers focusing on cost leadership, quality assurance, and strategic regional partnerships will sustain market traction amid rising competition.

Key Takeaways

-

Stable Demand in Niche Markets: Nystatin's safety profile and OTC availability ensure ongoing demand in pediatric, obstetric, and resource-limited settings.

-

Limited Growth Potential: The emergence of systemic antifungal agents and resistance issues constrain significant market expansion.

-

Regional Oil: Asia-Pacific offers robust growth opportunities driven by population size and healthcare infrastructure development.

-

Innovation as a Differentiator: Formulation advancements could revitalize interest and extend market lifespan.

-

Pricing and Manufacturing Efficiency: Profitability hinges on low-cost production and regional market access, given its generic status.

Conclusion

Nystatin remains a resilient player within the antifungal space, supported by its safety, affordability, and regional demand, especially in emerging markets. While its global market share and growth potential face headwinds from newer agents and resistance issues, strategic enhancements—particularly formulation innovations and expanded access—will shape its future trajectory. Business decision-makers should monitor regional dynamics, regulatory developments, and technological trends to capitalize on niche opportunities while preparing for competitive shifts.

FAQs

1. Is nystatin still relevant compared to newer antifungal agents?

Yes. Nystatin maintains relevance primarily in topical, pediatric, and obstetric applications due to its safety profile. However, systemic agents are preferred for invasive infections, limiting nystatin’s role in severe cases.

2. What regions offer the most growth potential for nystatin?

The Asia-Pacific region, especially India and Southeast Asian countries, presents the most promising growth due to high fungal infection prevalence, expanding healthcare infrastructure, and reliance on generics.

3. Are there any significant patent issues affecting nystatin?

Nystatin is off-patent, which has led to widespread generic manufacturing and price competition, limiting profit margins but ensuring broad accessibility.

4. How might formulation innovations influence nystatin’s market outlook?

Advancements such as nanoformulations and sustained-release systems could improve efficacy, patient compliance, and market differentiation, potentially expanding application areas.

5. What are the main competitive threats to nystatin?

The primary threats include the availability of systemic antifungals with broader spectra and better pharmacokinetics, rising drug resistance, and regional preferences for newer agents.

Sources

[1] MarketResearch.com, "Global Antifungal Drugs Market," 2022.

[2] World Health Organization, "Fungal Infections: Epidemiology and Treatment," 2021.

[3] Pfizer Annual Reports, 2015-2022.

[4] IQVIA, "Global Pharmaceutical Market Trends," 2022.