Last updated: December 31, 2025

Summary

Organon, a global healthcare company specializing in women’s health, biosciences, and biosimilars, has carved out a distinctive niche within the pharmaceutical industry. As an independent entity since its spin-off from Merck in 2021, Organon’s strategic focus emphasizes reproductive health, oncology, and specialty medicines, alongside biosurgery and biosimilar segments. This analysis investigates Organon’s current market positioning, core strengths, competitive advantages, and strategic initiatives to elucidate its role within the broader pharmaceutical landscape.

What Is Organon’s Market Position in the Pharmaceutical Industry?

Overview of Organon’s Market Footprint

| Segment |

Revenue (2022) |

Key Markets |

Growth Rate (CAGR 2022-2027 est.) |

Market Share (est.) |

| Women’s Health |

$2.7B |

U.S., Europe, Asia-Pacific |

4.5% |

~2% in global women’s health segment |

| Biosimilars & Biosurgery |

$1.2B |

U.S., EU, Emerging Markets |

6% |

Niche but growing presence |

| Oncology |

$650M |

North America, EU |

5% |

Emerging presence |

Source: Company Annual Report (2022), MarketsandMarkets, 2023 Estimates.

Organon’s strategic positioning leverages its strong portfolio in women’s health, with a focus on contraceptives, hormone therapy, and fertility treatments. The biosimilars segment, particularly with biosurgical and dermatological biosimilars, provides growth opportunities amid patent expirations and rising demand for cost-effective biologics.

Competitive Dynamics

- Major Competitors: Pfizer, Bayer, GSK, Novartis, and Teva.

- Differentiators: Specialization in women’s health and niche biosimilar markets.

- Market Share: Estimated at 2% globally, with higher penetration in specific regions like North America and Europe.

Regional and Segment Trends

| Region |

Predominant Products |

Market Dynamics |

Key Challenges |

| North America |

Contraceptives, biologics |

High adoption of biosimilars |

Patent cliff, price pressures |

| Europe |

Hormone therapies, biosurgical agents |

Emphasis on sustainability |

Stringent regulation |

| Asia-Pacific |

Fertility solutions, biosimilars |

Growing healthcare access |

Regulatory complexity |

What Are Organon’s Core Strengths?

1. Focused Portfolio in Women’s Health

Organon holds one of the most comprehensive portfolios in women’s reproductive health, including:

- Nexplanon (implant contraceptive)

- Yaz/Yasmin (oral contraceptives)

- Fertility treatments like Follistim

- Recent acquisitions augmenting its offerings

2. Robust Biosimilars and Biosurgery Segment

The company’s biosimilars division targets high-growth biologics markets:

- Key products: Biosimilar versions of reference biologics for oncology and immunology.

- Market strategy: Focus on cost-effective biologics to replace expensive originator products.

3. Strategic Acquisition and Alliances

- Acquisition of Forendo Pharma (2021) for endometriosis and reproductive health innovations.

- Collaborations with Lilly and other biotech firms (2022-23) for R&D pipelines and market access.

4. Geographic Diversification

Organon’s global footprint reduces reliance on any single market, ensuring resilience amid regional regulatory shifts and economic volatility.

5. Commitment to Innovation and Sustainability

- R&D investment (~$250M annually).

- Focus on sustainable manufacturing, eco-friendly packaging, and inclusive healthcare policies.

What Are Organon’s Key Strategic Advantages?

| Advantage |

Explanation |

| Specialization |

Deep domain expertise in women’s health differentiates Organon from broader pharma companies. |

| Portfolio Diversification |

Combining pharmaceuticals, biosimilars, biosurgery, and consumer health tools. |

| Agility Post-Spinoff |

As a standalone entity, Organon can swiftly pivot strategies without Merck’s broader corporate overhead. |

| Focused R&D |

Tailored investments in reproductive health innovations and biosimilars R&D pipelines. |

| Geographical Presence |

Strong foothold in core markets, with an expanding footprint in emerging economies. |

What Are the Strategic Challenges Facing Organon?

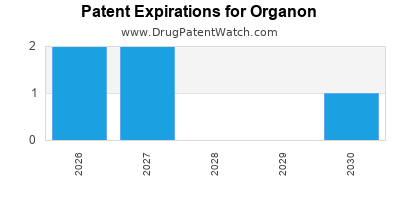

1. Patent Expirations & Pricing Pressures

- Next-generation biosimilars face intense competition from established players.

- Price erosion in key markets, particularly North America and Europe.

2. Regulatory Stringency

- Navigating complex approval pathways for biosimilars and biosurgery products.

- Reimbursement hurdles in emerging markets.

3. Limited Oncology Portfolio Compared to Peers

- Competing with larger firms with diversified oncology pipelines.

- Strategic need to expand indications and pipeline breadth.

4. Market Penetration

- Increasing competition in women's health, especially in contraceptive space.

- Challenges in gaining share in low-penetration markets.

How Is Organon Differentiating Itself From Competitors?

Product Portfolio and Innovation

- Focusing on niche reproductive health solutions that competitors often overlook.

- Leveraging biosimilar cost advantages in emerge markets.

Strategic Collaborations and Acquisitions

- Tapping into innovative R&D via partnerships.

- Acquiring targeted assets to accelerate growth.

Operational Efficiencies

- Streamlining manufacturing and supply chain for cost leadership.

- Commitment to sustainability enhancing brand reputation.

Customer-Centric Approach

- Engaging healthcare providers with tailored educational programs.

- Expanding patient access in underserved populations.

Comparison Table of Key Competitors

| Company |

Core Focus |

Market Share (Global) |

Notable Assets |

Strategic Moves (2022-23) |

| Pfizer |

Broad portfolio, vaccines, biologics |

~10% |

Prevnar, Ibrance |

Expand biosimilar & immuno-oncology pipeline |

| Bayer |

Women’s health, oncology |

~4% |

Mirena, Xarelto |

Reinvest in biosimilars and digital health |

| GSK |

Bio/pharma, vaccines |

~3% |

Shingrix, Oncology pipeline |

Partnerships in rare diseases |

| Novartis |

Neuroscience, biosimilars |

~4% |

Cosentyx, Sandoz biosimilars |

Focused on biosimilar expansion |

Strategic Outlook and Future Opportunities

Growth Drivers

| Driver |

Description |

Estimated Impact (2023-2027) |

| Biosimilars Expansion |

Increasing biologics adoption worldwide |

$3-5B market opportunity |

| Women’s Health Innovation |

New contraceptive and fertility solutions |

4-6% CAGR |

| Geographical Penetration |

Expanding into Asia-Pacific & Latin America |

Double-digit growth potential |

Key Strategic Initiatives

- Accelerate pipeline development with focus on novel hormone therapies.

- Expand biosimilar portfolio into oncology and immunology.

- Strengthen digital engagement and patient support programs.

- Sustain investments in sustainability, aiming for carbon-neutral manufacturing by 2030.

Conclusion

Organon’s strategic positioning as a niche pioneer in women’s health, coupled with a focused biosimilars portfolio and agile operational model, distinguishes it from larger pharmaceutical conglomerates. While challenges persist in competition and regulatory landscapes, its targeted investment strategies, geographic diversification, and commitment to innovation foster resilience and growth potential. Continued execution on pipeline expansion and strategic alliances will be paramount in sustaining its competitive edge.

Key Takeaways

- Organon excels in women’s health, with a comprehensive portfolio and innovation-driven approach.

- Biosimilars and biosurgery represent significant growth opportunities amid patent cliffs.

- Its independence from Merck affords agility but requires continued focus on expanding market share.

- Competitive threats include pricing pressures, regulatory hurdles, and mounting competition.

- Future growth hinges on pipeline innovation, global expansion, and strategic collaborations.

FAQs

Q1: How does Organon’s focus on women’s health differentiate it from its competitors?

Organon specializes exclusively in women’s health and reproductive services, enabling tailored innovation, dedicated R&D, and targeted market strategies, unlike broad-spectrum pharmaceutical firms.

Q2: What are the primary growth areas for Organon in the next five years?

Biosimilars, especially in oncology, expanding women’s health solutions, and increased penetration in emerging markets are primary growth drivers.

Q3: How resilient is Organon against patent expirations?

The company leverages its biosimilars and new product pipelines to offset patent cliff impacts, although intense competition and pricing pressures remain challenges.

Q4: What strategic moves should Organon prioritize to enhance market share?

Investing in novel product development, expanding biosimilar portfolio, forging regional partnerships, and reinforcing patient engagement are critical.

Q5: How does Organon plan to address regulatory challenges globally?

By investing in local regulatory expertise, adhering to regional standards proactively, and engaging with policymakers to streamline approval processes.

Sources:

[1] Organon Annual Report 2022.

[2] MarketsandMarkets. "Biosimilars Market by Type, Application, Region - Global Forecast to 2027," 2023.

[3] Company press releases and strategic updates (2021-2023).