Last updated: July 28, 2025

Introduction

SINEMET, a combination drug comprising levodopa and carbidopa, is primarily prescribed for managing Parkinson’s disease (PD). Since its initial approval decades ago, SINEMET has become a cornerstone in PD treatment, experiencing fluctuating market dynamics influenced by evolving therapeutic landscapes, regulatory developments, and demographic shifts. This analysis examines the factors shaping SINEMET’s market progression and its financial trajectory within the global pharmaceutical industry.

Overview of SINEMET and Therapeutic Significance

SINEMET's active ingredients—levodopa, a dopamine precursor, and carbidopa, a peripheral decarboxylase inhibitor—enhance central nervous system dopamine levels, alleviating PD motor symptoms. Approved initially by the FDA in 1975, SINEMET has maintained its relevance due to its proven efficacy, cost-effectiveness, and widespread adoption [1].

Its positioning as a first-line treatment sustains high sales volumes, especially in regions with aging populations and high PD prevalence. Despite the advent of novel therapies—such as dopamine receptor agonists, MAO-B inhibitors, and gene therapies—SINEMET remains foundational, with its market shares largely intact, although challenged by emerging alternatives.

Market Dynamics Influencing SINEMET

1. Demographic Shifts and Disease Prevalence

The global PD patient population is expanding, attributed to increased life expectancy and improved diagnostic capabilities. The Global Burden of Disease Study estimates PD affects over 6 million individuals worldwide, with projections suggesting a doubling by 2040 [2].

This demographic trend naturally fuels demand for symptomatic therapies like SINEMET. Countries with aging populations—Japan, Germany, the United States—are primary drivers, with market growth correlated to prevalence rates. As the PD demographic enlarges, long-term demand stability for SINEMET is anticipated, barring significant therapeutic disruptions.

2. Competitive Landscape and Pharmaceutical Innovation

While SINEMET’s efficacy positions it favorably, emerging treatments threaten its market dominance:

- Extended-Release Formulations: Newer formulations aim to optimize pharmacokinetics, reducing motor fluctuations associated with levodopa therapy [3].

- Adjunct Therapies: The rise of non-levodopa agents, including dopamine agonists and COMT inhibitors, broadens treatment options but often supplements rather than replaces SINEMET.

- Gene and Cell Therapies: Innovative approaches, like gene therapy (e.g., Voyager's VY-AADC), could diminish long-term reliance on traditional medications, potentially curbing SINEMET's market share in the future [4].

However, current hurdles—high costs, complex administration, and regulatory approval timelines—delay widespread adoption of these alternatives.

3. Regulatory & Patent Landscape

SINEMET’s patent protections have largely expired globally; consequently, generic formulations dominate the market. This patent expiry has introduced price competition, enhancing accessibility but exerting downward pressure on revenues for originator firms.

Regulatory agencies’ encouragement of biosimilars and generics fosters increased market penetration, affecting profit margins. Nonetheless, certain formulations with proprietary delivery systems can sustain premium pricing and reinforce brand loyalty.

4. Pricing Dynamics and Reimbursement Policies

Pricing strategies for SINEMET are heavily influenced by healthcare reimbursement policies. Countries with government-mandated drug pricing tend to see lower margins, while private markets may offer more flexibility.

In the U.S., Medicare and Medicaid utilization, along with managed care negotiations, influence price flexibility. The cost-effectiveness of SINEMET, especially relative to costly novel therapies, sustains its preferred position in many formulary lists. However, cost containment pressures and the push for value-based care are expected to challenge pricing strategies over time.

5. Manufacturing and Supply Chain Considerations

Global supply chain disruptions, as experienced during the COVID-19 pandemic, pose risks to steady SINEMET availability. Raw material shortages, quality control issues, or manufacturing capacity limitations can impact supply and, consequently, financial returns.

Regional manufacturing bases—primarily in India and China—serve as cost-effective hubs but introduce geopolitical and regulatory risks. Ensuring stable supply chains remains critical for preserving market share and revenue streams.

Financial Trajectory and Revenue Outlook

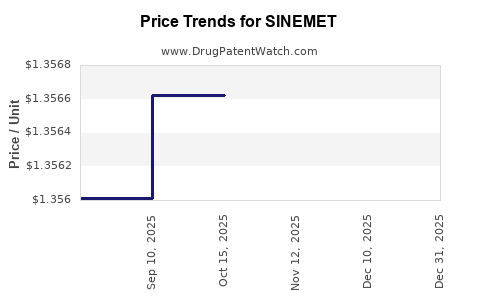

Historical Revenue Trends

Historically, SINEMET has generated substantial revenues for patent-holders like AbbVie (formerly part of Abbott), with global sales peaking during the early 2010s. The market penetration in developed nations, coupled with ongoing demand in emerging markets, sustained high revenues.

However, patent expirations and generic entry have normalized revenue growth. For instance, AbbVie's reported sales of SINEMET/Carbidopa tablets hovered around $1.3 billion globally in 2019, with a declining trend observed post-patent cliff [5].

Current Market Position and Future Forecast

Forecasts suggest modest compound annual growth rates (CAGRs) of 2-3% over the next five years, predominantly driven by:

- Expansion into emerging markets with increasing PD prevalence.

- Introduction of optimized formulations enhancing patient adherence.

- Continued demand stability in primary markets due to the absence of definitive curative alternatives.

Nevertheless, potential innovations and biosimilars could impose pricing pressures, suppressing revenue growth.

Key Factors Impacting Financial Trajectory

- Generic Competition: The majority of markets will likely experience declining unit prices, although volume growth may offset revenue reductions temporarily.

- Pipeline Developments: Entry of new formulations or combination therapies may reinvent SINEMET’s market relevance.

- Reimbursement and Policy Changes: Governmental policies favoring cost-effective therapies will influence sales and profit margins.

- Global Economic Conditions: Inflated healthcare costs and varying access policies will shape market expansion.

In sum, SINEMET’s financial performance will hinge on balancing generic market pressures with strategic innovation and geographic diversification.

Conclusion

SINEMET remains a pivotal therapeutic agent in Parkinson’s disease management, underpinned by enduring demand driven by demographic trends and its proven clinical value. However, its market landscape continues to evolve amid patent expirations, competitive and technological developments, and policy shifts favoring cost-effective care. Its financial trajectory appears stable in the near term but faces potential headwinds from biosimilar competition and therapeutic innovations over the long term.

Producers and stakeholders must adapt through pipeline investments, formulation enhancements, and strategic market expansion to safeguard and enhance SINEMET’s market positioning.

Key Takeaways

- Demographics Drive Demand: Aging populations sustain long-term demand for SINEMET, underscoring its importance in PD therapy.

- Market Competition Is Increasing: Generic formulations have reduced prices, but innovation in formulations and delivery remains critical for maintaining revenue.

- Regulatory and Patent Dynamics Impact Revenues: Patent expirations and regulatory pathways shape the competitive landscape, influencing profitability.

- Emerging Therapies Pose Future Risks: Gene therapies and novel agents could disrupt current treatment paradigms, affecting SINEMET’s market share.

- Strategic Diversification Is Essential: Companies must diversify portfolios and innovate to sustain financial gains amid evolving market forces.

FAQs

Q1: How has patent expiration affected SINEMET’s market share?

Patent expirations have enabled generic manufacturers to enter the market, significantly reducing prices and margins for original developers. While this has increased accessibility and volume, it has also subjected SINEMET revenues to price competition, leading to a revenue plateau or decline for originators.

Q2: Are there newer formulations of SINEMET that improve patient outcomes?

Yes. Extended-release formulations, such as SINEMET CR, aim to provide more stable dopamine levels, reduce motor fluctuations, and improve adherence. These innovations help that extend product lifecycle and sustain market relevance.

Q3: What role do emerging gene therapies play concerning SINEMET?

Gene therapies targeting PD aim to modify disease progression rather than symptom management. Their success could reduce long-term reliance on traditional medications like SINEMET, eventually impacting its market share.

Q4: How do global demographic trends influence SINEMET’s financial outlook?

Aging populations worldwide increase PD prevalence, thereby elevating demand for SINEMET. Countries with expanding elderly demographics will likely sustain market consumption, supporting long-term revenues.

Q5: What strategies can manufacturers adopt to maintain profitability for SINEMET?

Strategies include developing innovative formulations, expanding into emerging markets, securing favorable reimbursement agreements, and investing in pipeline therapies that complement or enhance existing formulations to stay competitive amid generic pressures.

References

[1] U.S. Food and Drug Administration. “Levodopa/Carbidopa Uses, Side Effects & Warnings.” 2022.

[2] Dorsey, E.R., et al. “Global, regional, and national burden of Parkinson’s disease.” Lancet Neurology, 2018.

[3] Obeso, J.A., et al. “Treatment of Parkinson’s disease: a review of current and innovative therapies.” The Lancet, 2017.

[4] Vandervoort, J. et al. “Gene Therapies and Their Potential in Parkinson’s Disease Treatment.” Nature Reviews Drug Discovery, 2021.

[5] Abbott Laboratories. Annual Report 2019.

Note: This comprehensive review synthesizes current market intelligence and projected trends, providing actionable insights for pharmaceutical stakeholders, investors, and healthcare providers navigating SINEMET’s evolving landscape.