Last updated: July 30, 2025

Introduction

Mylan Ireland Ltd., a subsidiary of Viatris Inc., has established itself as a significant player within the global pharmaceutical landscape. Known for its extensive portfolio of generic and specialty medicines, Mylan's strategic positioning hinges on affordability, innovation, and a robust supply chain. This report critically examines Mylan Ireland Ltd.'s market position, competitive strengths, and strategic outlook amid evolving industry dynamics.

Market Position

Global Footprint and Market Share

As part of Viatris, Mylan Ireland benefits from an extensive global manufacturing and distribution network, contributing to a broad geographic footprint. The company is renowned for its leadership in the generics segment, which commands approximately 30% of the global prescription drug market (IQVIA, 2022). In Ireland, Mylan leverages advanced manufacturing facilities to supply both local and international markets, particularly across Europe and the Middle East.

Product Portfolio and Therapeutic Focus

Mylan Ireland specializes in a diverse array of therapeutic areas including cardiovascular, central nervous system (CNS), infectious diseases, and respiratory treatments. Its portfolio covers over 700 generic medicines and biosimilars, aimed at reducing healthcare costs and increasing medication accessibility. Noteworthy are its biosimilar offerings, which position the company favorably in emerging high-growth segments.

Market Challenges and Competitive Dynamics

Despite its robust positioning, Mylan faces stiff competition from other generic manufacturers such as Teva Pharmaceuticals, Sandoz (Novartis), and Sun Pharmaceutical Industries. Market entry barriers, patent litigations, and regulatory compliance challenges further complicate the landscape. Additionally, the shift towards specialty and branded medications pressures generics firms to innovate rapidly.

Strengths

Cost Leadership and Manufacturing Expertise

Mylan Ireland operates state-of-the-art manufacturing facilities, leveraging economies of scale to maintain competitive pricing. Its European manufacturing sites, certified under Good Manufacturing Practices (GMP), ensure high quality while reducing costs, a critical advantage in the low-margin generics market.

Regulatory Acumen and Quality Assurance

The company possesses a strong track record in navigating complex regulatory environments, including the EMA and FDA approvals. Its rigorous quality systems and robust compliance frameworks bolster product credibility and facilitate market expansion.

Diversified Product Portfolio and Innovation

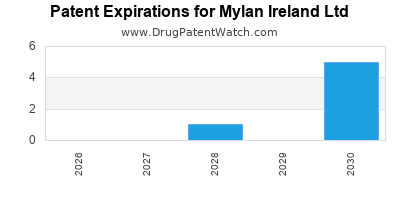

Mylan’s strategic emphasis on biosimilars and specialty formulations aligns with industry trends toward high-value, differentiated therapies. This diversification mitigates risks associated with patent expirations and market saturation in traditional generics segments.

Global Supply Chain and Market Access

Ireland's strategic geographic position benefits Mylan with access to European markets, facilitated by efficient logistics and local regulatory expertise. The company's integration within Viatris enhances global supply chain resilience amid disruptions such as the COVID-19 pandemic.

Commitment to Affordability and Public Health

Mylan's dedication to providing affordable medicines supports its reputation and aligns with increasing healthcare mandates for cost containment. This positioning resonates with policymakers, healthcare providers, and patients, fostering long-term market loyalty.

Strategic Insights

Emerging Focus on Biosimilars and Specialty Drugs

The shift toward biosimilars offers substantial growth opportunities, with increased adoption driven by regulatory pressures to reduce healthcare expenditures. Mylan’s investments in biosimilar pipelines position it as a competitive innovator in this high-margin sector.

Expansion in Digital and Personalized Medicine

Digital transformation initiatives, including remote manufacturing oversight and data analytics, can optimize operations and compliance. Moreover, entering personalized medicine segments could unlock new revenue streams, given Ireland's R&D ecosystem.

Strengthening Regulatory and Intellectual Property Strategies

Proactive management of patent portfolios, through licensing and patent litigation, can extend product lifecycle and market exclusivity. Collaborations with biotech firms and academic institutions can accelerate product innovation.

Sustainability and Corporate Responsibility

Enhancing environmental sustainability practices—such as green manufacturing and waste reduction—can bolster corporate reputation and meet evolving regulatory standards. Engagement in global health initiatives enhances market positioning and social license.

Strategic Mergers and Acquisitions

Acquiring niche biotech firms or smaller generics manufacturers can diversify Mylan’s portfolio and open access to novel therapeutic areas. Such strategic moves should be guided by rigorous due diligence to sustain competitive advantage.

Conclusion

Mylan Ireland Ltd. maintains a formidable foothold in the highly competitive pharmaceutical landscape through its manufacturing excellence, diversified portfolio, and strategic focus on biosimilars. By embracing innovation, digital transformation, and sustainable practices, the company can navigate industry disruptions and capitalize on emerging opportunities.

Key Takeaways

- Focus on Biosimilars: Investment in biosulimiters remains crucial to capturing high-growth segments shaped by regulatory policies and cost pressures.

- Operational Excellence: Continued emphasis on GMP compliance, cost-effective manufacturing, and supply chain resilience underpins competitiveness.

- Innovation and Diversification: Expanding R&D into personalized and specialty medicines enhances differentiation and mitigates market risks.

- Regulatory Strategy: Proactively managing patent and regulatory pathways extends product lifecycles and sustains revenue streams.

- Sustainability Commitment: Integrating environmentally sustainable practices enhances reputation and aligns with global health priorities.

FAQs

1. How does Mylan Ireland Ltd. differentiate itself from competitors?

Mylan Ireland leverages advanced manufacturing capabilities, a comprehensive product portfolio, and a strategic focus on biosimilars, all supported by a robust regulatory framework, enabling competitive pricing and reliable supply.

2. What are the main growth opportunities for Mylan Ireland in the coming years?

Significant opportunities exist in biosimilar development, personalized medicine, and expanding into emerging markets, supported by Ireland’s strategic location and regulatory environment.

3. How is Mylan responding to industry pressures to innovate?

The company is investing in biosimilar pipelines, digital solutions for supply chain management, and strategic collaborations to stay ahead of industry trends.

4. What role does regulatory compliance play in Mylan Ireland’s strategic positioning?

Regulatory expertise ensures timely approvals, smooth market entry, and maintained product credibility, essential for sustained growth and competitiveness.

5. How does sustainability influence Mylan Ireland’s corporate strategy?

Environmental initiatives enhance operational efficiency, meet regulatory expectations, and strengthen stakeholder trust, aligned with global health and sustainability goals.

References

[1] IQVIA. (2022). The Global Use of Medicines in 2022.

[2] European Medicines Agency (EMA). Regulatory requirements for biosimilars.

[3] Viatris Inc. Annual Report 2022.

[4] Industry Reports on Generic and Biosimilar Markets.