Last updated: July 27, 2025

Overview of Divalproex Sodium

Divalproex sodium, a derivative of valproic acid, is an established anticonvulsant and mood stabilizer primarily used to treat epilepsy, bipolar disorder, and migraine prophylaxis. Marketed under brand names such as Depakote, it boasts a long-standing presence due to its proven efficacy and safety profile. As the pharmaceutical landscape evolves, understanding the market dynamics and financial trajectory of divalproex sodium is vital for stakeholders—including manufacturers, investors, and policymakers.

Market Landscape and Competitive Positioning

The global market for divalproex sodium is characterized by high therapeutic demand driven by the prevalence of epilepsy, bipolar disorder, and migraines. The market is consolidated with key players like AbbVie (Depakote), Sanofi, and Teva Pharmaceuticals, holding significant share due to the drug’s established clinical profile and patent protections stemming from formulation patents and dosing formulations.

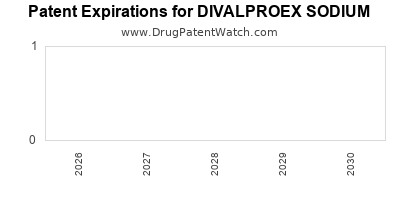

However, patent expirations have increased generic entry, intensifying price competition and pressure on margins. The influx of generics across major markets, notably the U.S. and Europe, has led to significant cost reductions, impacting revenue streams for brand-name manufacturers.

Market Drivers

1. Rising Prevalence of Target Indications

The increasing global burden of epilepsy, bipolar disorder, and migraines underpins steady demand. According to the World Health Organization (WHO), over 50 million people suffer from epilepsy worldwide, with bipolar disorder affecting approximately 1-2% of the population (WHO, 2021). The aging population further propels demand, as older adults exhibit higher incidences of these neurological conditions.

2. Expanding Off-Label Use and Clinical Adoption

Clinicians consider divalproex sodium for off-label uses, including psychiatric conditions like impulsivity and aggressive behaviors, expanding its prescribing footprint. New clinical guidelines and expanded indications continue to support its utilization.

3. Generic Market Penetration

The expiration of key patents around the mid-2010s led to increased generic competition. Generics typically comprise over 80% of the volume in developed markets, exerting downward pressure on prices and revenues for branded formulations.

Market Constraints and Challenges

1. Safety and Tolerability Concerns

Adverse effects such as hepatotoxicity, teratogenicity (notably neural tube defects), weight gain, and tremors have led to regulatory warnings and cautious prescribing practices. These concerns sometimes limit usage, especially among women of childbearing age.

2. Regulatory Environment and Patent Litigation

Patent disputes and regulatory hurdles influence market stability. While patents secured for formulations or delivery mechanisms have delayed generic entry in some regions, patent cliffs have substantially increased generic market penetration.

3. Price Erosion and Market Saturation

Fierce price competition has resulted in declining drug prices, reducing profit margins. The rise of biosimilars and alternative therapies, such as newer antiepileptic drugs (e.g., levetiracetam, lacosamide), further compounds market saturation.

Financial Trajectory and Revenue Forecasts

Historical Revenue Trends

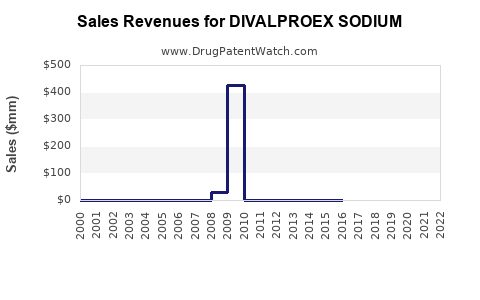

Historically, divalproex sodium generated peak global revenues exceeding $2 billion annually, driven predominantly by North American markets. Following patent expirations (notably in 2013 for Depakote in the U.S.), revenues declined sharply owing to generic competition, with some estimates indicating a 30-50% reduction in sales within five years post-patent loss.

Current and Projected Outlook

The current outlook indicates a stabilized but declining revenue trajectory. Conversely, some niche markets, such as specialty formulations (extended-release), continue to sustain incremental revenues.

Analysts project a compound annual growth rate (CAGR) of approximately -3% to -5% worldwide from 2023 through 2030, primarily due to generic erosion and competition from newer AEDs. However, specific markets like emerging economies—where regulation and price controls are less stringent—may offer modest growth opportunities.

Emerging Market Opportunities

Growth in Asia-Pacific, Latin America, and the Middle East is driven by increasing healthcare infrastructure, rising disease prevalence, and lower generic pressure. Local manufacturing and distribution partnerships are strategic avenues for growth.

Regulatory and Market Access Factors

Regulatory bodies globally scrutinize safety profiles; safety warnings and post-marketing surveillance impact prescribing. Reimbursement policies, especially in fragmented markets like the U.S., influence market uptake and pricing strategies. Payers tend to favor newer, potentially safer alternatives unless cost advantages of divalproex sodium are significant.

Implications for Stakeholders

- Manufacturers: Need to innovate via extended formulations, combination therapies, and biosimilars to sustain revenues amid mastodonic generic competition.

- Investors: Should monitor patent landscapes, regulatory changes, and emerging clinical data influencing prescription trends.

- Policymakers: Must balance access to cost-effective treatments with safety concerns, especially given teratogenic risks.

Conclusion: Market Dynamics and Future Trajectory

The divalproex sodium market remains an essential component within neurological and psychiatric therapeutic landscapes. Although revenue declines due to patent expiries and generic competition are evident, the enduring market demand driven by high prevalence rates sustains its relevance. Prospects for growth rely on strategic differentiation, addressing safety issues, and capitalizing on emerging markets.

Key Takeaways

- Patent expirations significantly shifted the market toward generics, reducing revenues for brand players.

- Growing demand for epilepsy, bipolar disorder, and migraine prophylaxis sustains baseline market size.

- Generics dominate in volume, though price erosion limits profit margins.

- Safety concerns influence prescribing trends and regulatory policies globally.

- Emerging markets present growth opportunities due to expanding healthcare infrastructure and less aggressive price controls.

FAQs

-

What are the main factors affecting the revenue of divalproex sodium?

Patent expirations, the influx of generics, safety concerns, and competition from newer anticonvulsant drugs are primary factors impacting revenues.

-

How does safety profile influence market performance?

Concerns over hepatotoxicity and teratogenicity lead to cautious prescribing, regulatory warnings, and limit drug utilization, affecting overall sales.

-

Are there opportunities for innovation within divalproex sodium formulations?

Yes, extended-release formulations and combination therapies offer avenues for differentiation and niche market sustenance.

-

Which regions present the most growth potential for divalproex sodium?

Asia-Pacific, Latin America, and Middle Eastern countries offer growth opportunities due to expanding healthcare access and less mature generic markets.

-

What is the outlook for brand-name versions versus generics?

Generics dominate volume but with squeezed profit margins; brand-name versions face declining revenues but can still command premium pricing in niche indications or specialized formulations.

Sources

- World Health Organization. (2021). Epilepsy Factsheet.

- Industry Reports. (2022). Global Antiepileptic Market Analysis.

- U.S. FDA. (2014). Patent and Exclusivity Data for Valproic Acid and Derivatives.

- IQVIA. (2022). Pharmaceutical Market Trends and Sales Data.