Last updated: July 27, 2025

Introduction

Topiramate, a versatile anticonvulsant and migraine prophylactic, has established itself as a significant player within the pharmaceutical landscape. Originally approved by the FDA in 1996 for epilepsy, its off-label uses and evolving therapeutic profile have propelled its market presence, impacting revenue streams and competitive strategies globally. This analysis delineates the current market dynamics and forecasts the financial trajectory of Topiramate, considering macroeconomic factors, patent landscape, regulatory environment, competitive pressures, and emerging opportunities.

Market Overview and Therapeutic Indications

Topiramate's primary approvals target epilepsy and migraine prevention, with additional off-label uses including weight management and bipolar disorder. The global prevalence of epilepsy stands at approximately 50 million, with migraine affecting over 1 billion individuals [1]. The expanding patient population fuels demand, particularly in regions with burgeoning healthcare access.

However, the therapeutic profile of Topiramate faces scrutiny due to adverse effects, notably cognitive impairment and metabolic concerns, influencing prescribing patterns. Despite this, its broad efficacy sustains its market relevance.

Market Dynamics

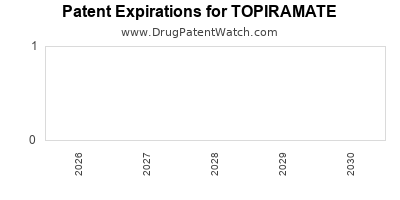

1. Patent Expiry and Generic Competition

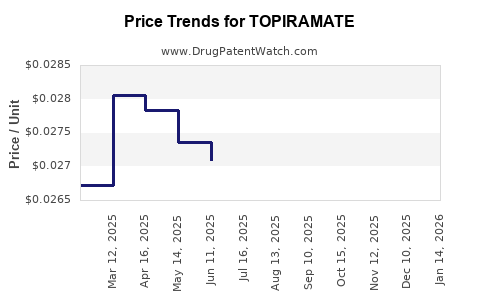

The expiration of patent protection significantly influences Topiramate's market dynamics. Since the initial patent expiry around 2008-2010 in various jurisdictions, multiple generic manufacturers have entered the market, intensifying price competition [2]. Generics constitute the majority of prescriptions, leading to substantial declines in branded sales and downward pressure on prices.

For example, in the United States, the branded version of Topiramate, originally marketed by Merck, lost patent exclusivity, prompting a surge in generic options. According to IQVIA data, generic formulations dominate prescriptions, comprising over 80% of the market share by volume [3].

2. Regulatory and Off-Label Use Impact

Regulatory bodies have issued warnings regarding Topiramate's adverse profile, impacting prescribing behavior. Nonetheless, clinicians continue to favor the drug due to efficacy and cost-effectiveness, especially where generics are dominant. Off-label indications, particularly weight loss prescriptions, have contributed to market fluctuations. The FDA's concerns over off-label promotion and safety issues, such as teratogenic risks, impose constraints that influence market evolution.

3. Geographic Market Variation

Market dynamics vary regionally. North America and Europe dominate sales, bolstered by established healthcare infrastructure, regulatory approvals, and high disease prevalence. Conversely, emerging markets like Asia-Pacific display growing adoption driven by increasing healthcare expenditure, although regulatory variability and cost sensitivities affect penetration.

4. Competitive Landscape

Several pharmacological alternatives challenge Topiramate, including newer migraine preventatives like CGRP inhibitors and other anticonvulsants with more favorable side-effect profiles. The competitive pressure compels continual price erosion and marketing strategies focused on differentiation and formulary positioning.

5. Socioeconomic Factors and Reimbursement Policies

Insurance coverage and reimbursement policies heavily influence prescription dynamics. In markets with comprehensive coverage, branded revenue retains some resilience; otherwise, generics dominate, further compressing profit margins.

Financial Trajectory and Revenue Forecasts

1. Historical Financial Performance

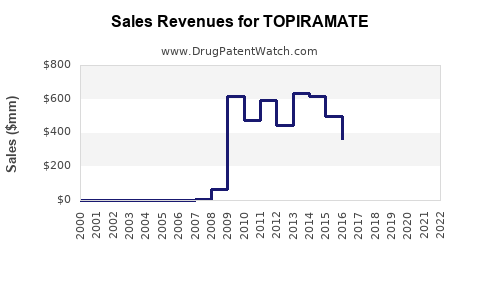

Historically, Topiramate generated peak revenues prior to patent expiry. For instance, Merck's branded Topiramate achieved approximately USD 1.2 billion annually in the late 2000s [4]. Post-patent expiry, revenues declined sharply with the proliferation of generics, with US sales dropping to below USD 200 million within a few years [5].

2. Market Size and Revenue Projections

Current global sales are largely driven by generics. Projections suggest the global Topiramate market will stabilize at USD 300-500 million annually over the next five years, influenced by generics' penetration and off-label use patterns [6].

Emerging markets are expected to demonstrate compounded annual growth rates (CAGRs) of 4-6%, mainly due to increasing epilepsy and migraine prevalence, improved healthcare access, and rising healthcare spending.

3. Impact of Patent Litigations and New Formulations

Patent litigations and the development of fixed-dose combinations or extended-release formulations could temporarily buoy revenues. However, such innovations face challenges due to existing generics and regulatory hurdles. A flagship example is the development of novel formulations aimed at improving tolerability, which could command premium pricing and expand market share.

4. Regulatory and Safety Developments

Ongoing safety concerns, including teratogenicity and neuropsychiatric side effects, influence regulatory decisions and consequently, market size. Stricter prescribing guidelines and contraindications may restrict use, thereby limiting revenue expansion.

5. Strategic Business Insights

Manufacturers aiming to sustain revenue streams are focusing on niche indications, exploring new formulations, and leveraging biosimilar or brand revitalization strategies. Venturing into combination therapies or adjunct indications remains a key strategy.

Future Outlook and Key Trends

The future of Topiramate’s market growth hinges on several variables:

- Innovation in Formulations: Extended-release and combination formulations could command better market positioning.

- Regulatory Landscape: Ongoing safety assessments and potential label updates may affect prescribing, thus influencing revenue.

- Generic Market Dynamics: Price competition will prevail unless new formulations or indications emerge.

- Emerging Therapeutics: Adoption of novel migraine preventives and seizure medications could reduce Topiramate’s market share.

Forecasts indicate that unless integrated with innovative strategies, Topiramate’s revenue trajectory will gradually decline, stabilizing at a relatively modest level, aligning with generic drug markets resilient to decline due to continual demand and labeling.

Key Takeaways

- Patent expirations have transformed Topiramate’s revenue landscape, shifting dominance to generics and prompting intense price competition.

- Despite safety concerns and regulatory challenges, demand persists in established markets driven by cost-effectiveness and broad therapeutic applications.

- Emerging markets present revenue growth opportunities owing to rising disease prevalence and expanding healthcare infrastructure.

- Continuous innovation, such as advanced formulations and combination therapies, is critical for manufacturers seeking to sustain or boost revenues.

- Regulatory and safety developments will heavily dictate future market size, emphasizing the need for adaptive strategies and vigilance.

FAQs

1. How has patent expiry affected Topiramate's market revenue?

Patent expiry led to an influx of generic competitors, sharply reducing the branded drug's revenue. Today, the market is dominated by generics, resulting in significantly lower sales compared to peak years.

2. What are the main therapeutic indications influencing Topiramate's market?

Epilepsy and migraine prevention remain primary indications. Off-label uses like weight management have contributed to demand but are limited by safety concerns.

3. Are there upcoming innovations that could revive Topiramate’s market?

Yes, formulations like extended-release versions, combination therapies, and new indication explorations could potentially revitalize market interest, provided they meet regulatory approval and demonstrate clinical benefits.

4. How do safety concerns impact the financial outlook for Topiramate?

Safety issues, especially teratogenicity and cognitive effects, lead to regulatory restrictions and cautious prescribing, which may constrain market growth and reduce revenue potential.

5. What regions offer the most growth potential for Topiramate?

Emerging markets in Asia-Pacific and Latin America offer promising growth due to expanding healthcare access, rising disease prevalence, and increasing adoption of generics.

Sources:

- WHO. Epilepsy. World Health Organization; 2019.

- U.S. Patent and Trademark Office. Patent Expiry Date Records.

- IQVIA. Pharmaceutical Market Data, 2022.

- Merck Annual Reports, 2008-2010.

- EvaluatePharma. Market Intelligence, 2021.

- MarketsandMarkets. Antiepileptic Drugs Market Forecast, 2022-2027.