ROFLUMILAST Drug Patent Profile

✉ Email this page to a colleague

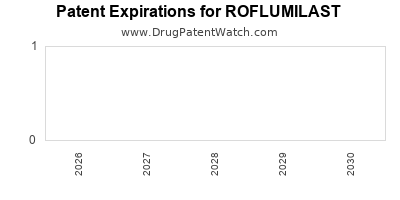

Which patents cover Roflumilast, and when can generic versions of Roflumilast launch?

Roflumilast is a drug marketed by Alkem Labs Ltd, Anda Repository, Aurobindo Pharma Ltd, Hetero Labs Ltd Iii, Micro Labs, MSN, Pharmobedient, Prinston Inc, Strides Pharma, Torrent, and Zydus Pharms. and is included in eleven NDAs.

The generic ingredient in ROFLUMILAST is roflumilast. There are ten drug master file entries for this compound. Sixteen suppliers are listed for this compound. Additional details are available on the roflumilast profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Roflumilast

A generic version of ROFLUMILAST was approved as roflumilast by PHARMOBEDIENT on July 13th, 2018.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ROFLUMILAST?

- What are the global sales for ROFLUMILAST?

- What is Average Wholesale Price for ROFLUMILAST?

Summary for ROFLUMILAST

Recent Clinical Trials for ROFLUMILAST

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Beth Israel Deaconess Medical Center | PHASE2 |

| Tulane University | PHASE2 |

| Ahmed Ibrahim | PHASE2 |

Pharmacology for ROFLUMILAST

| Drug Class | Phosphodiesterase 4 Inhibitor |

| Mechanism of Action | Phosphodiesterase 4 Inhibitors |

Anatomical Therapeutic Chemical (ATC) Classes for ROFLUMILAST

Paragraph IV (Patent) Challenges for ROFLUMILAST

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| ZORYVE | Cream | roflumilast | 0.3% | 215985 | 1 | 2023-12-27 |

| DALIRESP | Tablets | roflumilast | 250 mcg | 022522 | 1 | 2019-01-25 |

| DALIRESP | Tablets | roflumilast | 500 mcg | 022522 | 7 | 2015-03-02 |

US Patents and Regulatory Information for ROFLUMILAST

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Alkem Labs Ltd | ROFLUMILAST | roflumilast | TABLET;ORAL | 212490-001 | Apr 18, 2023 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Torrent | ROFLUMILAST | roflumilast | TABLET;ORAL | 208272-001 | Aug 6, 2018 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Hetero Labs Ltd Iii | ROFLUMILAST | roflumilast | TABLET;ORAL | 208213-002 | Apr 18, 2023 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for ROFLUMILAST

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| AstraZeneca AB | Daxas | roflumilast | EMEA/H/C/001179Daxas is indicated for maintenance treatment of severe chronic obstructive pulmonary disease (COPD) (FEV1 post-bronchodilator less than 50% predicted) associated with chronic bronchitis in adult patients with a history of frequent exacerbations as add-on to bronchodilator treatment., | Authorised | no | no | no | 2010-07-05 | |

| AstraZeneca AB | Libertek | roflumilast | EMEA/H/C/002399Libertek is indicated for maintenance treatment of severe chronic obstructive pulmonary disease (COPD) (FEV1 post-bronchodilator less than 50% predicted) associated with chronic bronchitis in adult patients with a history of frequent exacerbations as add-on to bronchodilator treatment. | Withdrawn | no | no | no | 2011-02-28 | |

| AstraZeneca AB | Daliresp | roflumilast | EMEA/H/C/002398Daliresp is indicated for maintenance treatment of severe chronic obstructive pulmonary disease (COPD) (FEV1 post-bronchodilator less than 50% predicted) associated with chronic bronchitis in adult patients with a history of frequent exacerbations as add-on to bronchodilator treatment. | Withdrawn | no | no | no | 2011-02-28 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

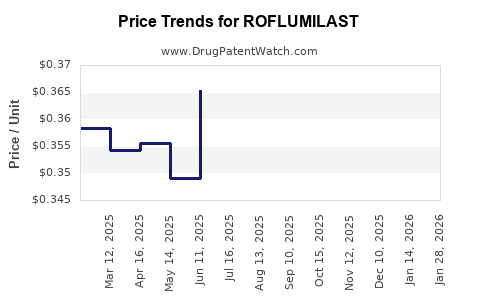

Market Dynamics and Financial Trajectory for Roflumilast

More… ↓