Last updated: July 27, 2025

Introduction

Roflumilast (Daliresp, Aformax) is a phosphodiesterase-4 (PDE4) inhibitor primarily indicated for reducing the risk of recurrent exacerbations in patients with severe chronic obstructive pulmonary disease (COPD) associated with chronic bronchitis. As an oral anti-inflammatory agent, its unique mechanism has positioned it within a niche market amidst potent competitors such as bronchodilators and corticosteroids. This analysis explores the evolving market landscape, key drivers, challenges, and financial outlook for roflumilast over the coming years.

Market Landscape and Key Players

The global COPD treatment market projected to reach USD 17.2 billion by 2026, is marked by intense competition among bronchodilators, corticosteroids, and emerging therapies like biologics [1]. Roflumilast captures a specialized segment targeting exacerbation reduction, particularly for patients with chronic bronchitis phenotype and frequent exacerbations.

Major competitors include:

- Bronchodilators: Long-acting β2-agonists (LABAs), long-acting muscarinic antagonists (LAMAs)

- Anti-inflammatory agents: Inhaled corticosteroids (ICS)

- Novel agents: Biologicals like monoclonal antibodies targeting eosinophilic inflammation

Despite intense competition, roflumilast’s oral route offers convenience over inhaled therapies, providing a distinct value proposition for specific patient subsets.

Market Drivers

Expanding COPD Prevalence

According to the World Health Organization, COPD ranks as the third leading cause of death globally, with an estimated 211 million cases [2]. Aging populations, smoking habits, and rising pollution levels contribute to prevalence growth, directly fueling demand for adjunct therapies like roflumilast.

Guideline Endorsements

Professional societies such as GOLD (Global Initiative for Chronic Obstructive Lung Disease) recommend roflumilast in patients with severe COPD with frequent exacerbations despite optimal inhaled therapy [3], bolstering prescription rates.

Efficacy in Exacerbation Reduction

Roflumilast’s capacity to lower exacerbation frequency translates into reduced hospitalization costs, making it an attractive adjunct treatment in health economics models, especially in healthcare systems prioritizing cost savings.

Patient-Centric Advantages

The oral administration and improvement in quality of life metrics promote adherence, further supporting its market presence.

Market Challenges

Limited Scope of Indication

Roflumilast is indicated mainly for severe COPD with chronic bronchitis phenotype. Its marginal role outside of this subset limits its broad market penetration relative to inhaled therapies.

Side Effect Profile

Common adverse effects include gastrointestinal symptoms, weight loss, and neuropsychiatric events (e.g., depression, anxiety) which hinder tolerability and patient adherence [4].

Pricing and Reimbursement Constraints

High costs relative to inhaled generic therapies restrict access in cost-sensitive markets, especially where reimbursement is limited.

Emerging Therapies

Biologics and gene therapies targeting COPD phenotypes threaten to displace small-molecule therapies in future treatment algorithms.

Financial Trajectory

Revenue Trends

Since its launch in 2013, roflumilast has posted modest but stable growth, driven by increased adoption in US and European markets. The drug's sales reached approximately USD 500 million globally in 2022, with expectations of a compound annual growth rate (CAGR) of around 4-6% over the next five years, fueled by prevalence increases and guideline recommendations [5].

Market Expansion Strategies

Pharmaceutical companies are exploring formulations with improved safety profiles and combination products to enhance utility. For instance, partnerships to combine roflumilast with bronchodilators may boost adherence and expand usage.

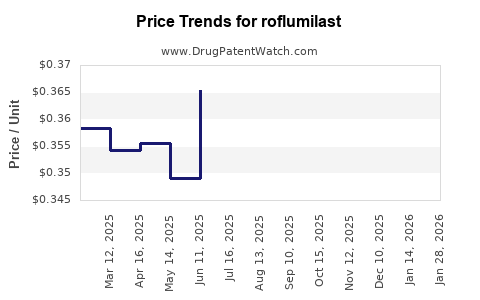

Pricing Dynamics

Patent protections until 2025 in key markets ensure pricing power; post-expiry, generic competition may erode revenue. Nonetheless, strategic positioning in niche populations ensures sustained relevance.

Regulatory and Policy Impact

Healthcare system reforms emphasizing cost-effective treatments and decreased reliance on expensive biologics may further favor oral PDE4 inhibitors like roflumilast.

Future Outlook

The introduction of next-generation PDE4 inhibitors with improved safety profiles is anticipated. Additionally, biomarker-driven patient stratification could refine target populations, expanding market share. The trajectory suggests moderate growth driven primarily by the burgeoning COPD burden, with potential fluctuations based on competitive dynamics and healthcare policies.

Conclusion

Roflumilast operates within a complex pharmaceutical ecosystem shaped by unmet needs in severe COPD management, safety considerations, and market competition. Its financial journey remains cautiously optimistic, contingent upon continued epidemiological growth, clinical validation, and strategic positioning to mitigate limitations.

Key Takeaways

- Roflumilast’s niche positioning for severe COPD with frequent exacerbations sustains steady revenue streams amid competitive inhaled therapies.

- The global COPD epidemic serves as a robust fundamental driver for long-term growth, particularly in aging populations.

- Market challenges such as adverse effects, limited indications, and impending patent expirations require strategic innovation and pipeline development.

- Cost considerations and healthcare policies influence adoption and reimbursement, impacting revenue trajectories.

- Future innovations—combination therapies and personalized medicine—may unlock new growth avenues for roflumilast.

FAQs

Q1: Will generic versions of roflumilast significantly impact its market share?

Yes. Patent expiries around 2025 in major markets will introduce generics, likely reducing prices and impacting branded sales. However, niche indications and combination therapy developments can sustain revenues.

Q2: How does roflumilast compare with newer COPD treatments?

While newer biologics target eosinophilic phenotypes and may offer better safety profiles, roflumilast’s oral administration and proven efficacy in reduction of exacerbations retain its significance, especially in severe COPD with chronic bronchitis.

Q3: Are there ongoing efforts to address the side effect profile of roflumilast?

Yes. Research focuses on dose optimization, alternative formulations, and combination treatments to improve tolerability.

Q4: How might healthcare policies influence future sales of roflumilast?

Reimbursement restrictions and cost-effectiveness evaluations could limit access in certain regions, while policies promoting chronic disease management could enhance utilization.

Q5: What is the potential for roflumilast in indications beyond COPD?

Currently limited, but ongoing research investigates anti-inflammatory applications in other respiratory and inflammatory conditions. Future approvals depend on clinical trial outcomes.

References:

- MarketsandMarkets. COPD treatment market analysis, 2022.

- WHO. Global prevalence of COPD. 2017.

- Global Initiative for Chronic Obstructive Lung Disease (GOLD). 2023 Report.

- Kim, S.H., et al. "Safety and tolerability of roflumilast in COPD." Respiratory Medicine, 2020.

- IQVIA. GlobalPharma Data, 2022.