Last updated: July 27, 2025

Introduction

Quetiapine fumarate, marketed under brand names such as Seroquel, is an atypical antipsychotic medication primarily indicated for schizophrenia, bipolar disorder, and major depressive disorder. Since its FDA approval in 1997, quetiapine fumarate has established a significant presence within the psychiatric medication market, driven by its efficacy, safety profile, and expanding therapeutic uses. This report examines the current market dynamics influencing quetiapine fumarate, alongside the financial trajectory shaping its future growth prospects.

Market Overview and Competitive Landscape

Global Market Size

The global antipsychotic drugs market was valued at approximately USD 14.3 billion in 2022, with expectations to reach USD 22.7 billion by 2030, at a CAGR of around 6.2% (2023-2030) [1]. Quetiapine fumarate notably comprises a substantial share owing to its extensive formulary adoption and widespread clinical use.

Key Players

Major pharmaceutical entities manufacturing and marketing quetiapine fumarate include:

- AstraZeneca (original developer of Seroquel)

- Sun Pharmaceutical Industries

- Teva Pharmaceuticals

- Lupin Limited

- Mylan (now part of Viatris)

AstraZeneca retains significant market share through brand equity, although generic formulations have widespread penetration, impacting revenue streams and competitive positioning.

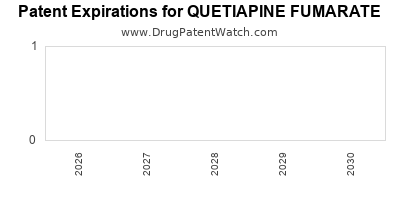

Patent Expiry and Generics

The expiration of AstraZeneca's patent in the early 2010s catalyzed the entry of generic versions, significantly reducing the drug’s price point. The proliferation of generics has led to increased accessibility, especially in emerging markets, but has also pressured brand-name sales. The consequence is a classic market commoditization scenario that impacts profit margins but broadens patient access.

Market Drivers

Increased Prevalence of Psychiatric Disorders

The rising incidence of schizophrenia, bipolar disorder, and comorbid depression, globally, sustains demand for antipsychotics including quetiapine fumarate. The WHO estimates schizophrenia affects approximately 20 million people worldwide, with bipolar disorder impacting an estimated 45 million [2].

Evolving Treatment Guidelines

International psychiatric guidelines increasingly favor atypical antipsychotics due to their improved side effect profiles, especially regarding extrapyramidal symptoms and tardive dyskinesia, favoring drugs like quetiapine [3].

Expansion of Indications

Beyond primary psychiatric conditions, research supports quetiapine’s off-label uses—e.g., sleep disorders, anxiety disorders—further broadening market scope. The drug’s sedative properties contribute to its off-label prescriptions, making it an attractive option in multiple therapeutic areas.

Growing Acceptance in Emerging Markets

Developing regions, such as Asia-Pacific and Latin America, display increased mental health awareness and healthcare infrastructure investments. Market access expansion, supported by governmental programs and insurance coverage enhancements, fuels growth of both branded and generic quetiapine fumarate.

Market Challenges

Safety and Tolerability Concerns

Despite its efficacy, quetiapine fumarate associates with adverse effects—metabolic syndrome, weight gain, cardiovascular risks—prompting cautious prescribing and monitoring. These safety issues can limit long-term adherence and influence clinician choices.

Competition from Newer Agents

Innovative antipsychotics, including drugs with novel mechanisms of action (e.g., brexpiprazole, cariprazine), challenge quetiapine’s market dominance. Some of these newer medications demonstrate favorable side effect profiles, influencing prescribing patterns.

Regulatory and Off-label Prescriptions

Increased scrutiny from regulatory bodies over off-label uses may impact prescribing trends and reimbursement policies. Also, off-label prescriptions can influence market stability and future revenue predictions.

Patent and Pricing Pressures

Patent expirations continue to erode market share and profit margins. Price erosion due to generics exerts downward pressure on revenue streams, especially in markets where price-sensitive healthcare systems dominate.

Financial Trajectory and Revenue Outlook

Revenue Streams and Trends

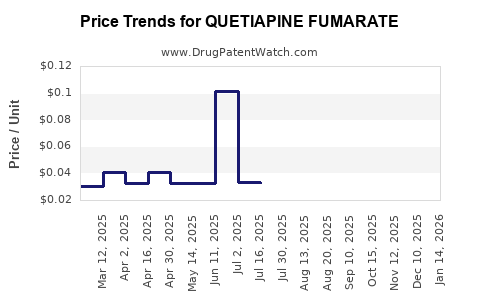

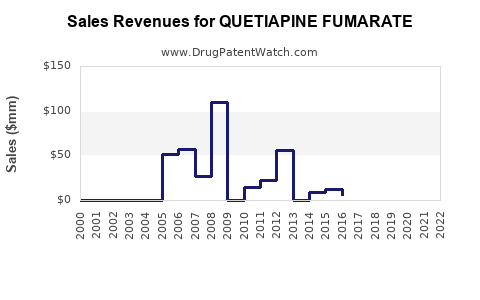

Historically, AstraZeneca’s sales of Seroquel generated peak annual revenues exceeding USD 5 billion. Post-patent expiry, revenues declined sharply, with generics taking market share. However, in territories where branded versions persist, or where restrictions limit generic entry, certain formulations maintain premium pricing.

Impact of Generic Competition

In the U.S., generic quetiapine accounted for a substantial share by 2014, decreasing brand-name sales significantly [4]. Nonetheless, branded sales persist in some jurisdictions for specific indications or formulations, such as extended-release versions.

Future Growth Opportunities

- Extended-Release (XR) Formulations: The popularity of XR formulations supports premium pricing. The launch of improved delivery systems and patent protections for specific formulations could sustain revenue.

- Off-label Therapies: Ongoing research into efficacy for off-label uses can generate additional revenue streams if supported by clinical evidence and regulatory approval.

- Digital Therapeutics and Companion Diagnostics: Integration with digital health solutions can enhance therapeutic adherence, indirectly influencing sales.

Market Projections

Based on current trends, the global quetiapine fumarate market is projected to grow modestly at a CAGR of around 3-4% through 2030, driven largely by emerging market expansion and off-label use. However, this growth trajectory will be tempered by increasing generic competition and safety concerns.

Strategic Considerations

Innovation and Patent Strategy

Focusing on formulation innovations, extended-release mechanisms, and combination therapies can provide competitive advantages and extend patent life cycles.

Pricing and Market Access

Strategic pricing, tailored to regional healthcare systems, ensures market penetration without compromising profitability. Collaborations with healthcare providers to enhance reimbursement pathways can expand access.

Diversification

Diversifying indications through clinical trials for related psychiatric conditions can unlock new revenue segments. Additionally, alliances with digital health firms for treatment adherence platforms can bolster market positioning.

Regulatory and Ethical Considerations

Continual monitoring of safety profiles, compliance with evolving prescribing guidelines, and transparent communication regarding risks are essential to sustain market credibility and avoid legal repercussions.

Key Takeaways

- The introduction of generics post-patent expiry significantly eroded AstraZeneca's original revenue, but branded formulations still find niche markets, particularly in specialized formulations.

- Rising rates of psychiatric disorders globally sustain overall demand, while expanding off-label therapies and indications offer additional growth avenues.

- Pricing pressures, safety concerns, and competition from newer agents shape a challenging yet resilient market landscape.

- Strategic innovation, including extended-release formulations and digital integration, will be pivotal for gaining competitive advantage.

- Emerging markets present the most promising long-term growth prospects due to increasing healthcare access and mental health awareness.

FAQs

-

What factors are most influential in determining the future profitability of quetiapine fumarate?

Patent statuses, generic competition, safety profile management, and expanding therapeutic indications significantly influence profitability. Strategic innovation and market access also play pivotal roles.

-

How has patent expiration impacted the global market for quetiapine fumarate?

Patent expiration led to a surge in generic availability, lowering prices and eroding revenue for original developers. While market share shifted, brand-name formulations still command premium pricing in certain regions and formulations.

-

Are there emerging competitors that could displace quetiapine fumarate?

Yes. Novel antipsychotics with improved safety and efficacy profiles, such as brexpiprazole and cariprazine, continue to challenge quetiapine’s dominance, especially in refined treatment algorithms.

-

What role do off-label uses play in the commercial landscape of quetiapine fumarate?

Off-label applications—like sleep disorders and anxiety management—expand market reach, though they carry regulatory and safety considerations that can impact long-term commercial strategies.

-

What strategies can pharmaceutical companies employ to maintain market relevance for quetiapine fumarate?

Innovating formulations, pursuing new indications through clinical trials, leveraging digital health integration, and optimizing regional market access are key strategies for enduring relevance.

References

[1] MarketWatch, "Antipsychotic Drugs Market Size, Share & Trends," 2022.

[2] World Health Organization, "Mental Health: Strengthening Our Response," 2022.

[3] American Psychiatric Association, "Practice Guidelines for the Treatment of Patients with Schizophrenia," 2021.

[4] IQVIA, "Pharmaceutical Market Performance 2014-2022."