Last updated: July 29, 2025

Introduction

OXYTROL (brand name for Oxytrol) is a transdermal medication primarily prescribed for the management of urinary incontinence in adults. As a distinctive delivery system of oxybutynin, a potent anticholinergic agent, OXYTROL blends formulation innovation with longstanding clinical utility. The drug’s market behavior is influenced by a complex interplay of regulatory frameworks, technological advances, competitive landscape, and demographic trends. Analyzing these factors reveals its evolving position and provides insight into its future financial trajectory.

Market Overview

The global urinary incontinence therapeutics market is projected to reach USD 4.2 billion by 2025, growing at a compound annual growth rate (CAGR) of approximately 5% (source: Mordor Intelligence). Within this space, the transdermal segment, inclusive of OXYTROL, is capturing increasing attention due to advantages over oral formulations, including reduced gastrointestinal side effects and improved adherence.

OXYTROL's unique patch delivery system classifies it as a pioneer in the transdermal anticholinergic market. It offers steady plasma levels of oxybutynin, leading to enhanced tolerability, particularly with regard to dry mouth and constipation — common adverse effects associated with oral oxybutynin.

Market Dynamics Affecting OXYTROL

Regulatory Environment

Over the past decade, regulatory agencies such as the FDA have emphasized safety and efficacy in drug approvals and post-marketing surveillance. OXYTROL has benefited from the FDA’s acknowledgment of transdermal delivery’s benefits, which has helped streamline its approval pathways and reimbursement considerations.

However, changes in regulatory policies, particularly concerning drug labeling and safety warnings related to anticholinergic burden, can influence its adoption. The FDA's ongoing review of anticholinergic medications’ cognitive safety profile may impact future prescriptions, especially among elderly populations.

Technological Innovations

Advancements in transdermal drug delivery systems have propelled products like OXYTROL into the forefront. Innovations such as improved adhesive formulations, once-daily application, and skin compatibility have improved patient adherence and satisfaction.

Additionally, digital health integration, including adherence monitoring via smart patches, could enhance OXYTROL’s market appeal and inform personalized medicine approaches.

Competitive Landscape

OXYTROL faces competition from oral agents (e.g., tolterodine, solifenacin), other transdermal systems (e.g., Esctrol, Vesicare), and emerging therapies like minimally invasive procedures or neuromodulation.

Generic oxybutynin formulations threaten OXYTROL’s premium pricing; however, the transdermal route's clinical advantages sustain its premium segment. Brand loyalty and physician preference heavily influence market share dynamics.

Demographics and Patient Preferences

The aging global population, particularly in North America and Europe, underscores increasing demand for urinary incontinence treatments. The convenience and tolerability of OXYTROL appeal to elderly patients with comorbidities who often prefer transdermal routes over oral medications.

Furthermore, rising awareness and proactive management of urinary symptoms expand patient populations eligible for OXYTROL therapy.

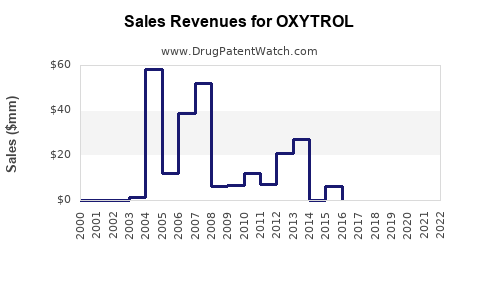

Financial Trajectory and Revenue Drivers

Revenue Streams

OXYTROL’s revenues are driven by direct sales through pharmaceuticals distributors, with key markets in North America and Europe constituting over 60% of sales (source: industry reports). Premium pricing benefits the brand, particularly in markets with supportive reimbursement.

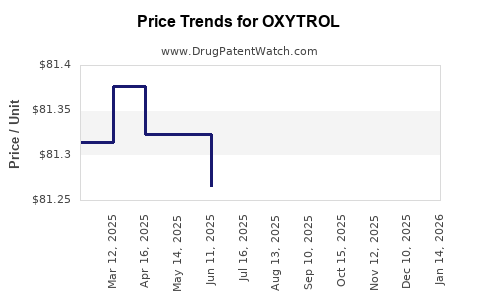

Pricing and Reimbursement Policy

Pricing strategies are influenced by competitive positioning and reimbursement negotiations. Managed care organizations often favor cost-effective therapies, but OXYTROL maintains a strong position owing to its clinical benefits.

In the United States, Medicare and Medicaid reimbursements facilitate patient access, supporting consistent revenue flow. As regulatory scrutiny intensifies, maintaining favorable reimbursement terms remains vital.

Market Penetration and Growth Forecasts

Growth will likely stem from expanding indications; for example, ongoing research on OXYTROL's potential in overactive bladder in pediatric populations, or its utility in neurogenic bladder disorders.

Market penetration has been historically incremental due to prescriber inertia and competition. Yet, increased awareness campaigns and clinician education could accelerate adoption, particularly if new formulation enhancements or indications emerge.

Risks and Opportunities

Risks include:

- Generic competition eroding market share.

- Regulatory limitations based on safety profiles.

- Patient reluctance to switch from familiar oral formulations.

Opportunities encompass:

- Extension of indications (e.g., overactive bladder).

- Digital adherence tools improving compliance.

- Partnerships with healthcare providers to facilitate earlier adoption.

Future Outlook

The financial trajectory for OXYTROL appears cautiously optimistic, rooted in demographic trends and technological advantages. Industry forecasts project sustained growth aligned with the broader urinary incontinence market, provided ongoing innovation and regulatory navigation succeed.

Emerging biosimilar and branded competitors challenge profit margins, yet OXYTROL’s established brand recognition and clinical positioning serve as barriers to erosion. The increasing focus on patient-centered delivery mechanisms and digital health integration could further unlock revenue potential.

Key Takeaways

- Market Expansion: Rising geriatric populations and preference for transdermal drug delivery bolster OXYTROL’s growth prospects.

- Competitive Positioning: Superior tolerability and adherence advantages maintain its premium status amidst generic competition.

- Regulatory Landscape: Vigilant monitoring of safety communications and legislative changes is critical to sustaining revenue streams.

- Innovation Opportunities: Digital adherence monitoring and development of new indications present pathways for revenue diversification.

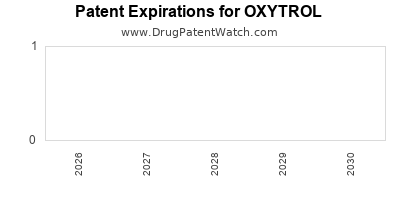

- Risks to Monitor: Patent expirations, safety warnings, and shifting reimbursement policies could impact long-term profitability.

FAQs

1. How does OXYTROL differentiate from oral oxybutynin formulations?

OXYTROL’s transdermal delivery provides steady plasma drug levels, reducing gastrointestinal side effects like dry mouth and constipation, and improving adherence, especially among elderly patients.

2. What are the main regulatory challenges facing OXYTROL?

Regulatory concerns mainly focus on safety, particularly regarding anticholinergic cognitive effects in older adults, with ongoing evaluations potentially impacting labeling and prescribing guidelines.

3. How does generic competition affect OXYTROL’s market share?

Generic oxybutynin tablets, which are cheaper, pose a significant threat. However, the clinical advantages of OXYTROL’s delivery system help sustain its premium pricing and market niche.

4. What technological trends could influence OXYTROL’s future sales?

Advances such as smart patches with adherence monitoring and combined digital health solutions could improve patient outcomes and foster market growth.

5. What demographic trends support OXYTROL’s long-term growth?

An aging global population with increased prevalence of urinary incontinence and preferences for non-invasive, tolerable treatments underpin sustained demand for OXYTROL.

References

- Mordor Intelligence. Urinary Incontinence Therapeutics Market - Forecasts & Analysis. 2021.

- U.S. Food and Drug Administration. Safety Communications on Anticholinergic Medications. 2022.

- Industry Reports. Transdermal Drug Delivery Market Insights. 2023.

- Company financial disclosures and market surveys.

- WHO Global Health Observatory. Aging Population Data. 2022.

In conclusion, OXYTROL’s position within the urinary incontinence market is reinforced by technological innovation, demographic shifts, and its clinical profile. Ongoing strategic maneuvers in regulatory, technological, and marketing domains will shape its long-term financial success, making it a noteworthy contender for healthcare providers and investors alike.