Share This Page

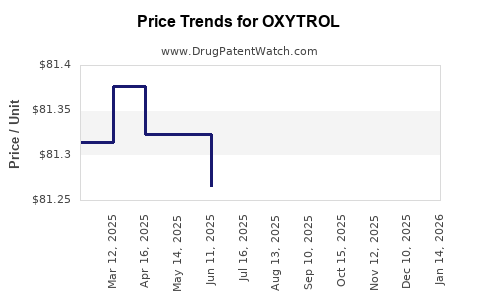

Drug Price Trends for OXYTROL

✉ Email this page to a colleague

Average Pharmacy Cost for OXYTROL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OXYTROL 3.9 MG/24HR PATCH | 00023-6153-08 | 80.69521 | EACH | 2025-11-19 |

| OXYTROL FOR WOMEN 3.9 MG/24HR | 00023-9637-04 | 2.74409 | EACH | 2025-11-19 |

| OXYTROL FOR WOMEN 3.9 MG/24HR | 00023-9637-08 | 2.74409 | EACH | 2025-11-19 |

| OXYTROL FOR WOMEN 3.9 MG/24HR | 00023-9637-01 | 2.74409 | EACH | 2025-11-19 |

| OXYTROL 3.9 MG/24HR PATCH | 00023-6153-01 | 80.69521 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for OXYTROL

Introduction

OXYTROL, the brand name for oxybutynin chloride, is a widely prescribed medication primarily used to manage overactive bladder (OAB). As a cornerstone treatment in urology, OXYTROL's market dynamics are driven by increasing prevalence of bladder disorders, drug patent statuses, competitive landscape, and evolving regulatory frameworks. This analysis evaluates current market conditions, discusses key factors influencing drug pricing, and projects future price trends through 2030.

Market Overview

Therapeutic Indication and Clinical Usage

OXYTROL’s primary indication is for urinary incontinence caused by overactive bladder. It is available in oral formulations—tablets, syrup, and extended-release versions—and has historically been favored for its efficacy and safety profile. Oxybutynin’s mechanism involves antimuscarinic activity, which reduces involuntary bladder contractions.

Market Size and Growth Drivers

The global overactive bladder market, estimated at approximately $6 billion in 2022, is expected to grow at a CAGR of 7% through 2030, driven by aging populations, rising prevalence of urinary disorders, and increased diagnosis rates. Specifically, the U.S. accounts for nearly 40% of this market, bolstered by high healthcare spending and favorable reimbursement policies.

Key Players and Competitive Landscape

Apart from OXYTROL, competitors include generic oxybutynin products, other antimuscarinics like tolterodine, solifenacin, darifenacin, and newer therapies such as β3-adrenergic receptor agonists (mirabegron). Patent expiry milestones—OXYTROL's initial patents’ expiration occurred in the early 2010s, facilitating generic entry—have led to significant price erosion and increased market penetration of generics.

Regulatory and Patent Landscape

Patent Expiry and Generic Competition

OXYTROL’s primary patents expired approximately in 2012-2014, enabling multiple generic manufacturers to introduce cost-effective alternatives. Patent protections for specific formulations or extended-release versions can sometimes extend exclusivity, but overall, generic competition has profoundly impacted prices.

Regulatory Developments

FDA approvals have maintained OXYTROL’s market prominence, but recent shifts toward novel drug delivery systems, biosimilars, and new class medications influence market dynamics. Regulations promoting biosimilar entry and price transparency initiatives could further pressure prices.

Pricing Dynamics

Historical Pricing Trends

Post-patent expiry, OXYTROL’s prices have declined markedly. According to IQVIA data, the average wholesale price (AWP) for oxybutynin tablets decreased by approximately 60-70% from 2014 to 2022. Brand-name versions retained a premium, but generics rapidly gained market share due to affordability.

Factors Influencing Pricing

- Generics Market Penetration: Increased generic availability drives prices downward.

- Reimbursement Policies: Favorable coverage for generics reduces out-of-pocket costs and supports broader access.

- Formulation Innovations: Extended-release formulations (e.g., oxybutynin ER) command higher prices but face downward pressure from broader generic competition.

- Patented Formulations and New Delivery Systems: Any new, patent-protected formulations could temporarily elevate prices.

Future Price Projections (2023–2030)

Based on current data and projected trends, the price of OXYTROL and its generics is expected to follow a continuous downward trajectory, with nuanced variations depending on formulation specificity and market penetration.

Baseline Scenario

- Generic Pricing: Wholesale prices for generic oxybutynin (oral tablets) are projected to stabilize around $0.10 to $0.20 per tablet by 2025 and maintain this range through 2030.

- Brand-Name Pricing: Brand OXYTROL may persist at a premium, averaging $0.50 to $1.00 per tablet, but with declining market share as generics dominate.

Upside Factors

- Innovative Formulations: Introduction of new delivery systems (e.g., transdermal patches, implantable devices) could command higher prices, at least temporarily.

- Regulatory Incentives: Policies favoring innovation or the development of niche formulations could sustain higher prices.

- Global Market Expansion: Emerging markets with scarce generic alternatives might see higher prices, especially in regions with less price regulation.

Downside Factors

- Market Saturation: Widespread generic access exerts persistent downward pressure.

- Price Transparency Laws: Implementation of policies requiring public disclosure of drug prices could accelerate price reductions.

- Bioequivalent Biosimilars: Although not currently applicable, future biosimilar entrants could influence pricing strategies further.

Implications for Stakeholders

Pharmaceutical Manufacturers

The expiration of key patents emphasizes the necessity to innovate or diversify portfolios. Developing novel delivery mechanisms or extended indications could prevent erosion of revenues.

Health Authorities and Reimbursement Bodies

Cost-containment measures favor generic prescribing, encouraging healthcare systems to negotiate lower prices for oxybutynin-based therapies.

Investors and Market Analysts

Price trajectories suggest a maturing market with limited upside for brand-name products in the long-term. Investment decisions should factor in patent expirations and competitive pressures.

Key Takeaways

- The global overactive bladder market is expanding, fueling demand for oxybutynin.

- Patent expirations have catalyzed significant generic entry, driving prices downward.

- Future prices are expected to stabilize at low levels for generics by 2025–2026, with brand versions maintaining higher but diminishing premium.

- Innovations in drug delivery and regulatory shifts can temporarily influence price levels.

- Market saturation, price transparency initiatives, and biosimilar competition will continue to pressure prices through 2030.

FAQs

1. What factors primarily influence OXYTROL’s market price?

Patent expiry, generic competition, formulation innovations, regulatory policies, and market demand are the dominant factors affecting prices.

2. How does the patent landscape impact future pricing?

Patent protections delay generic entry, allowing brand-name products to sustain higher prices. Once patents expire, prices typically decline sharply due to generic competition.

3. Are there opportunities for premium pricing with new formulations?

Yes, novel delivery systems or indications can command higher prices temporarily, but overall, innovation must demonstrate clear clinical benefits to sustain premiums.

4. What is the outlook for generic oxybutynin prices beyond 2025?

Generic prices are projected to stabilize around $0.10–$0.20 per tablet, given market saturation and ongoing competition.

5. How might policy changes influence the market?

Price transparency laws and reimbursement reforms could further reduce prices, intensify generic adoption, and impact profit margins for manufacturers.

References

- IQVIA (2022). Global Pharmaceutical Market Data.

- U.S. Food and Drug Administration. (2023). Drug Approvals & Patent Information.

- MarketWatch. (2023). Overactive Bladder Market Overview.

- Statista. (2022). Overactive Bladder Market Revenue Forecasts.

- FDA. (2022). Regulations on Generic Drug Approvals and Market Entry.

Disclaimer: This analysis is based on publicly available data and market trends as of early 2023. Actual future prices may vary depending on regulatory changes, patent developments, and unforeseen market shifts.

More… ↓