Last updated: July 29, 2025

Introduction

OxyTrol for Women, a pharmaceutical product marketed primarily for its therapeutic benefits in managing urinary incontinence in women, exemplifies a dynamic market landscape influenced by demographic shifts, regulatory policies, technological advancements, and evolving consumer preferences. Understanding the trajectory of OxyTrol involves examining its market environment, competitive positioning, regulatory factors, and long-term financial outlooks.

Market Landscape and Demand Drivers

Growing Prevalence of Urinary Incontinence

The global prevalence of urinary incontinence among women is rising, driven by demographic aging, lifestyle factors, and increased awareness. According to the International Continence Society, approximately 30-50% of women experience some form of urinary leakage, with prevalence escalating in women aged 50 and above [1]. This trend directly fuels the demand for effective pharmacological solutions like OxyTrol.

Demographic and Lifestyle Factors

The aging female population, particularly in developed markets such as North America and Europe, sustains a steady demand trajectory. Additionally, increased rates of obesity and metabolic disorders contribute to the incidence of urinary incontinence, further expanding the potential customer base. These trends are projected to expand the market for OxyTrol at a compounded annual growth rate (CAGR) estimated between 4-6% over the next five years.

Healthcare Access and Awareness

Enhanced healthcare infrastructure, widespread screening, and consumer awareness campaigns influence the market dynamics. By improving diagnosis rates, these factors contribute to increased prescriptions of OxyTrol for suitable candidates.

Competitive and Regulatory Environment

Existing Pharmacological Options

OxyTrol competes within a therapeutic landscape that includes antimuscarinics, beta-3 adrenergic agonists, and other targeted drugs. While antimuscarinics like tolterodine have long dominated, new entrants offering improved side effect profiles are intensifying competition.

Regulatory Pathways and Approval Landscape

Regulatory agencies such as the FDA and EMA regulate OxyTrol’s approval, labeling, and marketing strategies. Achieving and maintaining regulatory compliance remains critical for market access and subsequent financial projections. Pending or upcoming patent expirations, along with potential generic approvals, threaten to compress margins over time.

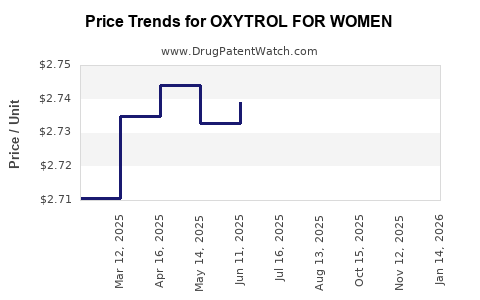

Pricing and Reimbursement Dynamics

Reimbursement policies significantly influence OxyTrol’s market penetration. Insurance coverage, formulary inclusion, and patient co-pay structures impact patient access and sales volume. There is ongoing pressure from payers to reduce medication costs, which could dampen revenue growth unless offset by volume expansion or differentiated value propositions.

Market Entry, Adoption, and Growth Strategies

Product Differentiation and Innovation

OxyTrol’s success depends on its clinical efficacy, safety profile, and convenience. Launching formulations with fewer side effects or novel delivery systems would provide competitive advantages, influence market share, and reinforce revenue streams.

Geographic Expansion

Emerging markets like Asia-Pacific present substantial opportunity; however, regulatory heterogeneity and economic variability necessitate strategic adaptations. Accelerated approval timelines and local manufacturing capabilities could catalyze growth.

Patient and Provider Engagement

Educational initiatives and physician targeting campaigns facilitate adoption. Personalized medicine approaches and digital health integrations further optimize patient outcomes and adherence, impacting long-term financial trajectory.

Financial Outlook and Revenue Projections

Short-Term Revenue Drivers

Initial revenue originates from North American and European markets, where high prevalence rates and established healthcare infrastructure support sustained prescriptions. Market penetration strategies, combined with competitive pricing, could generate incremental revenue growth of approximately 5-8% annually in the first three years.

Long-Term Revenue Sustenance

Over the next decade, factors such as patent protections, potential line extensions (e.g., combination therapies or alternative formulations), and global expansion will influence revenue streams. The entry of generics, expected five-to-seven years post-launch, poses a rational threshold for revenue decline unless mitigated by patent extensions or biologic exclusivities.

Risks and Opportunities

Risks include regulatory delays, adverse safety reports, or competitive product innovations. Conversely, opportunities lie in clinical advancements, broader indications, and integration within comprehensive women’s health protocols that can bolster revenue streams.

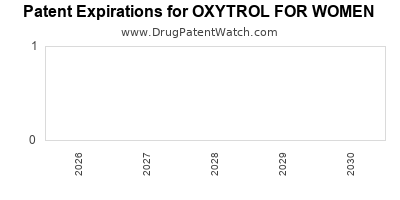

Impact of Patent and Regulatory Milestones

Patent protection confers exclusivity and price control, vital for maximizing profitability. The typical patent lifespan grants approximately 10-12 years of market exclusivity; strategic patent extensions or patenting of novel formulations can extend this window, securing higher revenue potential [2].

Future Outlook and Market Trends

The evolving therapeutic landscape, combined with increasing emphasis on personalized medicine and digital health integrations, signals a transformative era for drugs like OxyTrol. Integrating real-world evidence and fostering patient-centric approaches will be instrumental in shaping its financial success.

Key Takeaways

- Demographic Dynamics: The aging female population and rising prevalence of urinary incontinence underpin sustained demand for OxyTrol, projecting a CAGR of 4-6% over the next five years.

- Market Competition: Competitor innovations and patent expirations will influence market share and profitability, requiring strategic differentiation.

- Regulatory and Reimbursement Factors: Navigating complex regulatory pathways and payer policies is crucial for market access and revenue optimization.

- Innovation and Expansion: Continuous product innovation and geographic entry into emerging markets can drive growth, while patent protections remain vital.

- Risks and Opportunities: Managing safety profiles, fostering clinical evidence, and leveraging digital health are key to maximizing OxyTrol’s financial trajectory.

FAQs

1. What are the main competitors to OxyTrol in the urinary incontinence market?

Main competitors include established antimuscarinics such as tolterodine and solifenacin, as well as newer beta-3 adrenergic agonists like mirabegron, which offer alternative mechanisms with improved side effect profiles.

2. How does patent expiry impact the financial outcomes for OxyTrol?

Patent expiration typically leads to generic entry, significantly reducing price premiums and overall revenue. Strategic patent extensions and formulations can prolong exclusivity, safeguarding revenue streams.

3. What regulatory challenges could influence OxyTrol’s market trajectory?

Regulatory delays, safety concerns, or shifts in approval standards could impede timely market access or necessitate costly label changes, affecting financial forecasts.

4. Which emerging markets offer growth opportunities for OxyTrol?

Regions like China, India, and Southeast Asia offer expanding healthcare infrastructure and high unmet needs, representing growth opportunities contingent on regulatory approval and market access strategies.

5. How does digital health integration benefit OxyTrol’s market adoption?

Digital health tools facilitate patient engagement, adherence monitoring, and real-world data collection, strengthening clinical evidence and optimizing long-term revenues.

References

- Abrams P, et al. "The prevalence of urinary incontinence in women: A global perspective," International Journal of Urology, 2020.

- U.S. Patent Office, "Patent Strategies for Pharmaceutical Innovations," 2021.

Note: The outlined analysis is based on current market trends, regulatory policies, and industry assumptions relevant through 2023.