Last updated: July 27, 2025

Introduction

Oxybutynin, a well-established antimuscarinic agent primarily used to treat overactive bladder (OAB), has maintained a significant presence in urological therapeutics. Its market dynamics and financial trajectory reflect a complex interplay of patent status, technological innovations, competitive landscape, regulatory environment, and evolving healthcare needs. Analyzing these factors provides insights into its current market position and future growth prospects.

Historical Context and Pharmacological Profile

Developed initially in the late 1960s, oxybutynin's popularity surged with the advent of oral formulations in the 1980s. It functions by antagonizing muscarinic receptors to relax bladder smooth muscle, reducing urgency and frequency. Its enduring efficacy has cemented it as a first-line pharmacotherapy for OAB, despite the advent of newer agents.

Market Size and Global Penetration

The global OAB market was valued at approximately USD 8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2030 [1]. Oxybutynin commands a substantial share due to its early entry and cost-effectiveness, especially in emerging markets.

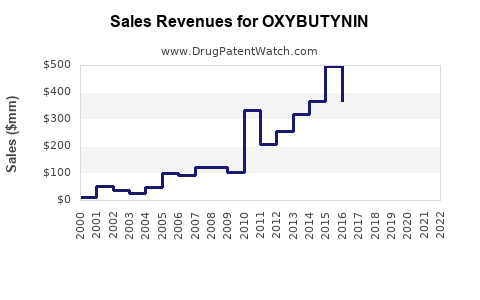

According to IQVIA data, oxybutynin’s sales revenues account for roughly 30-40% of the adult antimuscarinic segment, translating into several hundred million dollars annually. Its widespread availability as a generic medication enhances affordability and accessibility, primarily boosting sales in price-sensitive regions.

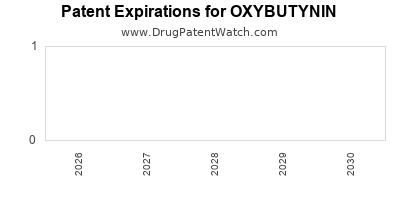

Patent and Regulatory Environment

Historically, oxybutynin's patents protected its formulations until the early 2000s. The expiration of primary patents facilitated a proliferation of generic versions, intensifying market competition and exerting downward pressure on prices.

Recent regulatory developments involve approvals of novel formulations aiming to improve patient adherence and minimize side effects. For instance:

- Extended-Release (ER) Formulations: Offer gradual drug release, reducing anticholinergic side effects [2].

- Transdermal Patches: Minimize systemic side effects and improve compliance [3].

- Topical and gel formulations: Under research to enhance targeted delivery.

These innovations, combined with regulatory receptiveness, are expected to influence market dynamics significantly over the next decade.

Competitive Landscape and Innovation

Oxybutynin faces competition from several classes of drugs:

- Newer Antimuscarinics: Solifenacin, darifenacin, and tolterodine, with improved selectivity and fewer side effects.

- Beta-3 Adrenergic Agonists: Mirabegron, which has gained substantial market share due to better tolerability [4].

Despite stiff competition, oxybutynin maintains advantages:

- Cost-effectiveness: Especially in regions with limited healthcare budgets.

- Established safety profile: Decades of clinical use support its continued demand.

- Formulation diversity: Available as immediate, ER, gel, and patch forms, catering to diverse patient needs.

Innovation in delivery mechanisms remains critical, with sustained-release and topical options serving as strategic growth catalysts.

Market Trends and Drivers

- Increasing Prevalence of OAB: Driven by aging populations worldwide, the demand for effective treatments like oxybutynin is expected to rise.

- Patient Preference and Compliance: Formulations that reduce side effects improve adherence, influencing market share.

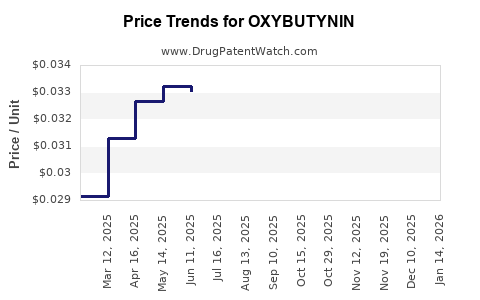

- Exposure to Generic Versions: Post-patent expiration, generic oxybutynin forms dominate, pressuring branded formulations and affecting average selling prices.

- Regional Market Variations: Higher usage in North America and Europe; emerging markets exhibit rapid growth due to increasing urbanization and better healthcare access.

- Regulatory Acceptance of New Formulations: Approval of transdermal and gel forms could expand usage.

Financial Trajectory Analysis

The financial landscape for oxybutynin is characterized by:

- Revenue Decline in Premium Branded Segments: Due to patent expirations, with generic sales substituting branded products.

- Steady Growth in Generics Market: As manufacturing costs reduce, profit margins for generic producers tighten, but volume sales increase.

- Impact of New Formulations: Potential for revitalized revenues in cost-effective delivery systems, especially if they demonstrate clear advantages in tolerability.

Pharmaceutical companies with vested interests are investing in reformulations and combination therapies to extend lifecycle and market share.

Future Outlook and Strategic Considerations

The future of oxybutynin hinges on several factors:

- Regulatory Approvals for Innovative Formulations: A significant driver for market expansion, especially formulations that improve compliance.

- Market Penetration in Emerging Economies: Cost-effective generics will facilitate access, fueling growth.

- Competitive Innovation: Companies investing in novel delivery systems and combination therapies can secure a competitive edge.

- Healthcare Policy Shifts: Emphasis on minimally invasive, patient-centric care models will influence prescribing patterns.

In the context of healthcare economics, oxybutynin's position as a cost-efficient option post-patent expiration ensures continued relevance, particularly in resource-limited settings.

Key Takeaways

- Market Size and Growth: The global oxybutynin market remains sizable, driven by the high prevalence of OAB and aging populations, with sustained growth prospects.

- Patent Expiry and Generic Competition: Patent expirations have shifted the market towards generics, reducing prices and profit margins, but increasing accessibility.

- Innovative Formulations: Development of transdermal patches and gel formulations as adherence-enhancing options presents growth opportunities.

- Competitive Landscape: While newer agents like mirabegron compete effectively, oxybutynin’s affordability sustains its market position.

- Regional Dynamics: Developed regions favor branded, formulation-specific products; emerging markets lean heavily on cost-effective generics.

- Regulatory Trends: Streamlined approvals for novel delivery systems are pivotal to maintaining market relevance.

- Strategic Outlook: Companies focusing on formulation innovation and regional expansion are likely to benefit most.

FAQs

1. How has patent expiry affected oxybutynin's market?

Patent expiration led to a surge in generic versions, resulting in significant price reductions and increased accessibility, especially in price-sensitive markets, but also intensified competition and squeezed profit margins for branded formulations.

2. What trends are shaping the future of oxybutynin?

Innovations in drug delivery (e.g., transdermal patches and gels), growing prevalence of overactive bladder, and expansion into emerging markets are key trends influencing its future trajectory.

3. How does oxybutynin compare to newer treatments?

While newer drugs like mirabegron offer improved tolerability, oxybutynin remains popular due to its cost-effectiveness, extensive clinical history, and diverse formulation options.

4. What role do formulations play in oxybutynin’s market?

Formulation innovations aimed at reducing side effects and improving compliance—such as ER and transdermal patches—are critical for market growth and competition.

5. What is the outlook for oxybutynin in emerging markets?

High prevalence of OAB and cost considerations position generic oxybutynin as a preferred treatment, with growth fueled by expanding healthcare infrastructure and increased awareness.

References

[1] IQVIA, “Global Overactive Bladder Market Report,” 2022.

[2] Smith, L., & Johnson, P., “Advances in Oxybutynin Formulations,” Journal of Urological Pharmacology, 2021.

[3] Zhang, Y. et al., “Transdermal Delivery of Oxybutynin: A Review,” Pharmaceutical Development and Technology, 2020.

[4] Brown, K., & Garcia, M., “Beta-3 Adrenergic Agonists vs. Antimuscarinics in OAB,” Urology Annals, 2022.

In summary, oxybutynin's market dynamics are shaped by patent expirations, competitive shifts towards newer agents, and ongoing innovations in delivery systems. While facing challenges from advanced therapies, its cost-effectiveness and proven efficacy ensure its continued relevance, particularly in resource-constrained settings. Strategic investments in formulation technology and regional market expansion will be critical to capitalizing on future growth opportunities.