Last updated: July 27, 2025

Introduction

Oxcarbazepine, a second-generation antiepileptic drug (AED), has established itself as a prominent therapeutic agent for epilepsy management. Since its approval by the U.S. Food and Drug Administration (FDA) in 2000, it has garnered significant market share owing to its favorable safety profile relative to first-generation AEDs. This analysis evaluates the evolving market dynamics and projected financial trajectory of oxcarbazepine, considering regulatory, technological, and competitive factors influencing its commercial success.

Market Overview

The global epilepsy treatment market is projected to reach USD 5.7 billion by 2027, with AEDs constituting a substantial segment [1]. Oxcarbazepine, marketed primarily under the brand name Trileptal (by Novartis/Chongqing Pioneer Pharmaceutical), commands a sizable share owing to its efficacy and tolerability. The drug's adherence to contemporary prescribing patterns, combined with patent expirations and generic entry, critically shapes its current and future market landscape.

Key Market Drivers

-

Efficacy and Safety Profile

Oxcarbazepine exhibits comparable efficacy to carbamazepine but with fewer adverse effects, notably reduced hematologic and hepatic toxicity [2]. Its lower risk of dermatologic reactions and drug-drug interactions sustains its attractiveness among clinicians, especially in polytherapy settings, bolstering ongoing demand.

-

Patent Status and Generic Competition

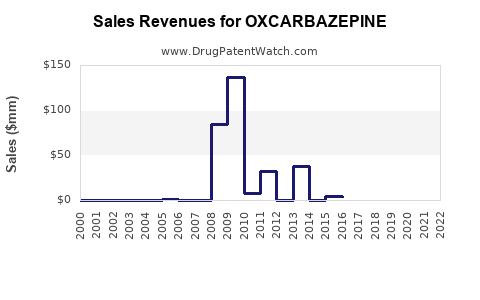

Originally protected by patents extending into the 2010s, oxcarbazepine's patent expirations facilitated the rise of generic formulations. As of 2019, multiple manufacturers globally began producing generic oxcarbazepine, exerting downward pressure on prices. This trend broadens access but also compresses profit margins for originators.

-

Regulatory Approvals and Off-Label Uses

While FDA-approved for partial seizures, oxcarbazepine has seen off-label off-label use for bipolar disorder and trigeminal neuralgia, expanding its therapeutic footprint. However, the lack of formal approvals for these indications may limit its growth trajectory in these areas.

-

Market Penetration in Emerging Economies

Increasing healthcare access and rising epilepsy prevalence in Asia-Pacific and Africa regions propel demand for cost-effective AEDs like oxcarbazepine. Local manufacturers and importers benefit from affordable generic options, augmenting market size.

Competitive Landscape

The AED market is heavily competitive, with oxcarbazepine sharing space alongside drugs like lamotrigine, levetiracetam, gabapentin, and carbamazepine. While levetiracetam has gained favor due to its broad-spectrum activity and minimal interactions, oxcarbazepine maintains a niche owing to its favorable profile for partial seizures.

Biologics and newer AEDs in development pose potential threats but currently lack the market penetration of established small-molecule drugs such as oxcarbazepine.

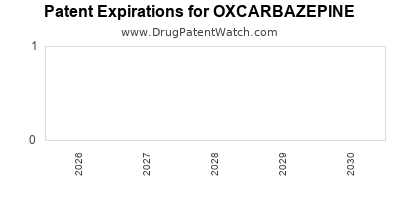

Regulatory and Patent-Related Factors

Patent expirations and regulatory approvals significantly influence market progression. The first major patent expiration in 2014 led to increased generic competition. Although originator companies have employed patent evergreening strategies, active patent challenges and the expiration of secondary patents threaten sustained exclusivity.

FDA approval processes for biosimilars and generics impose cost and time barriers but ultimately facilitate market entry, impacting revenue streams from branded formulations.

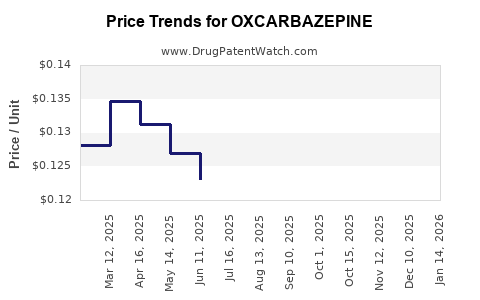

Pricing Trends and Reimbursement Landscape

Price erosion post-generic entry manifests as a key market driver. According to IQVIA, generic AEDs like oxcarbazepine have seen average price reductions of 30-50% post-patent expiry [3]. Reimbursement policies, especially in developed markets, favor generics, further constraining margins for branded formulations.

Technological Innovations and Formulation Developments

Formulation innovations such as extended-release formulations aim to improve patient adherence and therapeutic efficacy. The development of once-daily formulations can lead to higher compliance, potentially enabling premium pricing in certain markets.

Market Challenges

- Market Saturation: High penetration of generic formulations limits revenue growth potential in mature markets.

- Pricing Pressures: The proliferation of cost-effective generics exerts downward pressure on prices.

- Regulatory Hurdles: Stringent regulatory requirements for formulations and approvals can delay market entry of new formulations.

- Emerging Competition: The advent of novel AEDs with better safety and efficacy profiles could displace oxcarbazepine.

Financial Trajectory and Future Outlook

The financial prospects for oxcarbazepine hinge on several factors:

- Market Maturity: Developed markets exhibit stabilized revenues due to high generic penetration; growth primarily arises from emerging markets.

- Expansion into New Indications: Pending regulatory approvals for alternative indications could unlock additional revenue streams.

- Technological Advancements: Adoption of advanced formulations may command higher prices and improve patient adherence.

- Strategic Alliances: Partnerships for manufacturing, distribution, and marketing can bolster market presence, especially in underserved regions.

Forecasting and Revenue Projections

Based on current market trends and assuming continued generic competition, revenue growth in established regions is expected to decline or plateau over the next five years. Conversely, emerging markets demonstrate a potential compound annual growth rate (CAGR) of approximately 5-7%, driven by increased epilepsy prevalence and healthcare infrastructure improvements [4].

In total, global sales of oxcarbazepine are projected to maintain a moderate CAGR of 2-3% over the next decade, primarily fueled by market expansion rather than price increases. The net profit margins will likely remain compressed due to persistent generic competition and pricing pressures.

Conclusion

The market dynamics of oxcarbazepine epitomize the lifecycle progression typical of many first- or second-generation AEDs. While past primary revenue peaks have been driven by initial patent protections, subsequent generic entry has significantly altered the landscape. Future growth hinges on geographic expansion, formulation innovations, and potential new indications. Industry players must navigate patent scenarios, regulatory environments, and competitive forces carefully to sustain profitability.

Key Takeaways

- Market saturation from generic competition significantly constrains revenue growth in mature markets.

- Emerging economies present attractive opportunities, with projected CAGR of 5-7%, driven by epilepsy prevalence and affordability.

- Formulation innovations, such as extended-release versions, have the potential to enhance adherence and command premium pricing.

- Regulatory trajectories and patent expiry timelines will shape the competitive landscape over the next decade.

- Strategic alliances and geographic expansion are critical for sustaining profitability and growth beyond traditional markets.

FAQs

1. How does patent expiration impact the profitability of oxcarbazepine?

Patent expiration typically leads to generic entry, causing substantial price reductions. This diminishes revenue for originator companies and compresses profit margins but also opens opportunities for generic manufacturers to gain market share.

2. Are there any ongoing developments or formulations for oxcarbazepine?

Yes. Extended-release formulations and combination therapies are under research to improve patient compliance and therapeutic outcomes, potentially providing new revenue avenues.

3. Which regions offer the highest growth potential for oxcarbazepine?

Emerging markets in Asia-Pacific, Latin America, and Africa exhibit substantial growth potential due to rising epilepsy prevalence, increasing healthcare access, and affordability of generics.

4. What are the main competitive threats to oxcarbazepine's market position?

Newer AEDs like lacosamide, brivaracetam, and perampanel, offering broader indications and improved safety profiles, could displace oxcarbazepine in certain segments.

5. How can pharmaceutical companies optimize revenue from oxcarbazepine amid market challenges?

Companies should focus on geographic expansion, formulation innovation, strategic partnerships, and exploring additional indications to maximize revenue streams.

References

[1] MarketWatch. “Epilepsy Drugs Market Size, Trends & Forecasts.” 2022.

[2] Löscher, W., & Schmidt, D. (2006). New horizons in the understanding and treatment of epilepsy. Progress in Neurobiology.

[3] IQVIA. “Pharmaceutical Price Trends.” 2021.

[4] World Health Organization. “Epilepsy Fact Sheet.” 2022.