Last updated: July 28, 2025

Introduction

Naproxen, a nonsteroidal anti-inflammatory drug (NSAID), has been a cornerstone in pain relief and anti-inflammatory treatment for decades. Market visibility and financial performance of naproxen are influenced by evolving healthcare needs, regulatory shifts, patent landscapes, and competition from alternative or novel therapies. This analysis explores the core market dynamics, key drivers, challenges, and financial trajectories shaping naproxen’s commercial outlook.

Market Overview and Historical Context

Naproxen was first introduced in the 1970s by Syntex—later acquired by Roche—and remained a staple over-the-counter (OTC) medication for minor pain, as well as a prescription drug for arthritis, bursitis, and other inflammatory conditions. Its long-standing presence, coupled with established efficacy and safety profiles, has positioned it as a significant product within the NSAID market.

The global NSAID market, valued at over USD 12 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of approximately 4–5%, driven by increasing prevalence of chronic inflammatory diseases and pain management needs [1].

Market Dynamics

1. Evolving Regulatory Landscape

Regulatory policies profoundly influence naproxen's market performance. Agencies such as the FDA and EMA enforce rigorous safety standards, especially following concerns about NSAID-associated adverse cardiovascular events. The withdrawal or restriction of certain NSAIDs has heightened regulatory scrutiny over naproxen's cardiovascular risk profile, impacting its OTC and prescription formulations.

The 2015 FDA warning about cardiovascular risks associated with NSAIDs prompted manufacturers to revise labeling and dosing instructions, affecting consumer perception and prescribing behaviors [2]. These regulatory updates often lead to temporary sales volatility but can also shape long-term market positioning through enhanced safety profiles.

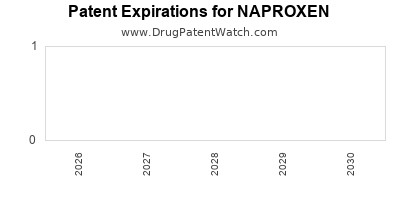

2. Patent Expiry and Generic Competition

Naproxen’s patent protection expired in the late 1980s, catalyzing a surge in generic formulations that account for a significant portion of global sales. The entry of cost-efficient generics has driven down prices substantially, making naproxen accessible across diverse healthcare economies.

Generic competition tends to commoditize the product, limiting profit margins for brandholders. Still, a robust pipeline of manufacturing capacity sustains high-volume sales, especially as more organizations adopt broad OTC strategies for mild to moderate pain relief.

3. Shifts Toward OTC Usage

In many markets, naproxen transitioned from prescription to OTC status, democratizing access and expanding consumer usage. OTC availability has been a double-edged sword—boosting sales but also increasing the risk of misuse, adverse events, and regulatory crackdowns.

Market expansion initiatives have focused on consumer education, optimized dosing, and combination formulations to maintain safety standards while capturing broader market segments. The OTC market for naproxen is projected to grow at a CAGR of 3–4% through 2030, driven by aging populations and self-care trends [3].

4. Competitive Landscape

Naproxen faces stiff competition from other NSAIDs (ibuprofen, diclofenac), opioids (in specific contexts), and emerging non-NSAID analgesics. The rise of acetaminophen as a safer alternative and the development of biologic agents for inflammatory diseases impact traditional NSAID markets.

Additionally, the advent of novel NSAID formulations, such as extended-release or gastrointestinal-sparing variants, aims to mitigate safety concerns and extend market share.

5. Impact of Emerging Technologies and Therapies

Biologics and targeted therapies for rheumatoid arthritis, osteoarthritis, and related conditions are gradually encroaching on traditional NSAID markets. These therapies offer disease-specific mechanisms and improved safety profiles but at significantly higher costs.

Despite this, NSAIDs like naproxen remain essential for acute pain and mild-to-moderate chronic conditions due to their affordability, immediate availability, and familiarity among healthcare providers.

Financial Trajectory

1. Revenue Streams and Profitability

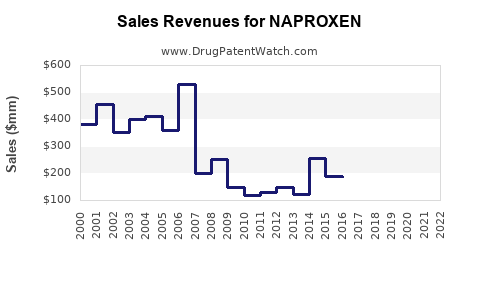

The bulk of naproxen revenues emanate from generic formulations, with branded products generating modest premium margins. According to IQVIA, global NSAID sales peaked around USD 12 billion in 2022, with naproxen constituting a substantial share of both prescription and OTC segments [1].

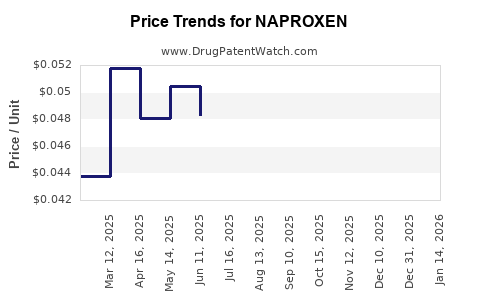

Pricing pressure, especially from generics, constrains profit margins. However, large-scale manufacturing capacity and continuous supply chain optimization enable consistent revenue streams. Market expansion into emerging economies further fuels sales growth.

2. Geographic Revenue Distributions

North America and Europe dominate naproxen markets, owing to high healthcare penetration and OTC accessibility. Emerging markets, like Asia-Pacific, exhibit rapid growth driven by increasing disposable incomes, aging populations, and rising awareness of self-medication.

In these regions, regulatory approvals for OTC sales and broadening distribution channels contribute to a steady upward trajectory.

3. Impact of Patent Expiry and Genericization

Post-patent expiry, revenue decline due to price erosion is typical. Nonetheless, manufacturers focus on maintaining revenue via cost efficiencies, expanding indications, and formulations offering improved safety profiles. Also, branded counterparts maintaining differentiation through quality assurance and marketing sustain some premium revenues.

4. Future Revenue Drivers

The market for naproxen is anticipated to stabilize as safety concerns are addressed, and formulations with improved safety profiles enter the market, supporting sustained demand. Simultaneously, ongoing initiatives in developing combination therapies and novel delivery systems (e.g., topical gels, patches) could open new revenue avenues.

Challenges and Risks

- Safety Concerns: Cardiovascular and gastrointestinal risks could lead to regulatory restrains or product withdrawal, impacting sales.

- Market Saturation: Extensive generic proliferation limits revenue growth potential.

- Emerging Competition: Biologics and alternative therapies threaten long-term market share.

- Regulatory Barriers: Stringent safety labeling requirements may influence consumer uptake.

- Public Perception: Increasing awareness of NSAID risks can diminish OTC sales.

Opportunities for Growth

- Formulation Innovation: Development of safer NSAID variants or combination drugs to mitigate adverse effects.

- Market Expansion: Increasing access in underpenetrated regions, especially India, China, and Southeast Asia.

- Digital and Direct-to-Consumer Channels: Leveraging digital marketing and online sales to reach consumers directly.

- Strategic Partnerships: Collaborations with healthcare providers and regulatory agencies to optimize safety and efficacy messaging.

Conclusion

Naproxen’s market dynamics are characterized by high generic penetration, evolving safety profiles, and shifting healthcare paradigms. While patent expiries and competition impose revenue constraints, strategic focus on formulation innovation, geographic expansion, and safety improvements can sustain its financial trajectory.

The decline of traditional NSAIDs may be offset by market expansion in emerging regions and reformulation strategies, ensuring naproxen remains a vital component of pain management and anti-inflammatory therapies.

Key Takeaways

- Regulatory evolution and safety concerns are pivotal—companies must prioritize safety profiling to sustain market relevance.

- Generic competition necessitates cost efficiencies and differentiation strategies for profitability.

- Market expansion into emerging economies offers significant revenue growth opportunities.

- Innovation in formulations and safety improvements are critical to extending product lifecycle.

- Consumer education and digital marketing will enhance OTC sales, especially amid self-medication trends.

FAQs

1. How does naproxen’s patent status affect its market value?

Patent expiration in the late 1980s led to a surge in generic competitors, reducing prices and profit margins but ensuring broad market access through cost-effective formulations. Patent expiry limits premium pricing opportunities but bolsters volume-based revenue.

2. What safety concerns could impact naproxen’s future market performance?

Cardiovascular and gastrointestinal risks are the primary safety issues. Enhanced labeling and formulation modifications aim to mitigate these concerns, but regulatory scrutiny remains intense, potentially restricting usage or sales.

3. Which markets present the most growth potential for naproxen?

Emerging markets in Asia-Pacific and Latin America offer significant growth due to rising disposable incomes, aging populations, and increased self-medication acceptance.

4. How are new formulations influencing naproxen’s market share?

Innovations like topical gels and extended-release tablets improve safety and compliance, thereby expanding usage and prolonging product lifecycle amid safety concerns.

5. Will biologic therapies replace NSAIDs like naproxen?

Biologics target specific inflammatory pathways and are preferred for chronic or severe disease management but are costly. NSAIDs like naproxen will continue to serve the need for affordable, immediate relief options, especially in mild to moderate cases.

Sources:

[1] IQVIA. Global NSAID Market Report, 2022.

[2] U.S. Food and Drug Administration. NSAID Cardio Risks, 2015.

[3] MarketResearch.com. OTC Pain Relief Market Analysis, 2023.