Last updated: July 27, 2025

Introduction

Clopidogrel Bisulfate, marketed under brand names such as Plavix, is a leading antiplatelet medication pivotal for the prevention of thrombotic cardiovascular events. Its significance is underscored by extensive clinical application, regulatory landscape, and evolving market conditions, shaping a complex environment for stakeholders. This analysis delineates current market dynamics, financial trajectories, and future forecasts for Clopidogrel Bisulfate within global healthcare markets.

Market Overview and Therapeutic Significance

Clopidogrel Bisulfate functions by inhibiting platelet aggregation through irreversibly blocking the P2Y12 component of ADP receptors on platelet surfaces. Its primary indications include reducing the risk of stroke, myocardial infarction (MI), and arterial thrombosis in patients with acute coronary syndrome (ACS), peripheral artery disease, and recent strokes [1].

The widespread adoption stems from its proven efficacy in secondary prevention, favorable safety profile, and inclusion in standard treatment protocols. The global market for antiplatelet agents, led overwhelmingly by Clopidogrel, reflects its established dominance and clinical acceptance.

Market Dynamics

Demand Drivers

-

Rising Cardiovascular Disease (CVD) Incidence

The global rise in CVD—expected to reach over 480 million affected individuals by 2030, according to WHO—fuels the demand for antiplatelet therapies [2]. Increased awareness of secondary prevention protocols consolidates Clopidogrel's role.

-

Aging Population Globally

Population aging correlates with heightened CVD prevalence, bolstering demand for long-term anticoagulant therapy.

-

Regulatory Approvals & Expanded Uses

Regulatory agencies have validated Clopidogrel in various indications, including off-label uses and combination therapies, facilitating broader clinical adoption.

-

Generic Entry and Cost Dynamics

Patent expirations in multiple regions catalyzed the entry of generic formulations, significantly reducing costs and expanding access, especially across emerging markets.

Supply Chain & Manufacturing Factors

-

Manufacturing Concentration

Production is concentrated among key pharmaceutical players with robust supply chains, ensuring consistent availability.

-

Regulatory Compliance & Quality Control

Stringent manufacturing standards influence costs and supply stability, particularly for generics.

Market Challenges

-

Emergence of Competitor Drugs

Newer antiplatelet agents like Ticagrelor and Prasugrel offer comparable or superior efficacy, introducing competitive pressure.

-

Genetic Variability & Personalized Medicine

Variations in CYP2C19 metabolism affect clopidogrel efficacy, prompting the development of personalized treatment approaches.

-

Market Saturation in Developed Economies

High penetration rates limit growth potential in mature markets, redirecting focus to emerging regions.

-

Safety Concerns and Contraindications

Risks of bleeding and contraindications reduce the prescribing scope, especially in populations with bleeding tendencies or on anticoagulation therapy.

Financial Trajectory & Market Forecasts

Historical Financial Performance

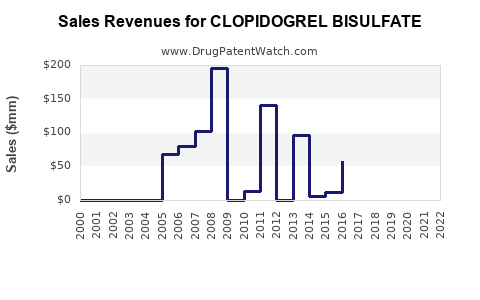

The global Clopidogrel market was valued at approximately USD 3.4 billion in 2021, driven largely by North American and European markets. Generic versions have historically accounted for over 70% of the market share post-patent expiry, contributing to price erosion but expanding volume sales [3].

Forecast Outlook (2023-2030)

-

Market Growth Rate:

The CAGR for the Clopidogrel market is projected at approximately 3-4% over the next decade, with variations based on region and regulatory developments.

-

Regional Dynamics:

- North America: Mature market with steady growth driven by aging demographics and high prevalence of CVD.

- Europe: Similar trends, with increasing uptake of generics and branded drugs in specialized indications.

- Asia-Pacific: Rapid growth anticipated (CAGR up to 6-8%), fueled by large populations, improved healthcare infrastructure, and expanding insurance coverage.

-

Effect of Patent Expirations:

While key patents expired in 2012-2014, subsequent patent litigations and regulatory delays temporarily shielded sales. As of 2023, most markets are saturated with generics, emphasizing volume over price.

-

Emerging Markets:

Governments and healthcare providers emphasize cost-effective treatments, with price sensitivity favoring generics, thus supporting volume growth.

Impact of Market Competition

Despite generic proliferation, supply chain stability and established clinical guidelines sustain consistent sales. However, competition from novel P2Y12 inhibitors threatens market share, especially in acute settings.

Pricing Dynamics

Price erosion has been significant since patent expiry, with generic formulations often priced at 20-40% of branded equivalents. Nevertheless, market consolidation, patent disputes, and regulatory compliance costs influence pricing strategies.

Regulatory & Patent Landscape

Patent protections for the original compound expired in many territories by 2012-2014. Patent litigation, formulations patents, and secondary patents have temporarily extended market exclusivity in certain regions [4].

Strategic Market Considerations

-

Regulatory Navigation:

Navigating evolving EMA, FDA, and other regional regulatory frameworks is critical for positioning, especially in combination therapies or novel formulations.

-

Partnerships & Licensing:

Collaborations with regional manufacturers enable wider distribution and compliance with local standards.

-

Innovation & Formulation Advances:

Opportunities exist in developing fixed-dose combinations, extended-release formulations, or biomarkers to optimize efficacy and safety.

-

Monitoring Competitive Alternatives:

The rise of newer agents like Prasugrel and Ticagrelor necessitates continuous evaluation of clinical benefits vs. cost advantages.

Key Takeaways

- The Clopidogrel Bisulfate market remains robust owing to its longstanding clinical utility, widespread generic availability, and expanding treatable populations.

- Market growth is primarily volume-driven, especially in emerging economies, with CAGR estimated at 3-4% over the next decade.

- Competition from newer antiplatelet agents and personalized medicine considerations pose ongoing challenges.

- Price erosion due to generics is counterbalanced by increased volume, especially in regions with expanding healthcare infrastructure.

- Strategic focus on innovation, regulatory compliance, and regional partnerships will be crucial for sustaining profitability.

FAQs

1. How will patent expirations impact the profitability of Clopidogrel Bisulfate?

Patent expirations have already led to widespread generic entry, significantly reducing prices but increasing volume sales. While profit margins per unit decline, overall profitability can remain stable or improve due to higher sales volume, provided supply chain costs are managed.

2. What are the main competitive threats to Clopidogrel in the antiplatelet market?

Emerging drugs like Ticagrelor and Prasugrel offer higher efficacy, especially in acute coronary syndromes. Additionally, personalized medicine approaches and genetic testing can influence drug choice, challenging Clopidogrel's dominance.

3. What regional factors influence Clopidogrel’s market evolution?

Developed markets exhibit high saturation with slow growth, while emerging markets see rapid expansion driven by healthcare infrastructure improvements, affordability of generics, and high CVD prevalence.

4. How does genetic variability influence the future market for Clopidogrel?

Variability in CYP2C19 impacts clopidogrel efficacy. This has prompted increased adoption of genetic testing and alternative therapies, potentially limiting Clopidogrel’s use in some populations.

5. What strategic opportunities exist for pharmaceutical companies in this market?

Innovating formulation options, developing combination therapies, expanding into underpenetrated regions, and leveraging regulatory pathways for new indications can offer growth avenues.

References

[1] American Heart Association. "Antiplatelet Therapy in Cardiovascular Disease," 2022.

[2] World Health Organization. "Cardiovascular diseases (CVDs)," 2021.

[3] MarketWatch. "Global Clopidogrel Market Size, Share & Forecast," 2022.

[4] U.S. Patent and Trademark Office. "Patent Expirations and Litigation related to Clopidogrel," 2015.

This comprehensive examination underscores the significance of both entrenched market dynamics and emerging factors shaping Clopidogrel Bisulfate's financial trajectory, providing informed strategic insights for healthcare stakeholders.