Last updated: September 28, 2025

Introduction

Carbamazepine, a longstanding anticonvulsant and mood stabilizer, continues to be a vital component in neurological and psychiatric therapeutics. Approved by the FDA in 1968, it remains globally prevalent in managing epilepsy, trigeminal neuralgia, and bipolar disorder. Despite the advent of newer pharmaceuticals, carbamazepine’s market persists due to its established efficacy, low manufacturing costs, and broad clinical acceptance. This analysis explores the nuanced market dynamics and projected financial trajectory of carbamazepine, emphasizing innovation, regulation, competitive landscape, and growth opportunities.

Current Market Overview

Market Size and Global Reach

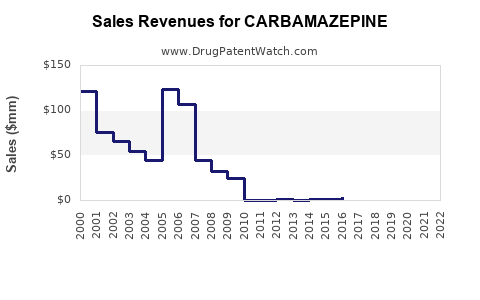

The global carbamazepine market is valued at approximately USD 1.2 billion as of 2022, with steady compound annual growth rates (CAGR) estimated between 3–4% over the next five years. Asia-Pacific and Latin America represent the fastest-growing regions, driven by expanding healthcare infrastructure and increasing neurological disorder prevalences. Developed nations like the U.S. and Europe maintain significant market shares, benefiting from established prescription patterns and healthcare spending.

Supply Chain and Manufacturing

Major pharmaceutical producers include Teva Pharmaceuticals, Novartis, Mylan (now part of Viatris), and Sandoz. These players benefit from generic manufacturing due to carbamazepine’s patent expiration in many jurisdictions, resulting in commoditized pricing and aggressive competition. Manufacturing processes leverage synthetic chemistry complexity, ensuring consistent drug quality but also establishing high entry barriers for new competitors.

Regulatory Environment

Regulatory agencies have maintained stringent quality standards for carbamazepine, especially concerning its safety profile. Notably, the risk of Stevens-Johnson syndrome (SJS) and toxic epidermal necrolysis (TEN) in patients with HLA-B*1502 allele, prevalent in Asian populations, mandates genetic screening prior to prescription. Such regulations influence market access and prescribing practices in different jurisdictions, impacting overall sales volume.

Market Dynamics

Epidemiological Drivers

The prevalence of epilepsy globally is estimated at 50 million people, with an annual incidence of approximately 50–70 per 100,000 individuals. Trigeminal neuralgia and bipolar disorder significantly contribute to carbamazepine's therapeutic demands. With aging populations and increased awareness, these conditions’ diagnoses are rising, supporting sustained demand.

Competitive Landscape

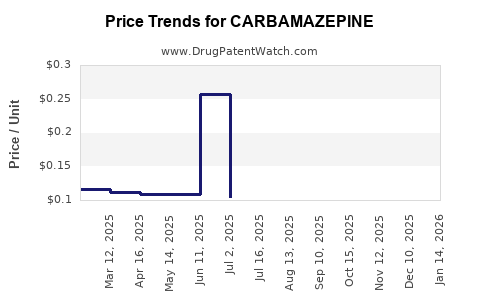

Generic carbamazepine dominates the market, pressuring branded counterparts on pricing. While newer antiepileptic drugs (AEDs) like lamotrigine, levetiracetam, and oxcarbazepine pose competition, carbamazepine’s low cost and long-term clinical data uphold its popularity, especially in regions with limited healthcare budgets.

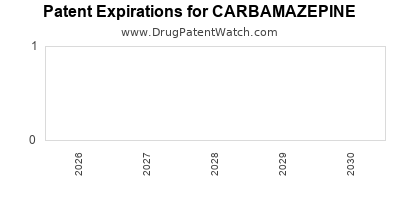

Innovation and Patent Expiry

Patent expiration in multiple jurisdictions has invigorated generic competition, reducing prices but also diminishing profitability for branded formulators. Few new formulations or delivery mechanisms have emerged, citing limited R&D incentives given the drug’s age and market saturation.

Regulatory and Safety Challenges

The necessity for genetic screening due to adverse skin reactions influences prescribing behaviors and adds an administrative layer. This factor slightly restrains market growth but also incentivizes the development of safer analogs or companion diagnostic tools.

Emerging Trends: Personalized Medicine & Digital Monitoring

Advances in pharmacogenomics and digital health facilitate personalized treatment and adherence monitoring. Although still in preliminary stages, these innovations could bolster carbamazepine’s clinical utility and market position, especially in tailored therapies for elderly populations and refractory epilepsy cases.

Financial Trajectory and Growth Projections

Short-Term Outlook (2023–2027)

In the next five years, carbamazepine’s revenue is expected to grow modestly, maintaining stability primarily through generic sales. Market expansion in emerging economies offers incremental gains, facilitated by increasing healthcare access. Price erosion from generics and healthcare budget constraints may temper margins but are offset by volume growth.

Long-Term Outlook (2028–2033)

The long-term outlook suggests a plateauing or slight decline in revenue unless innovations emerge. The focus on personalized medicine, improved safety profiles, or novel delivery systems could rejuvenate market interest. For instance, embedding carbamazepine into combination therapies or sustained-release formulations might create premium segments, supporting higher prices.

Key Influencers on Financial Trajectory

- Generic Competition: Continues to suppress prices but sustains volume.

- Regulatory and Diagnostic Advances: Affect prescribing and patient stratification.

- Emerging Markets Demographics: Drive volume growth due to expanding patient pools.

- Innovation in Formulation: Opportunities for premium priced, safer, or more effective variants.

Market Challenges and Opportunities

Challenges

- Safety Risks and Regulatory Restrictions: HLA-B*1502 allele screening limits prescribing in Asian populations, influencing sales dynamics.

- Market Saturation: Limited innovation reduces potential for premium pricing.

- Emerging Competition: Newer AEDs with better safety profiles and fewer interactions threaten carbamazepine’s dominance.

Opportunities

- Personalized Medicine: Pharmacogenomics-guided therapy enhances safety and efficacy.

- Combination Therapies: Fixed-dose combinations with other AEDs or mood stabilizers could appeal to clinicians.

- New Formulations: Extended-release or transdermal patches could attract niche markets, improving adherence.

- Market Expansion: Increasing neurological disorder diagnoses in Asia-Pacific and Africa.

Conclusion

Carbamazepine continues to demonstrate a resilient market anchored in its clinical efficacy, affordability, and global prevalence of target conditions. Although faced with challenges from safer alternatives and regulatory hurdles, its entrenched position ensures a steady financial trajectory, primarily driven by generic sales. Innovations aimed at safety, adherence, and personalized treatment could unlock new revenue streams, ensuring carbamazepine’s relevance in contemporary therapeutics. Industry stakeholders must navigate regulatory landscapes, capitalize on emerging market opportunities, and invest in incremental innovations to sustain profitability.

Key Takeaways

- The carbamazepine market remains sizable but is characterized by price pressures due to extensive generic competition.

- Demographic shifts, especially aging populations and rising neurological disorder diagnoses, support ongoing demand.

- Regulatory factors, including genetic screening requirements, influence prescribing patterns and market access.

- Innovation in formulations and personalized medicine presents growth opportunities amid limited pipeline activity.

- Strategic expansion into emerging markets offers substantial upside, contingent on healthcare infrastructure development.

FAQs

1. What factors influence carbamazepine’s continued market relevance?

Its proven efficacy, low cost, widespread clinical use, and established safety profile underpin its ongoing relevance, especially in resource-limited settings.

2. How do regulatory requirements affect carbamazepine’s market?

Genetic screening for adverse skin reactions (like SJS and TEN) particularly in Asian populations, impacts prescribing practices and market penetration.

3. Are there emerging alternatives threatening carbamazepine’s market share?

Yes, newer AEDs with improved safety profiles—such as levetiracetam and lamotrigine—pose competition, especially where safety concerns are prioritized.

4. What opportunities exist for pharma companies in this market?

Developing safer formulations, combination therapies, and leveraging pharmacogenomics can create premium niches and extend product lifecycle.

5. Will innovation revive carbamazepine’s market?

Potentially, through advances in personalized medicine and new formulations, which could improve adherence and safety, appealing to both clinicians and patients.

Sources:

[1] Market and Markets. "Global Carbamazepine Market Analysis." 2022.

[2] Statista. "Epilepsy Prevalence and Market Data." 2022.

[3] FDA Regulatory Guidelines. "Genetic Screening and Safety Measures." 2021.

[4] Pharma Intelligence. "Generic Drug Market Dynamics." 2022.