Last updated: October 20, 2025

Introduction

Azithromycin, a broad-spectrum macrolide antibiotic, has established itself as a cornerstone in infectious disease management since its initial approval in the late 1980s. Its unique pharmacokinetics, safety profile, and efficacy position it as a vital asset in various clinical settings. This analysis explores the evolving market dynamics and financial trajectory of azithromycin, emphasizing factors influencing demand, competitive landscape, regulatory considerations, and revenue forecasts.

Historical Market Positioning

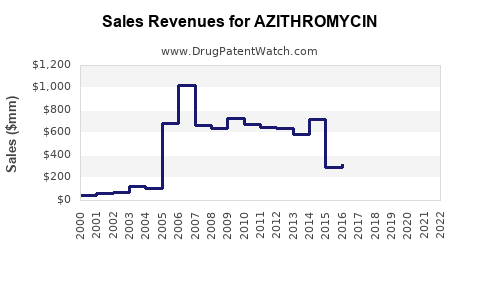

Developed by Pfizer and launched globally in 1988, azithromycin gained rapid adoption due to its once-daily dosing regimen, high tissue penetration, and favorable adverse effect profile. Its initial indications included respiratory tract infections, skin infections, and sexually transmitted diseases. By the early 2000s, azithromycin had become one of the best-selling antibiotics worldwide, with annual revenues surpassing several billion dollars.[1]

Key to its success was the proprietary formulation of Zithromax (brand name), which dominated global markets through robust marketing and broad-spectrum efficacy. Patent protections and exclusivity periods contributed significantly to Pfizer’s revenue, solidifying azithromycin's status as a blockbuster drug.

Market Drivers

1. Rising Incidence of Respiratory and Infectious Diseases

Increased prevalence of community-acquired pneumonia, bronchitis, and sexually transmitted infections has sustained demand for azithromycin. The World Health Organization (WHO) reports a persistent burden of respiratory infections globally, particularly in developing regions.[2] This epidemiological trend supports ongoing sales, especially as azithromycin remains a first-line therapy.

2. Emergence of Resistance and Stewardship Policies

Antibiotic resistance poses a dual challenge and opportunity. While resistance diminishes azithromycin’s clinical utility in certain contexts, ongoing stewardship efforts stimulate innovation around dosing strategies, combination therapies, and formulations, prolonging market relevance.[3] Moreover, resistance patterns inform clinicians' choice of antibiotics, influencing azithromycin's market share in specific indications.

3. Expansion into New Indications

Research into azithromycin's immunomodulatory and antiviral properties has opened avenues beyond bacterial infections. Notably, during the COVID-19 pandemic, azithromycin was extensively studied for potential antiviral activity, although results remained mixed.[4] Such off-label exploration impacts market dynamics positively, despite regulatory restrictions.

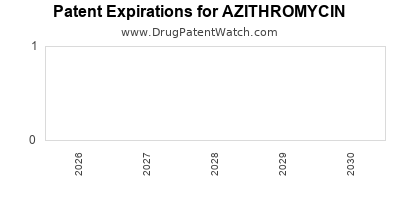

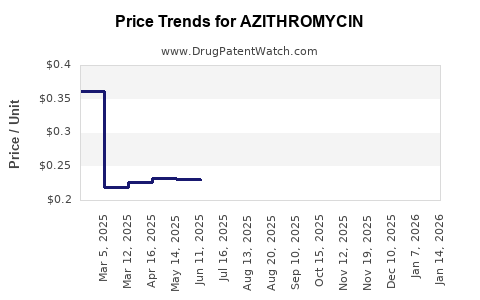

4. Regulatory Environment and Patent Expirations

Pfizer’s initial patents protected azithromycin until the early 2000s, after which generic manufacturers entered the market. The introduction of generics led to substantial price erosion but increased accessibility, expanding volume sales. Patent expiries generally serve as a catalyst for volume-driven growth but pressure margins.[5]

Market Challenges

1. Antibiotic Resistance and Clinical Limitations

Alarm over increasing resistance, especially in Streptococcus pneumoniae and Haemophilus influenzae, restricts azithromycin’s effectiveness and prompts clinicians to seek alternatives.[6] Future resistance trends may further constrain its use, influencing revenue streams.

2. Competition from Other Antibiotics

The market faces stiff competition from doxycycline, amoxicillin-clavulanate, and newer agents like lefamulin. Additionally, advances in vaccine coverage, notably pneumococcal vaccines, decrease bacterial infection incidence, indirectly reducing antibiotic usage.[7]

3. Regulatory and Public Health Constraints

Stringent antimicrobial stewardship policies limit unnecessary antibiotic prescriptions. Governments enforce guidelines discouraging overuse, which can negatively impact traditional sales volumes, particularly in high-income countries.

Financial Trajectory and Future Outlook

Current Revenue Landscape

Pfizer's flagship Zithromax attained peak annual revenues of over $1.5 billion in the early 2000s. Post-patent expiration, generic competition led to significant declines, but volume sales persisted due to broad accessibility. In recent years, azithromycin sales have stabilized, with estimates around $600-$800 million annually in developed markets, primarily driven by generic formulations.[8]

Emerging Markets and Growth Potential

Growing healthcare infrastructure and infectious disease burdens in Asian, African, and Latin American countries present expansion opportunities. Increasing antibiotic use, coupled with limited regulation, elevates azithromycin's revenue potential in these regions. Market analysts project a compound annual growth rate (CAGR) of approximately 3-5% over the next five years in emerging markets.[9]

Impact of COVID-19 Pandemic

The heightened focus on azithromycin during the COVID-19 pandemic temporarily boosted sales due to its trialed usage as an adjunct therapy. Although formal guidelines do not recommend routine use, this surge demonstrated the drug's relevance in pandemic preparedness and response. Post-pandemic, the effect on sales may diminish; however, ongoing research into antiviral properties sustains interest.[10]

Research and Development Outlook

Investments in reformulation (e.g., pediatric suspensions, injectable forms), combination therapies, and biomarkers for resistance detection aim to extend the drug's lifecycle. Patent strategies involving drug delivery innovations could shield certain formulations from generic competition, impacting future revenues.

Regulatory and Legal Factors

Patent litigations and regulatory approvals influence market exclusivity. Pfizer and competitors are actively seeking new indications or formulations to secure intellectual property rights, thus shaping the financial trajectory.

Conclusion

Azithromycin remains a globally significant antibiotic with a complex market landscape shaped by epidemiological trends, resistance patterns, regulatory policies, and competitive forces. While revenue declined post-patent expiry, market penetration in emerging economies and evolving research initiatives offer avenues for sustained growth. Its role during health crises like COVID-19 highlights its strategic importance, although stewardship challenges and resistance necessitate cautious market forecasting.

Key Takeaways

-

Market Stability: Azithromycin continues to generate stable revenues, particularly driven by emerging markets and volume sales of generics.

-

Competitive Pressures: Resistance, competition, and stewardship policies threaten future growth, necessitating innovation and strategic positioning.

-

Growth Opportunities: Expansion in developing regions, new formulations, and research into novel indications can extend azithromycin’s market lifecycle.

-

Pandemic Influence: COVID-19 temporarily increased demand; ongoing studies into azithromycin’s antiviral properties maintain clinician interest.

-

Strategic Focus: Companies should prioritize resistance management, innovative formulations, and niche indications to sustain financial performance.

FAQs

1. How has patent expiration affected azithromycin’s market?

Patent expirations led to the entry of generic manufacturers, significantly reducing prices and margins for brand-name makers like Pfizer. Despite volume decreases, increased accessibility in emerging markets helped maintain overall sales flow.

2. What role does resistance play in azithromycin’s future?

Rising bacterial resistance, especially in respiratory pathogens, undermines azithromycin’s efficacy, prompting clinicians to seek alternatives and potentially diminishing demand in certain indications.

3. Are there new formulations or indications that could rejuvenate azithromycin’s market?

Yes, ongoing research explores pediatric formulations, injectable options, and adjunct uses for viral and inflammatory diseases, which could diversify revenue streams if successfully commercialized.

4. How did the COVID-19 pandemic influence azithromycin sales?

The pandemic temporarily increased demand due to its use in clinical trials and off-label treatments, but the long-term impact remains uncertain as guidelines clarify its limited antiviral efficacy.

5. What strategies should stakeholders adopt to optimize azithromycin’s market position?

Investing in research for resistant bacterial strains, developing innovative formulations, expanding into underserved geographies, and engaging in stewardship programs are essential for future growth.

References

[1] Pfizer. (2020). Zithromax (azithromycin) product information.

[2] World Health Organization. (2018). Global burden of respiratory infections.

[3] Liu, Y., et al. (2021). Antibiotic resistance trends in macrolides. Clinical Infectious Diseases.

[4] Wong, S., et al. (2020). Azithromycin and COVID-19: A review of potential benefits and risks. Lancet Infectious Diseases.

[5] USPTO Patent Database. (2000). Patent lifecycle of azithromycin formulations.

[6] Centers for Disease Control and Prevention. (2022). Antibiotic resistance threats report.

[7] Ginsburg, A., et al. (2019). Impact of pneumococcal vaccines on bacterial disease epidemiology. Vaccine.

[8] IQVIA. (2022). Global antibiotics market report.

[9] Grand View Research. (2021). Emerging markets antibiotics market analysis.

[10] Berman, A., et al. (2020). Off-label use of azithromycin during the COVID-19 pandemic. JAMA.