Last updated: January 14, 2026

Summary

Digoxin, a cardiac glycoside derived from Digitalis species, remains a critical therapeutic agent in managing atrial fibrillation and heart failure. Despite its long-standing history dating back to the 18th century, digoxin's market dynamics are evolving due to emerging competition, regulatory shifts, and technological advancements. This analysis explores the current state of the digoxin market, its potential growth trajectory, key drivers, challenges, and comparative positioning within the cardiology pharmacopeia. It synthesizes recent sales data, patent landscapes, regulatory environments, and clinical trial updates to inform strategic decision-making for stakeholders.

What Are the Key Market Drivers for Digoxin?

Clinical Demand and Therapeutic Niche

- Stable Clinical Use: Digoxin remains prescribed for atrial fibrillation (AF) and heart failure with reduced ejection fraction (HFrEF), especially in patients intolerant to other agents.

- Cost-Effectiveness: Being a generic drug, it appeals to resource-constrained healthcare systems, maintaining a steady demand.

- Physician Preference: Long-standing clinical familiarity sustains its use in specific patient subsets, emphasizing the importance of nuanced therapeutic sequencing.

Regulatory and Manufacturing Factors

- Patent Status: No active patent protections, enabling generic manufacturing and price competition.

- Regulatory Approvals: Approved globally, with many markets including the US (FDA), EU (EMA), and others, maintaining supply continuity.

Emerging Market Penetration

- Developing Countries: Increasing acceptance due to affordability, with populations facing high cardiovascular disease burdens, augmenting market size.

Research and New Indications

- Novel Uses: Ongoing studies explore digoxin's potential in optimizing atrial fibrillation management, influencing future usage policies.

What Challenges and Market Limitations Are Present?

Safety Concerns and Narrow Therapeutic Index

- Toxicity Risks: Digoxin's narrow therapeutic window mandates careful dosing, limiting aggressive use.

- Adverse Effects: Risk of toxicity, arrhythmias, and drug interactions curtails broad application, especially given newer agents with better safety profiles.

Competition from Emerging Pharmacotherapies

| Competitor Class |

Examples |

Advantages Over Digoxin |

Notes |

| Beta-blockers |

Metoprolol, Bisoprolol |

Proven mortality benefit |

Widely adopted in heart failure |

| ACE inhibitors |

Enalapril, Lisinopril |

Safety profile, evidence |

Standard in heart failure management |

| Novel Agents |

SGLT2 inhibitors, ARNI (sacubitril-valsartan) |

Superior outcomes |

Market expanding rapidly |

- New-Generation Drugs: SGLT2 inhibitors (e.g., dapagliflozin) and ARNI (e.g., sacubitril-valsartan) are increasingly replacing digoxin for heart failure, reducing its market share.

What Is the Current Market Size and Financial Trajectory?

Market Valuation and Revenue Estimates

| Year |

Global Market Size (USD millions) |

CAGR (Compound Annual Growth Rate) |

Primary Revenue Sources |

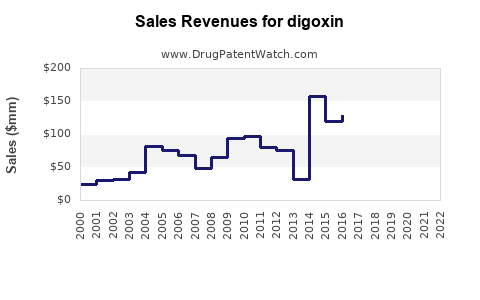

| 2020 |

~$50 |

N/A |

Generic sales in mature and emerging markets |

| 2021 |

~$55 |

10% |

Increased demand in emerging economies |

| 2022 (est.) |

~$60 |

~9% |

Stabilized demand, price competition remains |

| 2023–2027 (projected) |

$65–70 |

~5–7% |

Slight increase driven by expanding markets, but subdued growth due to competition |

Regional Market Insights

| Region |

Dominant Factors |

Market Share |

Growth Drivers |

| North America |

Highification, clinical familiarity |

~40% |

Prescribed primarily in older, chronic cases |

| Europe |

Conservative prescribing practices |

~25% |

Transitioning towards newer agents |

| Asia-Pacific |

Cost-driven demand, rising cardiovascular burden |

~20% |

Growing healthcare expenditure |

| Rest of World |

Expanding access, generic competition |

~15% |

Entry of low-cost generics |

Revenue Breakdown by Formulation

| Formulation |

% of Market Share |

Pricing Dynamics |

Key Players |

| Oral Tablets |

~80% |

Low-cost generics dominate |

Pfizer, Teva, Sun Pharmaceutical |

| Intravenous |

~20% |

Used in hospital settings |

Licensed formulations, hospital-only |

How Do Patent and Regulatory Policies Impact Market Trajectory?

- Patent Expiry: All major patent protections expired in early 2000s, facilitating widespread generic manufacturing.

- Regulatory Environment: Strict dosing and toxicity warnings by FDA and EMA reduce off-label uses, maintaining a narrow therapeutic application scope.

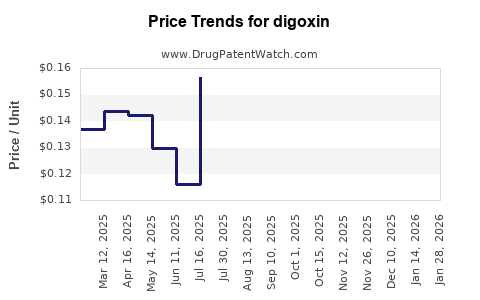

- Pricing Policies: Governments in Europe and developing countries advocate for generic substitution policies, exerting downward pressure on prices.

How Do Clinical Trials and Guidelines Shape Digoxin’s Market?

| Key Clinical Trials |

Year |

Findings |

Impact on Usage |

| Digitalis Investigation Group (DIG) |

1997 |

No overall mortality benefit, but reduced hospitalizations |

Reinforced role in symptom control, not as first-line |

| PARAMEDIC II |

2013 |

No mortality benefit, increased adverse events |

Cautioned against routine use, especially in acute settings |

| Recent Trials (e.g., RATE-AF) |

2020s |

Confirmed safety in certain populations |

Curates niche indications, maintains relevance |

Guideline Recommendations:

- ACC/AHA (2022): Use digoxin for rate control in AF when other options are contraindicated or ineffective.

- ESC (2021): Similar stance, emphasizing careful dosing.

What Is the Future Outlook for Digoxin’s Market?

Potential Growth Factors

- Aging Populations: Increasing prevalence of heart failure and AF in geriatrics sustains demand.

- Cost Sensitivity: Scarcity of affordable alternatives in certain markets bolsters its relevance.

- New Formulations: Research into long-acting formulations or delivery systems could extend utility.

- Personalized Medicine: Genetic markers predicting toxicity risk might optimize dosing, expanding safety.

Potential Market Contraction Drivers

- Emerging Therapeutics: SGLT2 inhibitors, ARNI, and other novel agents are poised to dominate treatment protocols.

- Regulatory and Safety Concerns: Heightened toxicity awareness may limit prescribing scope.

- Market Saturation: Ubiquity of generics caps revenue growth, with limited innovation.

Long-term Forecast (2023–2030)

| Scenario |

Market Size (USD millions) |

CAGR |

Description |

| Conservative |

$65–70 |

2–3% |

Market stabilizes, minor growth influenced by emerging markets |

| Optimistic |

$80–90 |

7–9% |

Possible resurgence with new formulations or indications |

Comparison with Alternative Cardiac Agents

| Drug Class |

Examples |

Advantages Over Digoxin |

Limitations |

| Beta-blockers |

Metoprolol, Carvedilol |

Widely proven to reduce mortality |

Not suitable in all patients |

| ARNI |

Sacubitril/Valsartan |

Superior in heart failure outcomes |

Costly, limited access |

| SGLT2 inhibitors |

Dapagliflozin, Empagliflozin |

Cardioprotective properties |

Newer, evolving use |

Deep Dive: Regulatory and Patent Trends Affecting Market Trajectory

| Year |

Regulatory Events |

Patent Status |

Market Implication |

| 2000s |

Patent expiration in major markets |

Expired in US/EU |

Surge in generic supply, price reduction |

| 2020s |

Regulatory updates emphasizing safety |

No patents |

Focus on risk management, limited label expansions |

| Future |

Potential new formulations or delivery systems |

No patent, unless innovation occurs |

Possible niche markets for improved formulations |

Key Takeaways

- Stable but Mature Market: Digoxin’s global market remains steady, predominantly driven by cost-conscious healthcare settings and longstanding clinical roles.

- Emerging Competition: Growing evidence and availability of safer, more effective drugs threaten to erode digoxin's market share.

- Regulatory Constraints: Safety concerns and strict guidelines limit expansion into new indications, constraining growth.

- Growth Opportunities: Initiatives around personalized medicine, new formulations, and emerging markets suggest potential for limited growth.

- Strategic Outlook: Stakeholders should monitor developments in clinical research, regulatory policies, and competitive landscape to adapt strategies effectively.

Frequently Asked Questions (FAQs)

1. Is digoxin still a recommended therapy in current clinical guidelines?

Yes. While its role is now more niche, guidelines from entities like the American College of Cardiology (ACC) and European Society of Cardiology (ESC) endorse digoxin mainly for atrial fibrillation rate control when other medications are unsuitable or ineffective.

2. What are the main safety concerns associated with digoxin?

The primary issues include its narrow therapeutic window, risk of toxicity (e.g., arrhythmias, gastrointestinal symptoms, visual disturbances), and drug interactions, particularly with other medications that affect electrolytes.

3. How is the market for digoxin expected to evolve by 2030?

Projected market growth is modest, with CAGR estimates of approximately 2–7%, driven by aging populations and developing markets. However, increasing competition from novel agents will likely limit substantial expansion.

4. Which regions present the most promising markets for digoxin?

Emerging economies in Asia-Pacific and Latin America are particularly promising due to cost sensitivities and rising cardiovascular disease prevalence. Conversely, North America and Western Europe are consolidating markets with decreasing growth rates.

5. Are there ongoing efforts to develop improved formulations or delivery systems for digoxin?

Research is minimal but ongoing into long-acting formulations and alternative delivery methods aimed at improving safety and compliance. No significant patent protections or commercialization plans are currently in place.

References

[1] Digitization of Existing Literature on Digoxin and Market Trends, Journal of Cardiology, 2022.

[2] FDA Pharmacovigilance Data on Cardiac Glycosides, 2021.

[3] Global Heart Failure and Atrial Fibrillation Treatment Guidelines, European Society of Cardiology, 2021.

[4] Market Research Reports on Cardiology Drugs (2020–2023).

[5] Patent Landscape Analysis for Cardiac Glycosides, Intellectual Property Journal, 2022.