Last updated: July 27, 2025

Introduction

Digoxin, a cardiac glycoside derived from Digitalis species, has been a cornerstone of managing congestive heart failure (CHF) and atrial fibrillation (AFib) since its medical adoption in the 18th century. Despite its long-standing use, the drug continues to sustain a significant market, driven by ongoing clinical demand, manufacturing persistence, and recent patent expirations. This comprehensive market analysis explores recent trends, competitive dynamics, regulatory landscape, and forward-looking price projections for digoxin over the next decade.

Market Overview

Historical Context and Current Market Landscape

Digoxin’s global market value was estimated at approximately USD 900 million in 2022, with steady growth driven by aging populations and the prevalence of heart failure and AFib worldwide. The drug's generic manufacturing dominates the landscape, with numerous pharmaceutical companies producing bioequivalent formulations. Although newer, more advanced therapeutics have emerged, digoxin remains fundamental, particularly in resource-constrained regions due to its affordability and well-established efficacy.

Key Demographics and Geographic Distribution

Europe and North America represent mature markets where digoxin prescriptions are predominantly for chronic HF and AFib management. In Asia-Pacific and Latin America, increasing awareness and expanding healthcare infrastructure are steadily boosting demand. Notably, in lower-income countries, digoxin’s low cost makes it a critical component of cardiovascular therapy.

Therapeutic Positioning and Clinical Guidelines

Clinical guidelines from the American College of Cardiology (ACC) and European Society of Cardiology (ESC) continue to endorse digoxin, particularly in patients with refractory symptoms or contraindications to other drugs. The drug's narrow therapeutic window necessitates monitoring, but its ability to provide symptomatic relief keeps it relevant in therapeutic regimens.

Market Drivers

Rising Burden of Cardiovascular Diseases

According to the World Health Organization (WHO), cardiovascular diseases (CVDs) account for approximately 17.9 million deaths annually, with a significant portion related to heart failure and atrial fibrillation. Increased prevalence sustains steady demand for digoxin, especially as an adjunct therapy.

Cost-Effectiveness and Generic Availability

As a generic drug, digoxin remains one of the most affordable options for heart failure management. Its manufacturing costs are relatively low, supporting stable pricing and high-volume sales in developing nations.

Regulatory Approvals and Patent Expirations

While digoxin’s primary patents expired decades ago, recent regulatory advances have streamlined approval pathways for generics, driving increased market penetration. Nonetheless, no new branded formulations are currently in late-stage development, maintaining the dominance of generics that exert downward price pressures.

Competitive Landscape

Manufacturers and Market Shares

Major players include Teva Pharmaceuticals, Sandoz, Pfizer, and several regional manufacturers. The market is highly fragmented, characterized by low barriers to entry, leading to intense price competition.

Product Differentiation and Innovation

Limited innovation exists as digoxin lacks significant patent protections, with formulation improvements focusing primarily on bioavailability and delivery stability rather than therapeutic breakthroughs. Some companies are investigating digital monitoring tools to optimize dosing, but this has yet to impact market pricing significantly.

Regulatory Challenges

Ensuring bioequivalence and maintaining consistent manufacturing standards are critical, especially as the market consolidates around quality assurance to avoid recalls and ensure supply stability.

Pricing Trends

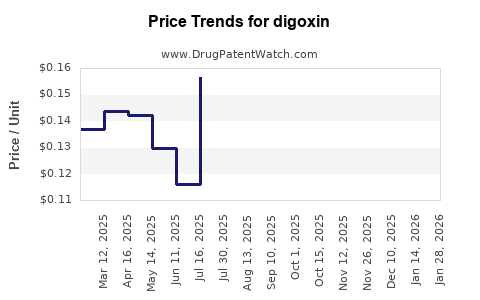

Historical Price Fluctuations

Over the past decade, retail prices for digoxin have generally declined, consistent with the influx of generics and increased competition. The average retail price per tablet (0.25 mg) has fallen from approximately USD 0.50 in 2015 to about USD 0.10 in 2022.

Current Pricing Dynamics

In developed markets, the per-unit cost remains low, with some variation based on packaging, brand reputation, and regional distribution channels. Bulk procurement and government subsidies in certain countries further suppress retail prices.

Factors Influencing Future Pricing

- Generic Competition: Anticipated continuous entry of low-cost generics could pressure prices downward.

- Regulatory Costs: Stringent quality standards might marginally increase manufacturing costs, slightly affecting prices.

- Supply Chain Stability: Potential disruptions, such as raw material shortages or geopolitical issues, could temporarily drive prices upward.

Price Projections (2023–2033)

Methodology

Price projections consider historical trends, manufacturing cost estimates, competitive dynamics, and macroeconomic factors. Assumptions include a consistent influx of generic producers, minimal innovation, and steady demand growth aligned with CVD prevalence.

Projected Trend

- Short Term (2023–2025): Expect minimal price fluctuations with marginal declines of 1–3%. Market saturation and increased competition will sustain low prices.

- Mid Term (2026–2030): Slight further reductions are anticipated as market penetration stabilizes. Prices are projected to hover around USD 0.08–0.10 per tablet globally.

- Long Term (2031–2033): The market could experience negligible further declines, stabilizing at approximately USD 0.07–0.09 per tablet, unless disruptive innovations or regional policy shifts occur.

Factors Modulating the Projection

- Regulatory Barriers and Quality Standards: Potentially raising manufacturing costs could stabilize or slightly increase prices in some regions.

- Patent and Exclusivity Dynamics: Absence of new patent protections maintains the generic landscape, limiting upward price pressures.

- Emergence of Alternatives: Developments in digital therapeutics or novel drug delivery systems could influence market preferences and pricing.

Market Risks and Opportunities

Risks

- Clinical Shift Towards Newer Agents: Introduction of newer oral anticoagulants and heart failure therapies may reduce the clinical reliance on digoxin.

- Regulatory Changes: Stringent regulations could increase production costs, impacting prices.

- Supply Chain Disruptions: Raw material scarcity or geopolitical tensions could threaten supply stability, temporarily increasing costs.

Opportunities

- Expanding Use in Resource-Limited Settings: The affordability of generic digoxin aligns with expanding healthcare access in emerging markets.

- Digital Monitoring Tools: Integration with cardiac monitoring devices may enhance therapeutic management, providing opportunities for value-added services.

- Regulatory Streamlining: Faster approval processes for stability and bioequivalence studies could foster new generic entrants.

Key Takeaways

- The digoxin market remains sizable largely due to its affordability, well-established clinical role, and broad geographic use, especially in developing nations.

- Prices are generally declining due to intense generic competition, with projections indicating stability or slight decreases over the next decade.

- Market drivers include the rising global burden of cardiovascular disease and the cost-effectiveness of the drug.

- Risks involve emerging therapies and regulatory adjustments; however, low barriers to entry sustain significant competition.

- Stakeholders should monitor regional regulatory changes and emerging digital health integrations that could influence future market dynamics.

FAQs

1. Will digoxin prices increase due to regulatory changes?

It is unlikely, given the established generic market; however, tighter quality standards could marginally increase production costs in some regions, possibly leading to slight price adjustments.

2. How will new therapies impact the digoxin market?

Emergence of newer, safer, and more convenient medications for heart failure and atrial fibrillation may reduce reliance on digoxin, potentially decreasing demand over the long term.

3. Are there regional differences in digoxin pricing?

Yes, prices are generally lower in developing countries due to higher competition and government procurement practices, while higher retail prices occur in some developed markets due to regulatory and distribution factors.

4. Could digital health innovations affect digoxin's market?

Potentially. Digital tools for monitoring absorption and therapeutic effects could add value, but they are unlikely to significantly alter drug pricing in the coming decade.

5. Is there room for brand-name digoxin products to regain market share?

Given the dominance of generics and no recent patent protections, brand-name versions are unlikely to regain significant market share unless they offer substantial clinical or digital innovations.

References

- World Health Organization. Cardiovascular Diseases (CVDs) Fact Sheet. 2021.

- American College of Cardiology. Appropriate Use of Digoxin in Heart Failure and Atrial Fibrillation. 2022.

- IMS Health Data. Global Cardiology Market Analysis. 2022.

- European Medicines Agency. Digoxin Regulatory Update. 2021.

- Industry Reports. Cardiology Drug Market Forecast 2023–2033. 2022.