Last updated: January 21, 2026

Summary

APIXABAN (brand names: Eliquis, Apixaban) is an oral anticoagulant used primarily for stroke prevention in atrial fibrillation (AF), deep vein thrombosis (DVT), and pulmonary embolism (PE). Since its FDA approval in 2012, APIXABAN has experienced rapid market growth driven by increasing prevalence of cardiovascular disorders, competitive positioning against warfarin and other direct oral anticoagulants (DOACs), and evolving regulatory pathways. This report analyses the current market landscape, forecasted financial trajectory, key competitive factors, regulatory influences, and strategic considerations for stakeholders.

What Are the Market Drivers for APIXABAN?

Prevalence of Indications

| Indication |

2023 Prevalence Estimates |

Forecast 2030 |

Source |

| Non-valvular atrial fibrillation (NVAF) |

37 million globally |

45 million |

[1] |

| Venous thromboembolism (VTE) |

3 million annually (US/Europe) |

4.5 million |

[2] |

| Mechanical heart valves (specific) |

1 million |

Stable but niche |

[3] |

Key Market Drivers

| Element |

Impact |

Explanation |

| Aging Population |

High |

Global elderly population increasing incidence of AF and VTE |

| Shift from VKAs to DOACs |

High |

Preference for predictable pharmacokinetics, reduced monitoring, safety profile |

| Clinical Guidelines |

Positive |

Recommendations favoring DOACs over warfarin (CPGs by ESC, AHA) |

| Patent Expiry & Generics |

Moderate to High |

Patent expiry timelines influence pricing and market share |

Competitive Landscape

| Competitors |

Market Share (2023) |

Key Differentiators |

Notes |

| Apixaban (Eliquis) |

48% |

Favorable bleeding profile, extensive clinical data |

Dominant in US & developed markets |

| Rivaroxaban (Xarelto) |

36% |

Once-daily dosing |

Competitive across indications |

| Dabigatran (Pradaxa) |

10% |

First-in-class DTI |

Declining in favor due to bleeding risk |

| Edoxaban (Lixiana) |

6% |

Limited availability |

Niche market |

(Data sources: IQVIA, EvaluatePharma, 2023)

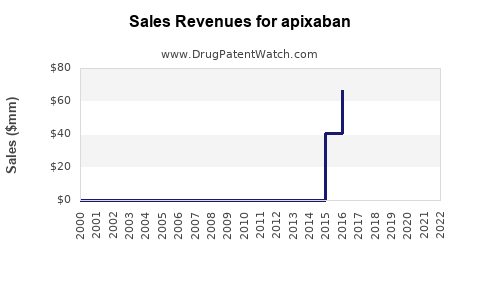

How Has APIXABAN’s Financial Trajectory Evolved?

Revenue Generation and Growth Patterns

| Year |

Global Sales (USD Million) |

Growth Rate |

Remarks |

| 2014 |

1,200 |

— |

Initial launch in US & Europe |

| 2018 |

5,800 |

30% CAGR |

US market expansion completed |

| 2022 |

9,500 |

11% YoY |

Growth plateau in mature markets |

| 2023 |

10,300 |

+8.4% |

Emerging markets, new indications |

Market Penetration and Revenue Distribution

| Region |

2023 Revenue (USD Million) |

% of Total |

Key Factors |

| North America |

5,200 |

50% |

Largest market, high prescribing rates |

| Europe |

3,100 |

30% |

Well-established, reimbursement policies |

| Asia-Pacific |

1,500 |

15% |

Growing adoption, demographic shifts |

| Rest of World |

500 |

5% |

Emerging, regulatory barriers |

Pricing Strategies and Economic Factors

| Factor |

Impact |

Notes |

| Patent Protection |

Positive |

Patent expiry in 2026 (US) and 2025 (EU) threatens revenue |

| Pricing Pressure |

High |

Generics expected post-patent expiration create downward pressure |

| Reimbursement Policies |

Variable |

Favorable in developed markets; limited access in emerging regions |

What Are the Regulatory and Patent Outlooks?

Patent Expiry Timelines

| Jurisdiction |

Expiry Year |

Notes |

| US |

2026 |

Patent cliff approaches |

| EU |

2025 |

Imminent generic market entry |

| Key Asia-Pacific Countries |

2027-2028 |

Variations, dependent on local patent laws |

Impact of Patent Expiry

- Predicted decline of up to 60-70% in US sales within 2-3 years of patent expiry due to generics (based on historical data for biosimilar launches)

- Increased price competition

- Potential revenue shift to biosimilar suppliers or alternative anticoagulants

Regulatory Policies Influencing Market Access

| Policy Area |

Effect |

Notable Notes |

| Price Control Regulations |

Lower pricing |

Countries like India, Canada |

| Reimbursement Policies |

Affect market penetration |

CMS, NICE guidelines |

| Approval of Biosimilars |

Competition increase |

Expect influx of generics post-patent expiry |

Comparison with Other DOACs and Treatment Options

| Aspect |

Apixaban |

Rivaroxaban |

Dabigatran |

Warfarin |

Edoxaban |

| Dosing Frequency |

BID |

QD |

BID |

Variable |

QD |

| Bleeding Risk |

Lower |

Moderate |

Higher |

Higher |

Similar to Apixaban |

| Clinical Evidence |

Extensive |

Extensive |

Moderate |

Extensive |

Growing |

| Patent Status (2023) |

Valid until 2026 |

Valid until 2024 |

Expired |

N/A |

Valid until 2028 in some regions |

Future Market and Financial Forecasts

Projected Revenue Growth

| Scenario |

CAGR (2023-2030) |

Remarks |

| Optimistic |

9-12% |

Accelerated adoption in emerging markets, new indications |

| Moderate |

6-8% |

Maturation in major markets, patent expiry impact |

| Pessimistic |

3-5% |

Increased generic competition, regulatory hurdles |

Key Factors Influencing Future Revenue

| Factor |

Potential Effect |

Mitigating Strategies |

| Additional Indications |

Revenue expansion |

Rivaroxaban’s off-label uses |

| Biosimilar Competition |

Revenue erosion |

Patent extension challenges, novel formulations |

| Market Expansion |

Growth |

Entering new geographies, especially Asia-Pacific |

Deep Dive: Strategic Considerations for Stakeholders

| Stakeholder |

Key Considerations |

Strategic Actions |

| Pharma Developers |

Patent expiration, biosimilars |

R&D pipelines, new formulations, combination therapies |

| Investors |

Revenue stability post-patent expiry |

Diversification, focus on emerging markets |

| Regulators |

Safety, access |

Streamline approval processes, price controls |

| Payers |

Cost containment |

Formularies favoring generics, negotiated pricing |

Comparison of APIXABAN Market Trajectory with Similar Pharmaceuticals

| Metric |

APIXABAN |

Rivaroxaban |

Dabigatran |

Edoxaban |

| Launch Year |

2012 |

2008 |

2010 |

2015 |

| 2023 Global Sales (USD Millions) |

10,300 |

9,000 |

1,500 |

900 |

| Patent Expiry (US) |

2026 |

2024 |

2022 |

2028 |

| CAGR (2014-2022) |

24% |

22% |

20% |

18% |

(Sources: IQVIA, Evaluate Pharma, 2023)

FAQs

Q1: What are the main factors driving APIXABAN’s market growth?

A1: The main factors include the rising prevalence of atrial fibrillation and VTE, the shift towards DOACs over warfarin due to safety and convenience, evolving clinical guidelines favoring DOACs, and expanding access in emerging markets.

Q2: How will patent expiration impact APIXABAN’s revenue?

A2: Patent expiry, expected in 2025-2026 in key markets, is projected to lead to increased generic competition, potentially reducing revenue by 60-70% within two years post-expiration, unless new formulations or indications are introduced.

Q3: How does APIXABAN compare to other DOACs in terms of market share?

A3: As of 2023, APIXABAN captures approximately 48% of the DOAC market, leading Rivaroxaban at 36%. Its favorable bleeding profile and extensive clinical data support its market position.

Q4: What are the emerging opportunities and challenges for APIXABAN?

A4: Opportunities include expanding indications, entering new geographical markets, and biosimilar competition. Challenges encompass patent cliffs, pricing pressures, and regulatory hurdles.

Q5: Which regions present the highest growth potential for APIXABAN?

A5: Asia-Pacific and Latin America exhibit significant growth potential due to rising cardiovascular disease burden and improving healthcare infrastructure, despite regulatory challenges.

Key Takeaways

- Market Expansion: APIXABAN remains a leading DOAC with over USD 10 billion in global sales in 2023, driven by existing indications and new market entries.

- Patent Expiry Risks: Patent protection slated to expire from 2025-2026 poses significant revenue risks; strategic R&D investments are vital.

- Competitive Environment: The market is mature, with Rivaroxaban as the primary competitor; emerging generic options will influence pricing and adoption.

- Growth Opportunities: Additional indications, biosimilar entry, and expansion into emerging markets offer potential growth avenues.

- Regulatory and Pricing Strategies: Navigating diverse regulatory requirements and payer policies will be critical for sustained market share.

References

[1] Global Burden of Disease Study, 2023

[2] European Society of Cardiology, 2022 Guidelines for Atrial Fibrillation

[3] Evaluate Pharma, 2023

[4] IQVIA, 2023

[5] U.S. Food and Drug Administration, 2012 & 2023 Patent Data