Last updated: July 28, 2025

Introduction

Impax Laboratories, Inc., a prominent player in the pharmaceutical sector, specializes in the development, manufacturing, and commercialization of differentiated pharmaceutical products across several therapeutic areas. As the landscape evolves with increased generic drug entry, biosimilars development, and specialty formulations, understanding Impax’s market positioning, strategic strengths, and future trajectory becomes essential for industry stakeholders.

This analysis provides a comprehensive overview of Impax’s current competitive standing, highlighting its core strengths, market challenges, and strategic options for maintaining growth amid a dynamic pharmaceutical environment.

Market Position of Impax

Core Business Segments and Therapeutic Focus

Impax operates primarily within two segments: generics and specialty branded pharmaceuticals. The company's portfolio includes oral, injectable, and biosimilar products aimed at neurological, psychiatric, and wellness-related markets.

A pivotal component of Impax’s market presence is its focus on complex generics and specialty formulations. The company's strategic emphasis on products like generic versions of branded drugs and niche injectable pharmaceuticals positions it favorably against larger generic giants and innovative biotech firms.

Geographical Footprint and Market Share

Impax maintains a strong U.S.-centric footprint, capturing a significant share within the North American generics and specialty markets. Its distribution channels and regulatory approvals in key markets bolster its competitive advantage domestically.

While global expansion remains a strategic objective, the company's market share outside North America remains modest, constrained by regional regulatory barriers and capital constraints. Nevertheless, recent acquisitions and pipeline advancements aim to bolster its international footprint.

Competitive Positioning in the Industry

Compared with peers such as Teva, Mylan (now part of Viatris), and Allergan (acquired by AbbVie), Impax differentiates itself through its focus on complex formulations and biosimilars. Its agility in developing niche products appeals to healthcare providers seeking specialized treatment options.

However, the company faces intense competition from larger players leveraging extensive R&D and manufacturing capacities. Impax’s relatively focused product portfolio makes it susceptible to market shifts within niche sectors, demanding continuous innovation and strategic diversification.

Core Strengths of Impax

Product Portfolio Customization and Innovation

Impax’s strength lies in its ability to develop complex generic formulations that are challenging for competitors to replicate. Its expertise in bioequivalence studies, pharmaceutical formulation, and manufacturing of biologics positions it as a leader in producing complex generics and biosimilars.

The company's investment in biosimilars—such as its pipeline of biospecific antibody therapeutics—aligns with industry trends favoring biologics over traditional small molecules. This strategic pivot enhances its long-term growth prospects.

Regulatory and Intellectual Property Acumen

Impax’s efficient navigation of the regulatory landscape, including FDA approvals for complex generics and biosimilars, underscores its technical capabilities. Its portfolio benefits from numerous ANDA (Abbreviated New Drug Application) approvals, which create barriers to entry and protect market share.

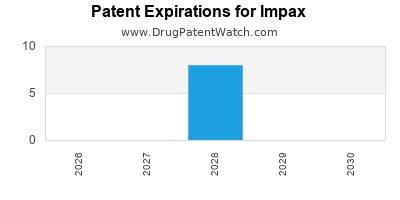

Furthermore, Impax's strategic use of exclusivity periods and patent protections fortify its market position, enabling sustained revenue streams.

Operational Agility and Strategic Partnerships

The company's streamlined operational structure allows rapid product development and commercialization. Strategic partnerships, including licensing agreements with biotech firms and collaborations with healthcare providers, amplify its market reach.

Recent acquisitions, such as the acquisition of Nephron Pharmaceuticals’ injectable portfolio, expanded its manufacturing capacities and diversification, underscoring agility in strategic execution.

Focused Niche Strategy

By concentrating on specialized therapeutic areas like neurology and psychiatric disorders, Impax minimizes direct competition from mass-market pharmaceutical firms. This niche focus fosters customer loyalty and allows premium pricing strategies for differentiated formulations.

Strategic Insights and Future Outlook

Emerging Opportunities

-

Biosimilars Growth: The acceleration of biosimilar development is a significant opportunity for Impax. Its pipeline demonstrates potential for products in oncology, immunology, and endocrinology [1].

-

Complex Generics Market: Increasing hunger for complex generics—such as inhalation products and complex injectables—creates avenues to expand revenue without extensive R&D investment required for novel therapeutics.

-

International Expansion: Targeted regulatory pathways, such as the European Medicines Agency (EMA) approvals, coupled with localized manufacturing, can unlock new markets and diversify revenue sources.

Challenges to Address

-

Pricing Pressures and Market Entry Barriers: The commoditization of generics imposes pricing pressures, shrinking margins. Ensuring patent defenses and high-value differentiation becomes crucial.

-

Regulatory Hurdles: Navigating stringent regulatory pathways for biosimilars and complex generics can delay product launches and increase costs.

-

Competitive Landscape Dynamics: Larger players with extensive product pipelines and manufacturing capacity pose a continuous threat, necessitating innovation and strategic alliances.

Strategic Recommendations

-

Invest in Biosimilar Development: Accelerating biosimilar pipeline expansion aligns with industry trends and offers high-margin opportunities.

-

Enhance Global Footprint: Pursuing approvals and manufacturing opportunities in Europe, Asia, and emerging markets can dilute risk concentrations.

-

Leverage Front-End Innovation: Focusing on developing high-value, difficult-to-copy formulations can create sustainable points of differentiation.

-

Explore M&A Opportunities: Acquiring smaller biotech or specialty pharmaceutical firms can provide immediate pipeline enhancements and technological assets.

Long-Term Outlook

Impax’s strategic emphasis on complex generics and biosimilars positions it favorably within the evolving pharmaceutical landscape. Its capacity to innovate within niche markets, coupled with operational flexibility, can translate into sustained competitive advantage. However, maintaining agility amidst aggressive competition and regulatory challenges remains paramount.

Key Takeaways

-

Market Position: Impax’s stronghold in complex generics and specialty formulations offers a differentiated niche, though expansion into international markets remains vital.

-

Strengths: Expertise in complex formulations, regulatory navigation, operational agility, and strategic partnerships underpin its competitive advantages.

-

Strategic Opportunities: Emphasizing biosimilars, diversifying geographically, and investing in high-value formulations can catalyze growth.

-

Challenges: Pricing pressures, regulatory hurdles, and global competition necessitate proactive strategic adaptation.

-

Future Outlook: Focused innovation and strategic acquisitions promise sustainable growth; however, agility and differentiation will determine long-term success.

FAQs

1. How does Impax differentiate itself from larger generic pharmaceutical companies?

Impax specializes in complex generics and biosimilars, segments that require advanced formulation expertise, bioequivalence studies, and regulatory navigation. Its focus on niche, difficult-to-develop products allows it to command premium pricing and better defend against commoditization.

2. What are the primary growth drivers for Impax in the coming years?

Key drivers include expansion in the biosimilars pipeline, commercialization of complex generics, entering new international markets, and strategic acquisitions that enhance manufacturing capacity and product diversity.

3. What regulatory challenges does Impax face with biosimilar development?

Navigating biosimilar approvals involves rigorous clinical data, demonstrating biosimilarity, and meeting diverse regional regulatory standards. Delays in approval or rejection can impact revenue forecasts and pipeline timelines.

4. How does Impax manage competitive pressures in the generics market?

Impax mitigates competition through product differentiation, patent protections, strategic partnerships, and focusing on complex formulations less vulnerable to price erosion.

5. What strategic moves should Impax consider to strengthen its market position?

Impax should prioritize biosimilars development, expand geographically, pursue M&A opportunities in niche markets, and continually invest in innovative formulations to sustain competitive advantage.

References

[1] Industry Reports on Biosimilars Pipeline and Market Trends, 2023