Last updated: July 27, 2025

Introduction

Tretinoin, also known as all-trans retinoic acid, is a derivative of vitamin A predominantly used in dermatology and oncology. Its versatility spans acne management, photoaging, and acute promyelocytic leukemia (APL). As a mature compound with established therapeutic indications, tretinoin's market has experienced notable shifts driven by evolving treatment paradigms, regulatory policies, and patient preferences. Analyzing its market dynamics and financial trajectory offers insights for pharmaceutical stakeholders seeking competitive positioning and investment strategies.

Pharmacological Profile and Clinical Applications

Tretinoin's primary dermatological utility lies in treating acne vulgaris. Its mechanism involves promoting keratinocyte turnover, reducing comedone formation, and alleviating post-inflammatory hyperpigmentation [1]. In oncology, tretinoin revolutionized APL treatment, inducing differentiation of malignant promyelocytes and drastically improving survival rates [2].

The compound's success in both segments reflects its distinct pharmacodynamic properties. However, recent advancements and alternative therapies challenge its dominance, prompting shifts in market dynamics.

Market Size and Regional Trends

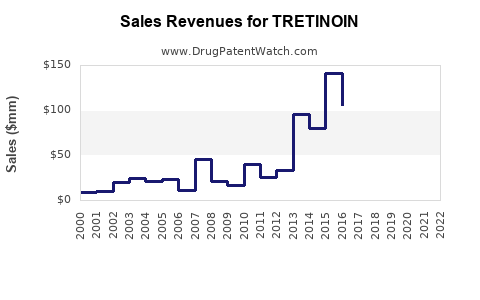

The global tretinoin market was valued at approximately USD 250 million in 2022, with expectations to reach USD 320 million by 2028, reflecting a compound annual growth rate (CAGR) of around 4.2% (2023–2028) [3].

Regional Analysis

-

North America: Leads due to high dermatologist adoption, strong healthcare infrastructure, and significant APL prevalence. The US accounts for about 60% of regional sales.

-

Europe: Represents a mature market with steady demand, though constrained by regulatory and safety concerns.

-

Asia-Pacific: Exhibits rapid growth driven by rising skin concerns, expanding healthcare access, and increasing APL diagnoses.

Key Drivers

- Rising Dermatological Disorders: Increased awareness and social media influence have accelerated demand for acne treatments.

- Oncology Advancements: Continued improvements in APL management with tretinoin, particularly in combination therapies, bolster its use.

- Generic Availability: Patent expirations have led to a surge in generic formulations, making tretinoin more affordable and accessible.

Challenges

- Safety and Side Effects: Skin irritation, teratogenicity concerns limit some use cases, especially in pregnancy.

- Regulatory Environment: Stringent regulations, especially in Europe and the US, impact marketing and formulation approvals.

- Competition: The emergence of alternative therapies for acne (e.g., biologics, laser treatments) and newer differentiation agents influence market share.

Competitive Landscape

Major players include Johnson & Johnson, Mylan (now part of Viatris), and Teva Pharmaceuticals. These companies dominate with established manufacturing, distribution networks, and brand recognition.

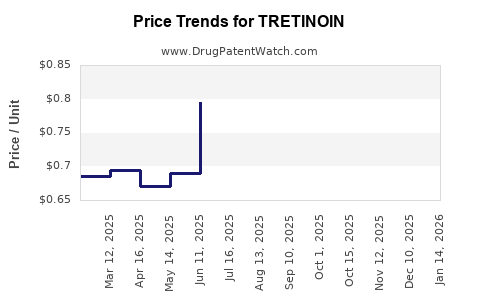

The presence of multiple generics has significantly reduced prices, enhancing accessibility but limiting profit margins for original developers.

Innovative formulations—topical gels, creams, and combination therapies—aim to improve patient compliance and efficacy, representing a strategic focus for competitors.

Regulatory and Patent Trajectory

Patent protections for tretinoin typically expired in the early 2000s, leading to a wave of generic products. Future patent filings focus on novel delivery systems or combination formulations aimed at extending exclusivity or market share.

Regulatory agencies continue to scrutinize safety profiles, especially concerning teratogenicity, affecting labeling and prescription controls. Approval processes for biosimilars or similar compounds remain complex, influencing market entry strategies.

Financial Projections and Investment Outlook

Given the moderate growth rate and market maturity, stakeholders primarily focus on generic sales, with limited scope for substantial premium pricing. The revenue is expected to stabilize around USD 310–320 million annually by 2028.

Investments in formulation innovation could catalyze growth, especially in niches offering improved safety or convenience. Moreover, expanding into emerging markets presents an opportunity, although price sensitivity poses challenges.

In the oncology segment, tretinoin-related therapies may experience incremental growth through combination regimens, warranting ongoing R&D and licensing strategies.

Market Trends and Future Outlook

- Personalized Dermatology: Tailoring tretinoin-based regimens according to genetic and phenotypic patient profiles could drive niche markets.

- Safety Optimization: Development of formulations with reduced irritation profiles and pregnancy-safe options may expand patient base.

- Synergistic Combinations: Integrating tretinoin with other agents (e.g., antibiotics, corticosteroids) enhances treatment efficacy and adherence.

- Digital Engagement: Teledermatology platforms facilitate prescription and monitoring, influencing sales channels.

Emerging Challenges

- Regulatory tightening concerning teratogenic risks.

- Competition from novel dermatological agents and advanced laser treatments.

- Market saturation, especially in developed regions.

Key Takeaways

- Tretinoin sustains stable demand driven by dermatology and oncology, but growth potential is moderate due to market maturity.

- Generic proliferation diminishes profit margins but enhances global accessibility.

- Innovation in delivery systems and safety profiles remains essential for capturing niche opportunities.

- Strategic expansion into emerging markets and oncology combination therapies could augment the financial trajectory.

- Regulatory landscapes continue to shape product positioning and market strategies, necessitating vigilant monitoring.

FAQs

1. What factors primarily influence tretinoin's market growth?

Market growth hinges on dermatological demand, innovation in formulations, accessibility via generics, and ongoing advances in oncology treatments. Regulatory policies and safety profiles also play pivotal roles.

2. How do patent expirations affect tretinoin's market competition?

Patent expirations have led to increased generic availability, lowering prices and intensifying competition, which constrains profit margins but boosts accessibility.

3. Are there ongoing developments to improve tretinoin's safety profile?

Yes, pharmaceutical companies are researching formulations with reduced irritation and pregnancy-safe options. Such innovations could broaden the patient base.

4. What emerging markets offer significant opportunities for tretinoin?

Asia-Pacific and Latin America present growth opportunities due to increasing dermatology awareness, expanding healthcare infrastructure, and rising disposable incomes.

5. How is tretinoin positioned within the evolving landscape of acne and skin aging therapies?

While remaining a staple, tretinoin faces competition from biologics, laser treatments, and novel topical agents. Its future positioning depends on innovation, safety, and regulatory compliance.

Sources

[1] Gollnick H. "Topical tretinoin for acne scarring: Efficacy, safety, and tolerability." Clin Dermatol. 2008.

[2] Lo-Coco F, et al. "Retinoic acid and arsenic trioxide for acute promyelocytic leukemia." N Engl J Med. 2013.

[3] Research and Markets. "Global Tretinoin Market Forecast 2023–2028."