Last updated: July 28, 2025

Introduction

Cheplapharm Arzneimittel GmbH stands as a formidable player within the global pharmaceutical industry, emphasizing specialty and mature pharmaceuticals. Founded in 1998 and headquartered in Germany, the company’s strategic focus revolves around acquiring, developing, and commercializing established pharmaceutical products from leading global companies. As the pharmaceutical landscape becomes increasingly competitive, understanding Cheplapharm’s market position, core strengths, and strategic directions is vital for stakeholders, including investors, competitors, and partners.

This analysis provides a comprehensive assessment of Cheplapharm’s market positioning, its key strengths, and strategic insights that could influence future growth and competitive differentiation.

Market Position Overview

Niche Focus on Established Pharmaceuticals

Cheplapharm’s core niche involves mature, well-established pharmaceutical products with proven efficacy and safety profiles. This approach aligns with a high-margin, less R&D-intensive model that capitalizes on existing approvals and market acceptance. The company's portfolio spans cardiology, dermatology, ophthalmology, and central nervous system therapies, among others.

Global Reach and Market Penetration

Though headquartered in Germany, Cheplapharm has cultivated a multi-national footprint, with distribution channels and licensing agreements across Europe, North America, Asia, and Latin America. Its strategic acquisitions of rights to well-known drugs enable entry into diverse markets, often via licensing agreements with large pharmaceutical firms seeking to divest mature assets.

Competitive Positioning

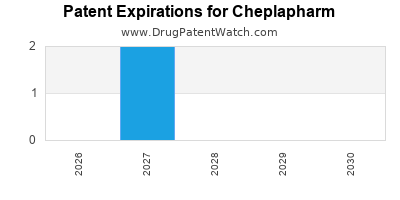

In the evolving pharmaceutical landscape, Cheplapharm occupies a unique space as an acquirer and licensee of established products rather than an innovator. Its portfolio management approach provides stability in revenue streams amid patent expirations and generic competition. These factors position the company as a reliable partner and acquirer in the lifecycle management of pharmaceutical assets.

Strengths Analysis

1. Specialization in Mature Pharmaceuticals

Cheplapharm’s core competency lies in managing mature pharmaceutical assets—products that have reached patent expiration but retain therapeutic significance. Such assets often command predictable cash flows, lower regulatory risk, and reduced developmental costs, enabling the company to generate steady revenue streams.

2. Strategic Portfolio Management

The company's disciplined approach to portfolio optimization involves acquiring rights to assets with minimal competition or high therapeutic value. It emphasizes lifecycle extension strategies and licensing agreements that optimize the market potential of these drugs.

3. Robust Acquisition and Licensing Strategy

Cheplapharm’s growth model relies heavily on strategic acquisitions and licensing agreements. Its flexibility in negotiating terms with originators enables it to secure rights cost-effectively, providing a foundation for value creation through efficient commercialization and lifecycle extension.

4. Diversification Across Therapeutic Areas and Markets

By maintaining a diversified portfolio across multiple therapeutic categories and geographic markets, Cheplapharm mitigates sector-specific risks. This diversification enhances resilience against regional patent cliffs or regulatory challenges.

5. Strategic Focus on Non-R&D-Intensive Business Model

Unlike many competitors focused heavily on innovation, Cheplapharm’s emphasis on established products reduces R&D expenses and regulatory uncertainties. This model offers faster-than-average time-to-market for new acquisitions, bolstering cash flow predictability.

6. Strong Industry Relationships

Long-standing licensing and distribution agreements with large pharmaceutical companies furnish Cheplapharm with a broad pipeline of assets and market access, fostering stability and growth potential.

Strategic Insights

A. Leveraging Portfolio for Expansion

Cheplapharm’s established expertise in lifecycle management positions it well to expand into adjacent therapeutic sectors, particularly where aging populations demand sustained drug use. It can also leverage its portfolio to enter emerging markets where demand for mature therapies is rising.

B. Potential for Strategic Partnerships

Open to collaborations with innovative biotech firms and global pharma, Cheplapharm can strengthen its pipeline through licensing new assets and co-marketing arrangements, fostering diversification and growth avenues.

C. Digital Transformation and Market Optimization

Investing in digital tools and data analytics can enhance market penetration strategies, optimize supply chain management, and improve targeted marketing efforts, which are crucial in mature asset management scenarios.

D. Diversification and Innovation

While maintaining its core focus, Cheplapharm might explore opportunities for targeted innovation, such as developing improved formulations or delivery systems for existing drugs, to extend product lifecycle and enhance revenues.

E. Regulatory and Market Challenges

Potential hurdles include increasing regulatory scrutiny around licensing agreements and patent cliffs that impact portfolio valuation. Staying agile and well-informed on regulatory trends will be crucial for sustained success.

F. Navigating Pricing Pressures

Global healthcare reforms and cost-containment policies pose risks to profit margins. Strategic pricing and contract management are critical to maintaining profitability margins in mature products.

Competitive Landscape Positioning

Cheplapharm’s competitive edge derives from its specialization in non-innovative, lifecycle-managed products, enabling high margins and lower R&D burden. Major competitors include divisions of large pharma firms divesting mature assets, generic manufacturers, and other specialty pharma companies with similar portfolios.

Its ability to maintain long-term licensing agreements and diversify geographically buffers against regional market volatility. The company's stability and predictable revenue streams stand in contrast to early-stage biotech ventures, making it attractive for investors seeking low-risk exposure within the pharmaceutical sector.

Conclusion

Cheplapharm's focused strategy on mature pharmaceuticals and lifecycle management distinguishes it in an industry increasingly driven by innovation. Its strengths lie in strategic acquisitions, diversified portfolios, and sustained partner relationships, underpinning a resilient business model. Future growth hinges on expanding its therapeutic scope, leveraging digital advancements, and navigating regulatory challenges adeptly.

Stakeholders benefitting from Cheplapharm’s trajectory should monitor its adaptation to market dynamics, potential for portfolio expansion, and ability to sustain its niche amidst intensifying competition and pricing pressures.

Key Takeaways

- Cheplapharm's specialization in well-established, mature pharmaceutical products offers predictable revenue with lower R&D investment.

- Its strategic acquisition and licensing model capitalizes on lifecycle management, strengthening market position without heavy innovation costs.

- Diversification across therapeutic areas and regions mitigates sector-specific risks, bolstering financial stability.

- Strategic initiatives like digital transformation, diversification, and partnership expansion can further enhance competitiveness.

- Navigating regulatory challenges and pricing pressures will be essential for maintaining profitability and market relevance.

FAQs

Q1: What distinguishes Cheplapharm from innovative pharmaceutical companies?

A: Cheplapharm focuses exclusively on established, mature pharmaceuticals rather than investing in R&D for novel drugs, emphasizing lifecycle management and licensing to generate steady revenue.

Q2: How does Cheplapharm mitigate risks associated with patent expirations?

A: The company's portfolio comprises drugs that have already faced patent cliff risks but continue to hold therapeutic value, allowing it to extend product lifecycles and market access through licensing and lifecycle management strategies.

Q3: In what regions does Cheplapharm primarily operate?

A: Although based in Germany, Cheplapharm maintains an extensive footprint across Europe, North America, Asia, and Latin America, supported by licensing agreements and distribution channels.

Q4: What are the main growth prospects for Cheplapharm?

A: Growth opportunities include expanding into new therapeutic areas, entering emerging markets, forming strategic partnerships, and leveraging digital tools for market optimization.

Q5: What are the principal risks facing Cheplapharm?

A: Key risks include increasing regulatory scrutiny, market access challenges, pricing pressures, and the potential for portfolio devaluation due to patent challenges or market shifts.

Sources:

[1] Cheplapharm Annual Reports and Investor Presentations.

[2] Industry analysis reports (e.g., IQVIA, EvaluatePharma).

[3] Public filings and licensing agreements, industry news outlets.