Last updated: November 24, 2025

Introduction

Mometasone furoate, a potent synthetic corticosteroid, has established a vital position within dermatology, allergy, and respiratory therapeutics. Its anti-inflammatory and immunosuppressive properties support treatment for conditions like rhinitis, eczema, and psoriasis. Market dynamics surrounding mometasone furoate are shaped by advanced formulations, regulatory landscapes, competitive pressures, and evolving healthcare needs. This article evaluates the underlying drivers influencing the drug's market trajectory and forecasts its financial prospects within global markets.

Pharmacological Profile and Therapeutic Applications

Mometasone furoate’s high receptor affinity underpins its efficacy. It is predominantly marketed via nasal sprays (e.g., Nasonex, marketed by Merck), topical creams, and inhalers. The versatility underscores its broad commercial potential. These formulations effectively manage allergic rhinitis, nasal polyps, atopic dermatitis, and asthma, positioning the drug at the intersection of respiratory and dermatological therapeutics.

The rising prevalence of allergic and inflammatory disorders globally is a primary catalyst for increased mometasone furoate demand. For instance, according to WHO, allergic rhinitis affects approximately 10-30% of the global population, with rising trends driven by urbanization and environmental changes[1].

Market Dynamics Influencing Growth

1. Patent Expirations and Generic Competition

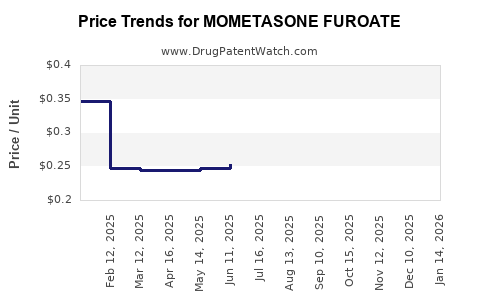

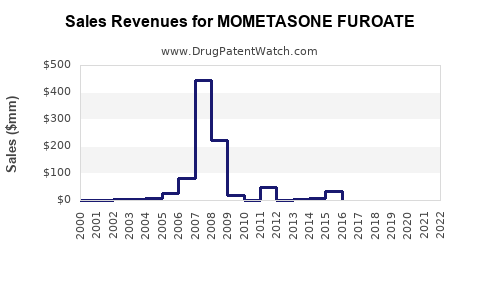

Patents for branded formulations like Nasonex in key markets such as the US and Europe have expired or are nearing expiry, facilitating generic entry. Generic mometasone furoate products provide more affordable options, intensifying price competition, which affects brand revenues but broadens access to therapy. For example, the US FDA approved several generics in recent years, leading to price reductions and volume growth in generics segment.

2. R&D and New Formulation Development

Pharmaceutical companies are investing in novel delivery mechanisms, including micro-sphere-based controlled-release formulations and combination therapies, to enhance patient compliance and therapeutic outcomes. These innovations offer premium pricing potential and extend product life cycles, sustaining revenue streams amid generic competition.

3. Regulatory and Reimbursement Policies

Stringent regulatory standards, such as EMA’s approval processes and FDA requirements, shape market access and commercialization strategies. Favorable reimbursement policies, especially in developed countries with high healthcare spending, improve patient access and brand loyalty.

4. Competitive Landscape

Major players like Merck, Teva, Mylan, and Sandoz drive price competition and innovation. Multinational corporations leverage extensive distribution channels and marketing expertise, consolidating market share. The entry of biosimilars and combination inhalers further complicates this landscape.

5. Global Prevalence of Target Conditions

The rising incidence of allergic diseases and asthma, notably in urbanizing regions in Asia and Africa, propels market growth. Data from the Global Asthma Network estimates over 250 million asthma sufferers worldwide, underpinning the sustained demand for mometasone-based therapies[2].

Market Segments and Regional Outlook

By Formulation:

- Nasal Sprays: Dominant, accounting for a significant share due to widespread use in allergic rhinitis.

- Topical Creams: Steady growth, especially in dermatological therapeutic markets.

- Inhalers: Expanding segment, driven by respiratory disease prevalence.

Regional Markets:

-

North America: The largest market, fueled by high disease prevalence, advanced healthcare infrastructure, and innovation. The US accounts for about 65% of the global nasal corticosteroids market[3].

-

Europe: Maintains stable growth, with increased adoption of generic formulations and ongoing R&D initiatives.

-

Asia-Pacific: The fastest-growing segment, driven by increasing awareness, urbanization, and economic expansion. Countries like India and China witness rising demand, facilitated by regulatory approvals and increasing healthcare coverage.

-

Latin America and MEA: Emerging markets with growth potential owing to expanding access to healthcare and product availability.

Financial Trajectory and Market Forecasts

The global corticosteroid market, valued at approximately USD 5 billion in 2022, is expected to grow at a compounded annual growth rate (CAGR) of around 4-6% through 2028[4]. Mometasone furoate, representing a substantial segment within this market, is forecasted to benefit from this expansion.

Key drivers include:

- Increased adoption of combination therapies: Synergistic formulations with antihistamines and other agents attract patient and prescriber preference.

- Regulatory approval of new indications: Expanded use cases extend revenue streams.

- Market integration strategies: Licensing, collaborations, and strategic acquisitions expand reach, especially in emerging markets.

Potential setbacks include:

- Generic price erosion: Accelerated by patent expirations, which can reduce per-unit revenues.

- Market saturation in mature regions: Limits growth potential, necessitating diversification strategies.

Financial projections suggest:

- In North America and Europe, revenues for mometasone formulations will likely stabilize or witness modest growth, maintaining high-profit margins due to premium formulations and brand loyalty.

- In Asia-Pacific, revenues could see robust double-digit growth, driven by increasing access and demand, compensating for lower margins through high-volume sales.

- Global market share for mometasone furoate is projected to reach approximately USD 1.5-2 billion by 2030, considering compounded growth and expanding indication labels[5].

Competitive Strategies and Innovation

To sustain growth, pharmaceutical companies innovate in formulation science, such as sustained-release nasal sprays and combo inhalers targeting asthma-COPD overlap. Strategic mergers and acquisitions aim to acquire pipeline assets and diversify therapeutic portfolios, especially in antibiotics and biologics, which complement corticosteroid brands.

The integration of digital health—remote monitoring and adherence tracking—also offers revenue opportunities by ensuring continued patient engagement and device sales.

Regulatory and Patent Landscape

Global patent landscape evolution influences market trajectory. While patent exclusivities extend the market lifespan for flagship products, imminent expirations necessitate proactive strategies. Registrations for new indications can delay generic penetration, maintaining revenue streams.

Regulatory agencies increasingly demand real-world evidence for drug approvals and label expansion, incentivizing ongoing R&D investments. Such policies aim to balance innovation incentives with affordability.

Key Takeaways

- The mometasone furoate market remains robust, supported by its broad therapeutic applications and increasing disease prevalence.

- Patent expirations and generic competition exert downward pressure on pricing, demanding innovation and differentiation.

- Emerging markets and regulatory pathway advancements present high-growth opportunities.

- Investment in formulation innovation and strategic market expansion are vital for sustained financial success.

- Market growth will be tempered by pricing pressures but compensated by volume increases and new indication approvals.

FAQs

1. What are the main factors influencing the decline of branded mometasone furoate sales?

Patent expirations and the introduction of generic equivalents primarily suppress branded sales through price competition, though brand loyalty and new formulations can mitigate impacts.

2. How is the COVID-19 pandemic affecting mometasone furoate's market?

The pandemic temporarily disrupted supply chains but also heightened demand for respiratory therapies. Additionally, increased focus on respiratory health may stimulate further utilization.

3. What is the outlook for mometasone furoate in emerging markets?

Rapid economic growth, expanding healthcare access, and rising disease prevalence position emerging markets as high-growth zones, with revenues expected to grow at double-digit CAGR.

4. Are there ongoing innovations leading to new formulations of mometasone furoate?

Yes, researchers are exploring sustained-release nasal sprays, combination therapies, and inhalers integrating digital health aids to improve efficacy and adherence.

5. How do regulatory hurdles impact the global market for mometasone furoate?

Strict regulations can delay product approvals, restrict indications, or require substantial post-marketing studies, influencing the pace of market expansion and product launches.

References

[1] World Health Organization. (2022). Allergic Rhinitis Fact Sheet.

[2] Global Asthma Network. (2021). Worldwide Asthma Prevalence.

[3] MarketWatch. (2022). Corticosteroids Market Analysis.

[4] Fortune Business Insights. (2023). Global Corticosteroids Market Size and Forecast.

[5] Allied Market Research. (2022). Pharmacology and Market Trends for Nasal Corticosteroids.