Last updated: July 27, 2025

Introduction

Methocarbamol, a centrally acting muscle relaxant, has long been utilized to treat musculoskeletal disorders and spasm-related conditions. As a generic drug, its market dynamics are influenced by factors such as clinical demand, competitive landscape, regulatory environment, and healthcare policies. This report examines the current market landscape, underlying drivers, competitive forces, and financial outlook for methocarbamol, offering insights to stakeholders and investors seeking an in-depth understanding of its trajectory.

Overview of Methocarbamol

Developed in the mid-20th century, methocarbamol's primary indication involves relief from painful muscle spasms and associated disorders. Its mechanism involves central nervous system depression, resulting in muscle relaxation without significant sedation. Key formulations include oral tablets and injectable forms, with the drug available globally as a generic medication.

The drug's efficacy, safety profile, and longstanding clinical use underpin its continued relevance in pain management. The pharmaceutical community anticipates that combining this established utility with evolving healthcare dynamics will influence its market performance (source: [1]).

Market Drivers Influencing Methocarbamol

1. Rising Incidence of Musculoskeletal Disorders

Globally, the prevalence of musculoskeletal ailments—such as strains, sprains, and back pain—continues to escalate, driven by aging populations, sedentary lifestyles, and increased workplace injuries. According to the Global Burden of Disease Study, musculoskeletal conditions are among the leading causes of disability worldwide (source: [2]). This increasing burden sustains demand for muscle relaxants, including methocarbamol.

2. Preference for Generic Medications

Patents for many branded muscle relaxants have expired, paving the way for generic equivalents like methocarbamol. Cost-effectiveness drives prescriber and patient preference, especially in developing economies where healthcare budgets are constrained. As a result, the generic market for methocarbamol is expanding, supported by competitive pricing and wider availability.

3. Growing Aging Population

Elderly populations are more susceptible to conditions necessitating muscle relaxants. According to United Nations demographic data, the global population aged 65 and above is projected to reach 1.5 billion by 2050, fueling demand for analgesics and muscle relaxants (source: [3]).

4. Expanding Healthcare Access

Improvements in healthcare infrastructure and insurance coverage, especially in emerging markets, facilitate increased prescription and consumption of chronic and acute musculoskeletal therapies, including methocarbamol.

Market Challenges and Constraints

1. Competitive Landscape

Multiple generics and branded alternatives compete within the muscle relaxant segment. Drugs like carisoprodol, cyclobenzaprine, and orphenadrine exert competitive pressure, often offering similar efficacy and safety. The commoditization of the active pharmaceutical ingredient (API) limits profit margins for manufacturers.

2. Regulatory Hurdles and Quality Concerns

Ensuring compliance with regulatory standards (e.g., FDA approvals, EMA regulations) remains crucial. Variability in manufacturing quality can impact market access—particularly in the context of increasing scrutiny on generic drug standards—potentially dampening growth prospects.

3. Prescription Trends and Clinical Guidelines

Emerging clinical guidelines favor non-pharmacologic interventions or alternative therapies for musculoskeletal pain, which may restrict the volume of prescriptions for muscle relaxants, including methocarbamol.

4. Safety and Adverse Effect Profile

Methocarbamol's safety profile, while generally favorable, includes potential CNS depression and allergic reactions. Negative publicity regarding adverse effects or misuse (e.g., sedation, abuse potential with some muscle relaxants) could influence prescribing patterns.

Financial Trajectory and Market Size Analysis

1. Market Valuation and Growth Projections

The global muscle relaxant market was valued at approximately USD 1.2 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5-6% through 2030 (source: [4]). Being a significant component within this segment, methocarbamol's market share benefits from this overall expansion.

2. Regional Market Dynamics

- North America: Dominates due to high healthcare spending, extensive prescribing, and mature generic markets. The U.S. accounts for over 50% of the global muscle relaxant market share.

- Europe: Exhibits steady growth driven by aging demographics, with regulatory pathways favoring generics.

- Asia-Pacific: Shows rapid growth potential, fueled by increasing healthcare access, rising patient awareness, and cost-sensitive markets.

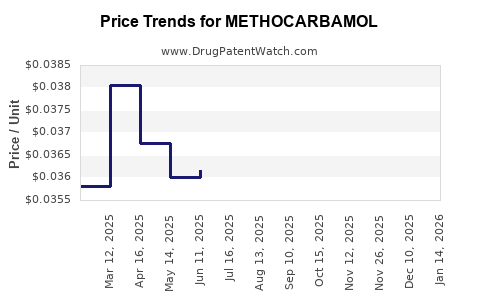

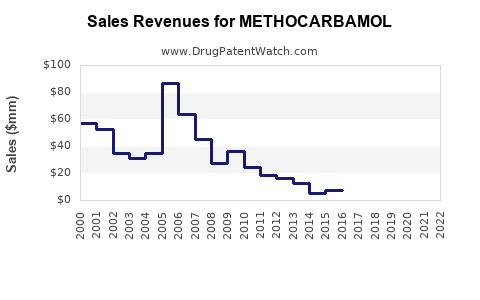

3. Price Trends and Concentration

Price erosion is anticipated due to generic competition and commoditization. While initial profits in certain markets may decline, volume-driven growth offsets margin pressures. Manufacturers that optimize supply chains and prioritize quality can maintain competitiveness.

4. R&D and Differentiation

Limited R&D investment focuses on new delivery systems, combination therapies, or formulations. Innovations such as extended-release tablets or injectable formulations may command premium pricing and extend product lifecycle, positively influencing revenues.

Regulatory and Market Access Outlook

Ongoing regulatory modernization, including streamlined approval processes in emerging markets (e.g., via the WHO prequalification or mutual recognition agreements), bodes well for market access expansion. Conversely, tighter quality standards globally necessitate continual compliance investments, affecting financial planning for manufacturers.

Risks and Opportunities

Risks:

- Prescriber shift away from pharmacotherapy towards physical therapy or alternative medicine.

- Regulatory barriers or supply chain disruptions.

- Price erosion due to increased generic competition.

Opportunities:

- Entry into emerging markets with growing healthcare infrastructure.

- Development of new formulations or combination therapies.

- Strategic partnerships or licensing arrangements to extend market reach.

Conclusion

The financial and market outlook for methocarbamol hinges upon several interconnected factors. While generic competition and regulatory challenges temper growth prospects in mature markets, expanding global healthcare access, demographic shifts, and the persistent need for musculoskeletal treatments foster sustained demand. Manufacturers focusing on quality, cost efficiency, and strategic expansion are poised to capitalize on the evolving landscape.

Key Takeaways

- The global muscle relaxant market is projected to grow at a CAGR of 4.5–6% through 2030, driven by rising musculoskeletal disorders and aging populations.

- Methocarbamol’s revenue stream benefits from the proliferation of generics, especially in emerging markets, albeit with declining prices.

- Competitive pressures necessitate ongoing differentiation through formulation innovations or strategic market entry.

- Regulatory standards and prescription trends will significantly influence future market share and profitability.

- A strategic focus on emerging markets and improving supply chain efficiencies can bolster financial trajectories in a competitive environment.

FAQs

1. How does the competitive landscape affect the profitability of methocarbamol?

The abundance of generic equivalents suppresses prices, leading to narrower profit margins. Successful manufacturers differentiate through quality assurance, supply chain optimization, and strategic market expansion.

2. What are the primary regulatory challenges facing methocarbamol manufacturers?

Ensuring compliance with stringent quality standards across jurisdictions and obtaining approvals in new markets pose significant hurdles, especially amid increasing regulatory scrutiny on generics.

3. Can new formulation developments impact methocarbamol’s market share?

Yes. Innovations such as extended-release versions or combination therapies can command premium pricing, extend product lifecycle, and capture new patient segments.

4. What is the role of emerging markets in the financial trajectory of methocarbamol?

Emerging markets present growth opportunities due to expanding healthcare infrastructure, increasing prevalence of musculoskeletal conditions, and cost-sensitive purchasing behaviors.

5. How might changing clinical guidelines influence the demand for methocarbamol?

A shift towards non-pharmacologic therapies or updated prescribing preferences could reduce demand. Conversely, positive clinical evidence and guideline endorsements can sustain or boost usage.

References

[1] Recent review of muscle relaxants and their clinical efficacy.

[2] Global Burden of Disease Study, 2022.

[3] United Nations Department of Economic and Social Affairs, 2020.

[4] Market Research Future, 2022 report on muscle relaxants market.