Last updated: July 27, 2025

Introduction

Methocarbamol, a centrally acting muscle relaxant, plays a significant role in managing musculoskeletal conditions such as muscle spasms, strains, and sprains. Although not a front-line medication, its widespread off-label use and established safety profile ensure its consistent demand within the pharmaceutical market. This analysis delivers an in-depth overview of the current market landscape and projects future pricing trends, guiding stakeholders through evolving dynamics influencing Methocarbamol's positioning.

Market Overview

Current Market Size

The global muscle relaxant market, valued at approximately USD 3.0 billion in 2022, includes medications like methocarbamol, cyclobenzaprine, methadone, and tizanidine [1]. Methocarbamol’s share, estimated at 4-5% of this market, signifies a value of roughly USD 120-150 million, dominated by North American and European markets. The increasing incidence of musculoskeletal disorders, coupled with rising awareness and off-label applications, sustains demand.

Market Drivers

- Prevalence of Musculoskeletal Disorders: According to WHO, musculoskeletal conditions are the leading cause of disability globally, influencing drug utilization patterns [2].

- Off-Label Uses: Enhancement of application scope for non-specific muscle pain accelerates volume sales.

- Aging Population: Older demographics are particularly susceptible to muscle-related ailments, intensifying demand.

- Generic Availability: The expiration of patent protections for many formulations has led to widespread generic dispensing, stabilizing prices but constraining revenue growth.

Market Constraints

- Limited Innovation: The absence of new formulations curtails growth; the industry relies predominantly on generics.

- Regulatory Challenges: Variability across markets affects exportability and price standards.

- Market Saturation: High competition among generics drives prices downward, especially in mature markets.

Competitive Landscape

Major players include:

- Hikma Pharmaceuticals

- Macleods Pharmaceuticals

- Amneal Pharmaceuticals

- Generic manufacturers in India and China

These companies mainly emphasize cost competitiveness, which impacts pricing strategies and margin pressures. Brand-name versions are limited due to patent expiries, with the market predominantly bifurcated along generic and over-the-counter (OTC) segments.

Regulatory and Reimbursement Environment

Reimbursement policies in key markets influence pricing. In the United States, methocarbamol is available via Medicaid and private insurers, affecting net achievable prices. Variability exists in European markets due to different national formularies and approval processes. Regulators continue emphasizing stringent quality standards, affecting drug costs and supply stability.

Price Trends and Projections

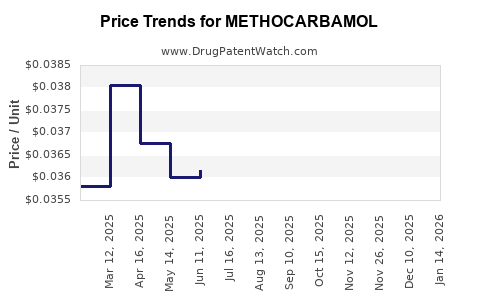

Historical Pricing

Pricing for methocarbamol has decreased over the past decade, driven by generic competition. A typical 500 mg tablet, previously priced around USD 0.50 per tablet, now averages USD 0.10-0.20 per tablet in the US and Europe [3].

Current Price Dynamics

- Generics dominate, with prices stabilizing at a low level.

- Price erosion risks remain due to market saturation.

- Bulk purchasing by healthcare providers and insurance schemes may further depress unit costs.

Forecasts for the Next 5 Years

Based on current trends and industry analyses:

| Year |

Estimated Price per Tablet (USD) |

Factors Influencing Prices |

| 2023 |

USD 0.10 – 0.20 |

Continued generic competition, patent expirations |

| 2025 |

USD 0.10 – 0.18 |

Marginal reductions; supply chain stability |

| 2027 |

USD 0.08 – 0.15 |

Market maturation, potential entry of biosimilars/regulators |

| 2030 |

USD 0.07 – 0.13 |

Potential flattening or slight decrease |

This projection assumes minimal innovation and stable regulatory landscapes.

Emerging Trends and Future Opportunities

- Formulation Innovation: Developing unique delivery systems (e.g., extended-release formulations) could mitigate price erosion.

- Regional Expansion: Untapped markets, particularly in Asia and South America, may offer volume growth with variable pricing.

- Regulatory Movements: Stringent control over compounding and importation may influence prices, either upward via supply chain resilience or downward through market access limitations.

Conclusion

Methocarbol’s market is characterized by mature, highly competitive dynamics with limited scope for substantial price hikes due to widespread generics and saturation. Moving forward, minor price declines are anticipated, attributable to continued competition and supply chain efficiencies. Nonetheless, strategic differentiation through innovation and regional expansion could offer incremental growth opportunities.

Key Takeaways

- The global methocarbamol market remains stable but mature, with prices trending downward due to intense generic competition.

- Pricing per tablet is forecasted to decline modestly over the next five years, stabilizing around USD 0.07 to 0.15.

- Market growth is primarily driven by increasing musculoskeletal disorder prevalence and aging populations.

- Innovation in formulations and expansion into emerging markets may provide pathways to future revenue stabilization.

- Regulatory environments and reimbursement policies will continue to influence pricing strategies, especially in Europe and North America.

FAQs

-

What factors most significantly influence methocarbamol’s market price?

Competition among generic manufacturers, patent expirations, regulatory standards, and reimbursement environments are primary drivers.

-

Are there any recent innovations in methocarbamol formulations?

Currently, no notable innovations; the market remains dominated by existing immediate-release tablets.

-

How does regional regulation impact methocarbamol pricing?

Stringent approval processes and patent laws in different jurisdictions cause regional price variations and influence market entry strategies.

-

What is the potential for methocarbamol in emerging markets?

Rising healthcare infrastructure and prevalence of musculoskeletal disorders present growth opportunities; however, pricing remains competitive.

-

Could new therapeutic alternatives cannibalize methocarbamol sales?

Alternatives such as tizanidine and baclofen might impact demand, especially if priced competitively or with superior efficacy.

References

[1] Grand View Research. "Muscle Relaxants Market Size, Share & Trends Analysis Report." 2022.

[2] WHO. "Musculoskeletal Conditions." World Health Organization, 2021.

[3] IQVIA. "Global Generic Drug Market Report," 2022.