LATANOPROST - Generic Drug Details

✉ Email this page to a colleague

What are the generic drug sources for latanoprost and what is the scope of freedom to operate?

Latanoprost

is the generic ingredient in seven branded drugs marketed by Sun Pharm, Thea Pharma, Amring Pharms, Apotex Inc, Bausch And Lomb, Epic Pharma Llc, Eugia Pharma, Fdc Ltd, Gland, Micro Labs, Pharmobedient, Sandoz, Somerset, Upjohn, and Alcon Labs Inc, and is included in seventeen NDAs. There are twenty-four patents protecting this compound. Additional information is available in the individual branded drug profile pages.Latanoprost has fifty-three patent family members in thirty-one countries.

There are twenty drug master file entries for latanoprost. Fifteen suppliers are listed for this compound. There is one tentative approval for this compound.

Summary for LATANOPROST

| International Patents: | 53 |

| US Patents: | 24 |

| Tradenames: | 7 |

| Applicants: | 15 |

| NDAs: | 17 |

| Drug Master File Entries: | 20 |

| Finished Product Suppliers / Packagers: | 15 |

| Raw Ingredient (Bulk) Api Vendors: | 77 |

| Clinical Trials: | 204 |

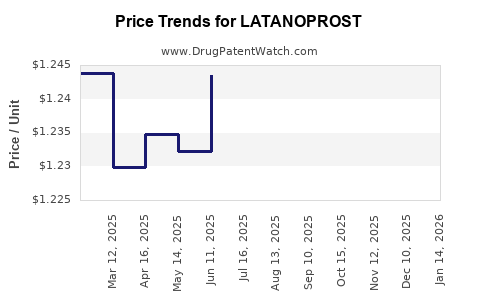

| Drug Prices: | Drug price trends for LATANOPROST |

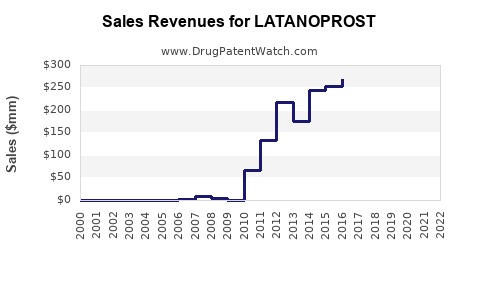

| Drug Sales Revenues: | Drug sales revenues for LATANOPROST |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for LATANOPROST |

| What excipients (inactive ingredients) are in LATANOPROST? | LATANOPROST excipients list |

| DailyMed Link: | LATANOPROST at DailyMed |

Recent Clinical Trials for LATANOPROST

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Insight Eyecare Specialties, Inc. dba Vision Source Eyecare, | PHASE4 |

| Universitas Padjadjaran | PHASE2 |

| IUVO S.r.l. | PHASE2 |

Generic filers with tentative approvals for LATANOPROST

| Applicant | Application No. | Strength | Dosage Form |

| ⤷ Get Started Free | ⤷ Get Started Free | 0.005% | SOLUTION; OPHTHALMIC |

The 'tentative' approval signifies that the product meets all FDA standards for marketing, and, but for the patents / regulatory protections, it would approved.

Anatomical Therapeutic Chemical (ATC) Classes for LATANOPROST

US Patents and Regulatory Information for LATANOPROST

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sandoz | LATANOPROST | latanoprost | SOLUTION/DROPS;OPHTHALMIC | 091449-001 | Mar 22, 2011 | AT | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Upjohn | XALATAN | latanoprost | SOLUTION/DROPS;OPHTHALMIC | 020597-001 | Jun 5, 1996 | AT | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Alcon Labs Inc | ROCKLATAN | latanoprost; netarsudil dimesylate | SOLUTION/DROPS;OPHTHALMIC | 208259-001 | Mar 12, 2019 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Micro Labs | LATANOPROST | latanoprost | SOLUTION/DROPS;OPHTHALMIC | 219306-001 | Apr 14, 2025 | AT | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Alcon Labs Inc | ROCKLATAN | latanoprost; netarsudil dimesylate | SOLUTION/DROPS;OPHTHALMIC | 208259-001 | Mar 12, 2019 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Eugia Pharma | LATANOPROST | latanoprost | SOLUTION/DROPS;OPHTHALMIC | 206519-001 | Sep 3, 2019 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Sun Pharm | XELPROS | latanoprost | EMULSION;OPHTHALMIC | 206185-001 | Sep 12, 2018 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for LATANOPROST

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Upjohn | XALATAN | latanoprost | SOLUTION/DROPS;OPHTHALMIC | 020597-001 | Jun 5, 1996 | ⤷ Get Started Free | ⤷ Get Started Free |

| Upjohn | XALATAN | latanoprost | SOLUTION/DROPS;OPHTHALMIC | 020597-001 | Jun 5, 1996 | ⤷ Get Started Free | ⤷ Get Started Free |

| Upjohn | XALATAN | latanoprost | SOLUTION/DROPS;OPHTHALMIC | 020597-001 | Jun 5, 1996 | ⤷ Get Started Free | ⤷ Get Started Free |

| Upjohn | XALATAN | latanoprost | SOLUTION/DROPS;OPHTHALMIC | 020597-001 | Jun 5, 1996 | ⤷ Get Started Free | ⤷ Get Started Free |

| Upjohn | XALATAN | latanoprost | SOLUTION/DROPS;OPHTHALMIC | 020597-001 | Jun 5, 1996 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for LATANOPROST

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Ukraine | 100393 | НОВЫЕ ОФТАЛЬМОЛОГИЧЕСКИЕ КОМПОЗИЦИИ;НОВІ ОФТАЛЬМОЛОГІЧНІ КОМПОЗИЦІЇ (NOVEL OPHTHALMIC COMPOITIONS) | ⤷ Get Started Free |

| Mexico | 2010004211 | COMPOSICION OFTALMICA QUE COMPRENDE UNA PROSTAGLANDINA. (OPHTHALMIC COMPOSITION COMPRISING A PROSTAGLANDIN.) | ⤷ Get Started Free |

| Cyprus | 1115396 | ⤷ Get Started Free | |

| Japan | 5646331 | ⤷ Get Started Free | |

| Eurasian Patent Organization | 025026 | ⤷ Get Started Free | |

| Croatia | P20140631 | ⤷ Get Started Free | |

| Eurasian Patent Organization | 201070483 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for LATANOPROST

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 3461484 | SPC/GB21/033 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: A COMBINATION OF LATANOPROST AND NETARSUDIL; REGISTERED: UK EU/1/20/1502(FOR NI) 20210107; UK PLGB 16053/0034 20210107 |

| 3461484 | C202130024 | Spain | ⤷ Get Started Free | PRODUCT NAME: NETARSUDIL O UN ENANTIOMERO, DIASTEREIOISOMERO, SAL O SALVADO DEL MISMO EN COMBINACION CON LATANOPROST O UNA SAL DEL MISMO; NATIONAL AUTHORISATION NUMBER: EU/1/20/1502; DATE OF AUTHORISATION: 20210107; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/20/1502; DATE OF FIRST AUTHORISATION IN EEA: 20210107 |

| 3461484 | 2021C/515 | Belgium | ⤷ Get Started Free | PRODUCT NAME: ROCLANDA - LATANOPROST / NETARSUDIL; AUTHORISATION NUMBER AND DATE: EU/1/20/1502 20210108 |

| 0364417 | SPC/GB97/014 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: LATANOPROST (I.E. 13,14-DIHYDRO-17-PHENYL-18,19,20-TRINOR-PGF-ALPHA-ISOPROPYLESTER); NAT. REGISTRATION NO/DATE: 00032/0220 19961216; FIRST REGISTRATION: SE 12716 19960718; SPC EXTENSION AUTHORISATION: PL00057/1057-008 20101216 |

| 3461484 | 122021000036 | Germany | ⤷ Get Started Free | PRODUCT NAME: LATANOPROST, ODER EIN PHARMAZEUTISCH ANNEHMBARES SALZ DAVON, UND NETARSUDIL MESYLAT; REGISTRATION NO/DATE: EU/1/20/1502 20210107 |

| 3461484 | 301101 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: LATANOPROST OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN EN NETARSUDILMESYLAAT; REGISTRATION NO/DATE: EU/1/20/1502 20210108 |

| 0364417 | 9690031-1 | Sweden | ⤷ Get Started Free | PRODUCT NAME: LATANOPROST |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Latanoprost

More… ↓