GLYCOPYRROLATE - Generic Drug Details

✉ Email this page to a colleague

What are the generic sources for glycopyrrolate and what is the scope of freedom to operate?

Glycopyrrolate

is the generic ingredient in ten branded drugs marketed by Abraxis Pharm, Accord Hlthcare, Alembic, Am Regent, Amneal, Apotex, Caplin, Eugia Pharma, Fresenius Kabi Usa, Gland, Hikma Farmaceutica, Hospira, Lupin Ltd, Mankind Pharma, Meitheal, Omnivium Pharms, Piramal Critical, Prinston Inc, Sagent, Sandoz, Somerset Theraps Llc, Teva Parenteral, Umedica, Watson Labs, Xiromed, Zydus Pharms, Hikma, Robins Ah, Novartis, Sumitomo Pharma Am, Exela Pharma, Merz Pharms, Ajenat Pharms, Annora Pharma, Aurobindo Pharma Ltd, Chartwell Rx, Granules, MSN, Ph Health, Sciegen Pharms Inc, Suven Pharms, Edenbridge Pharms, Appco, Aurobindo Pharma, Hikma Intl Pharms, Lgm Pharma, Natco, Oxford Pharms, Quagen, Regcon Holdings, Rising, Sun Pharm Inds Ltd, Velzen Pharma Pvt, Casper Pharma Llc, and Azurity, and is included in sixty-eight NDAs. There are eighteen patents protecting this compound and four Paragraph IV challenges. Additional information is available in the individual branded drug profile pages.Glycopyrrolate has one hundred and seventy-two patent family members in thirty-two countries.

There are seventeen drug master file entries for glycopyrrolate. Sixty-one suppliers are listed for this compound.

Summary for GLYCOPYRROLATE

| International Patents: | 172 |

| US Patents: | 18 |

| Tradenames: | 10 |

| Applicants: | 55 |

| NDAs: | 68 |

| Drug Master File Entries: | 17 |

| Finished Product Suppliers / Packagers: | 61 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 175 |

| Patent Applications: | 7,655 |

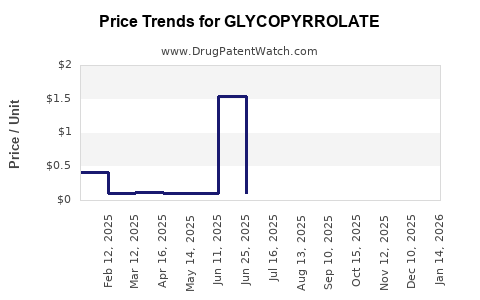

| Drug Prices: | Drug price trends for GLYCOPYRROLATE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for GLYCOPYRROLATE |

| What excipients (inactive ingredients) are in GLYCOPYRROLATE? | GLYCOPYRROLATE excipients list |

| DailyMed Link: | GLYCOPYRROLATE at DailyMed |

Recent Clinical Trials for GLYCOPYRROLATE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Alabama at Birmingham | PHASE2 |

| PAEC General Hospital, Islamabad | PHASE2 |

| Mount Sinai Hospital, Canada | PHASE2 |

Pharmacology for GLYCOPYRROLATE

| Drug Class | Anticholinergic Cholinergic Muscarinic Antagonist |

| Mechanism of Action | Cholinergic Antagonists Cholinergic Muscarinic Antagonists |

Medical Subject Heading (MeSH) Categories for GLYCOPYRROLATE

Paragraph IV (Patent) Challenges for GLYCOPYRROLATE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| CUVPOSA | Oral Solution | glycopyrrolate | 1 mg/5 mL | 022571 | 1 | 2012-06-20 |

| ROBINUL FORTE | Tablets | glycopyrrolate | 2 mg | 012827 | 1 | 2010-10-12 |

| ROBINUL FORTE | Tablets | glycopyrrolate | 1 mg | 012827 | 1 | 2009-08-14 |

US Patents and Regulatory Information for GLYCOPYRROLATE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Azurity | PREVDUO | glycopyrrolate; neostigmine methylsulfate | SOLUTION;INTRAVENOUS | 216903-001 | Feb 23, 2023 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Watson Labs | GLYCOPYRROLATE | glycopyrrolate | TABLET;ORAL | 086178-001 | Approved Prior to Jan 1, 1982 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Watson Labs | GLYCOPYRROLATE | glycopyrrolate | TABLET;ORAL | 086902-001 | Approved Prior to Jan 1, 1982 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Chartwell Rx | GLYCOPYRROLATE | glycopyrrolate | SOLUTION;ORAL | 216368-001 | Aug 28, 2024 | AA | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for GLYCOPYRROLATE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Novartis | SEEBRI NEOHALER | glycopyrrolate | POWDER;INHALATION | 207923-001 | Oct 29, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| Sumitomo Pharma Am | LONHALA MAGNAIR KIT | glycopyrrolate | SOLUTION;INHALATION | 208437-001 | Dec 5, 2017 | ⤷ Get Started Free | ⤷ Get Started Free |

| Novartis | SEEBRI NEOHALER | glycopyrrolate | POWDER;INHALATION | 207923-001 | Oct 29, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| Novartis | SEEBRI NEOHALER | glycopyrrolate | POWDER;INHALATION | 207923-001 | Oct 29, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for GLYCOPYRROLATE

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Taiwan | 200613021 | Organic compounds | ⤷ Get Started Free |

| Ecuador | SP066987 | DISPOSITIVO INHALADOR | ⤷ Get Started Free |

| Denmark | 1663155 | ⤷ Get Started Free | |

| European Patent Office | 3375474 | DISPOSITIF DE THÉRAPIE PAR INHALATION POURVU D'UNE AMPOULE DESTINÉE A CONTENIR UN MÉDICAMENT À NÉBULISER (INHALATION THERAPY DEVICE COMPRISING AN AMPOULE FOR HOLDING A DRUG TO BE ATOMIZED) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for GLYCOPYRROLATE

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2435024 | SPC/GB21/029 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: A COMBINATION OF FORMOTEROL, INCLUDING PHARMACEUTICALLY ACCEPTABLE SALTS, ESTERS AND SOLVATES THEREOF, GLYCOPYRROLATE, INCLUDING PHARMACEUTICALLY ACCEPTABLE SALTS, ESTERS AND SOLVATES THEREOF, AND BUDESONIDE INCLUDING PHARMACEUTICALLY ACCEPTABLE SALTS, ES; REGISTERED: UK EU/1/20/1498 (NI) 20201210; UK PLGB 17901/0352-001 20201210 |

| 2435025 | 2019C/532 | Belgium | ⤷ Get Started Free | PRODUCT NAME: UNE COMBINAISON DE GLYCOPYRROLATE (INCLUANT LES SELS ACCEPTABLES PHARMACEUTIQUEMENT, LES ESTERS, LES ENANTIOMERES OU LES AUTRES DERIVES DE CECI) ET DE FORMOTEROL (INCLUANT LES SELS ACCEPTABLES PHARMACEUTIQUEMENT, LES ESTERS, LES ENANTIOMERES OU LES AUTRES DERIVES DE CECI); AUTHORISATION NUMBER AND DATE: EU/1/18/1339 20181220 |

| 2435024 | 21C1020 | France | ⤷ Get Started Free | PRODUCT NAME: COMBINAISON DE FORMOTEROL (Y COMPRIS LES SELS, ESTERS, SOLVATES OU ENANTIOMERES PHARMACEUTIQUEMENT ACCEPTABLES DE CELUI-CI), GLYCOPYRROLATE (Y COMPRIS LES SELS, ESTERS, SOLVATES OU ENANTIOMERES PHARMACEUTIQUEMENT ACCEPTABLES DE CELUI-CI) ET BUDESONIDE (Y COMPRIS LES SELS, ESTERS, SOLVATES OU ENANTIOMERES PHARMACEUTIQUEMENT ACCEPTABLES DE CELUI-CI); REGISTRATION NO/DATE: EU/1/20/1498 20201210 |

| 2435025 | 1990034-9 | Sweden | ⤷ Get Started Free | PRODUCT NAME: A COMBINATION OF GLYCOPYRROLATE, INCLUDING PHARMACEUTICALLY ACCEPTABLE SALT OR ESTERS THEREOF AND FORMOTEROL, INCLUDING PHARMACEUTICALLY ACCEPTABLE SALTS OR ESTERS THEREOF.; REG. NO/DATE: EU/1/18/1339 20181220 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Glycopyrrolate

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.