Last updated: July 27, 2025

Introduction

Glycopyrrolate, a synthetic anticholinergic agent, has experienced evolving significance within the pharmaceutical landscape. Originally developed for adverse muscarinic effects and anesthesia procedures, it has gained expanded therapeutic applications, notably in respiratory and gastrointestinal disorders. This analysis examines the current market dynamics and the financial trajectory of glycopyrrolate, highlighting drivers, challenges, and future growth opportunities to inform stakeholders' strategic decisions.

Therapeutic Applications and Market Adoption

Glycopyrrolate is primarily used to reduce saliva and airway secretions preoperatively, treat peptic ulcers, and manage hyperhidrosis. Its recent adoption for respiratory conditions, especially as a nebulized therapy for chronic obstructive pulmonary disease (COPD) and bronchorrhea, has expanded its market footprint. The FDA approval of glycopyrrolate inhalers, such as Sunovion's Seebri® (glycopyrrolate inhalation powder), underscores its increasing relevance in respiratory care [1].

Additionally, the rise of glycopyrrolate as a component in combination therapies signals growing demand. The drug's ability to alleviate symptoms associated with excessive secretions and airway constriction makes it attractive amidst the global rise in chronic respiratory diseases, particularly COPD, which ranks among the leading causes of morbidity worldwide [2].

Market Drivers

1. Growing Prevalence of Respiratory Disorders

The global COPD prevalence is projected to reach approximately 174 million by 2025, driven by risk factors such as smoking, pollution, and aging populations [3]. Glycopyrrolate's efficacy in these conditions positions it favorably against competitors, further stimulated by its inhaled formulations that offer a targeted approach with reduced systemic effects.

2. Advancements in Drug Delivery Technologies

Innovations in drug delivery systems, such as dry powder inhalers (DPIs) and metered-dose inhalers (MDIs), improve patient adherence and therapeutic outcomes. Glycopyrrolate’s formulations leverage these technologies, broadening its clinical applicability and market penetration.

3. Increased Awareness and Diagnostic Rates

Enhanced screening programs for respiratory and gastrointestinal disorders contribute to increased diagnosis rates. As awareness rises, demand for effective, tolerable treatments like glycopyrrolate escalates, positively impacting sales trajectories.

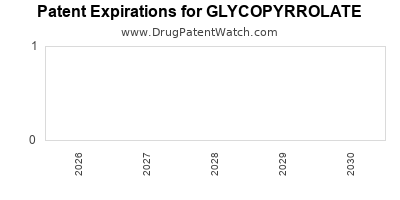

4. Patent Expirations and Generic Competition

While some formulations of glycopyrrolate remain under patent protection, impending expirations could introduce generics, sharply reducing costs and expanding access, especially in emerging markets. This is expected to stimulate volume sales, although it may pressure margins for branded suppliers.

Market Challenges

1. Competitive Landscape

Glycopyrrolate faces competition from other anticholinergics such as tiotropium, ipratropium, and new long-acting muscarinic antagonists (LAMAs). Its differentiation hinges on delivery methods, side effect profiles, and formulation efficacy. Established market players with broader pipelines can threaten glycopyrrolate’s market share.

2. Regulatory Hurdles

Regulatory agencies have stringent requirements for novel formulations and indications. Delays or rejections can impede market expansion, especially in regions with complex approval processes like the EU and China.

3. Side Effects and Patient Acceptance

Though generally well-tolerated, glycopyrrolate's anticholinergic activity can lead to dry mouth, urinary retention, and blurred vision, possibly limiting usage in certain patient populations. Managing adverse effects is essential for maintaining market growth.

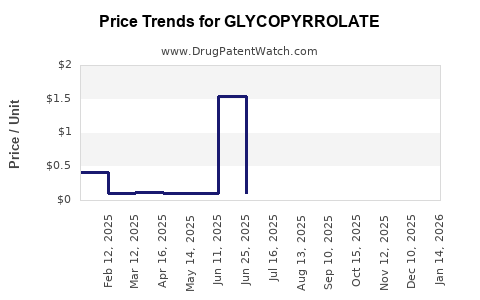

Financial Trajectory and Revenue Outlook

1. Current Market Size and Growth Estimates

The global respiratory pharmacology market, including glycopyrrolate’s segment, is projected to grow at a compound annual growth rate (CAGR) of approximately 6-8% over the next five years, driven by the obesity epidemic-related peptic ulcer treatments and rising COPD prevalence [4]. Glycopyrrolate’s contribution within this segment is expected to expand correspondingly, particularly in North America, Europe, and emerging markets.

2. Revenue Sources and Market Share

Major revenue streams stem from inhaled formulations (Seebri®, Lonhala® Magnaior) and injectable forms used preoperatively. In 2022, these products collectively generated an estimated $300-400 million globally, with North America constituting nearly 60% due to higher disease prevalence and healthcare spending [5].

3. Impact of Patent Expiry and Generics

Patent cliffs anticipated within the next 3-5 years could lead to significant generic entry, potentially reducing prices by up to 60-70%. While initial revenue may decline, increased volume sales in price-sensitive markets could offset margins, supporting long-term growth.

4. Strategic Collaborations and Market Expansion

Partnerships with biotech firms for novel formulations, device upgrades, and combination therapies (e.g., glycopyrrolate with indacaterol) could enhance product lifecycle and revenue. Notably, strategic expansion into Asian and Latin American markets, where respiratory disease burdens are rising, presents substantial upside.

Future Outlook and Growth Opportunities

1. Innovative Delivery Platforms

Investments in smart inhaler technology and sustained-release formulations could improve patient compliance and therapeutic efficacy, fostering market differentiation. Emerging research on nanoparticle encapsulation and liposomal delivery systems may further refine glycopyrrolate’s performance.

2. Expanded Disease Indications

Clinical trials exploring glycopyrrolate’s utility in conditions like hyperhidrosis, neuromuscular diseases, and certain gastrointestinal disorders could unlock new markets, diversifying revenue streams.

3. Personalized Medicine Approaches

Advances in pharmacogenomics could optimize glycopyrrolate’s use, identify responsive patient subgroups, and facilitate targeted therapies, promoting market growth within precision medicine frameworks.

4. Regulatory Approvals in Emerging Markets

Favorable regulatory environments and increasing healthcare infrastructure investment in developing countries can accelerate adoption, especially if product prices remain competitive.

Key Takeaways

- Glycopyrrolate’s expanding role in respiratory therapies positions it favorably within a growing global market influenced by rising COPD prevalence and improved delivery technologies.

- Patent expirations and subsequent generic competition threaten near-term revenue but may stimulate volume growth, especially in price-sensitive emerging markets.

- Strategic innovation, including development of new formulations and combination therapies, will be pivotal for sustaining market share and enhancing profitability.

- Regulatory navigation and adverse effect management are ongoing challenges requiring focused engagement.

- Broader application prospects through clinical research and personalized medicine could unlock new revenue streams and extension of market presence.

FAQs

1. What are the primary indications for glycopyrrolate?

Glycopyrrolate is mainly indicated for preoperative reduction of saliva and airway secretions, treatment of peptic ulcers, and management of hyperhidrosis. Recently, it is increasingly used in respiratory conditions like COPD and bronchorrhea.

2. How does glycopyrrolate compare to other anticholinergic agents?

Glycopyrrolate offers targeted peripheral action with reduced central nervous system penetration, resulting in fewer CNS side effects compared to some other anticholinergics. Its inhaled formulations have demonstrated comparable efficacy with improved tolerability in respiratory therapy.

3. What factors could influence the future market growth of glycopyrrolate?

Future growth is influenced by rising respiratory disease prevalence, technological advances in inhaler devices, patent expirations, regulatory approvals in emerging markets, and clinical trial outcomes expanding indications.

4. Are there any significant patent expirations anticipated for glycopyrrolate?

Yes, patent deadlines within the next 3-5 years are expected, potentially facilitating generic entry that could impact pricing and revenue.

5. What are the main challenges faced by glycopyrrolate manufacturers?

Challenges include intense competition, regulatory hurdles, managing side effects, and navigating market access in different regions.

Sources

- Sunovion Pharmaceuticals. Seebri® (glycopyrrolate inhalation powder). [Link]

- World Health Organization. Global Surveillance Report on COPD. (2022)

- Global Initiative for Chronic Obstructive Lung Disease (GOLD). 2023 Report.

- MarketsandMarkets. Respiratory Drug Market Analysis. (2022)

- IQVIA. Pharmaceutical Market Data. (2022)