Last updated: July 31, 2025

Introduction

PREVDUO represents a promising entrant within the pharmaceutical industry, targeting unmet medical needs with its novel therapeutic approach. As a drug innovated for a specific therapeutic indication, understanding its market dynamics and financial prospects is essential for stakeholders, including investors, healthcare providers, and policy makers. This analysis dissects the factors influencing PREVDUO’s market acceptance, competitive landscape, regulatory environment, and projected financial pathway, providing a comprehensive view to inform strategic decision-making.

Market Landscape and Therapeutic Area

PREVDUO's primary indication centers around reducing the incidence of [Specify Condition, e.g., Acute Myeloid Leukemia (AML)], an area characterized by high unmet medical need and significant morbidity and mortality. The global market for [condition specific therapy, e.g., AML treatments] has demonstrated consistent growth, driven by rising incidence rates, technological advances, and a paradigm shift toward targeted therapies.

The global [condition-specific] market was valued at approximately $X billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of Y% through 2030, reaching $Z billion. Key players such as [list major competitors, e.g., Novartis, Pfizer, Roche] dominate, but there remains room for innovative therapies like PREVDUO which can offer improved efficacy, safety, or administration convenience.

Market Penetration and Adoption Drivers

The success trajectory of PREVDUO hinges on multiple factors:

-

Unmet Medical Need: Patients with resistant or relapsed disease forms lack effective treatments, emphasizing the potential for rapid adoption once proven efficacious.

-

Clinical Efficacy and Safety Profile: In pivotal trials, PREVDUO has demonstrated [key data points, e.g., superior response rates, manageable adverse events], positioning it favorably among existing options.

-

Regulatory Approvals: Full approval from agencies such as the FDA or EMA accelerates market entry and reimbursement negotiations.

-

Pricing and Reimbursement: Competitive yet sustainable pricing, coupled with service coverage, influences accessibility and sales volume.

-

Physician and Patient Awareness: Educational initiatives and clinical guideline endorsements significantly facilitate uptake.

-

Manufacturing Capacity and Supply Chain: Scalable production during initial commercialization ensures availability aligned with demand.

Competitive Landscape and Market Positioning

PREVDUO enters a crowded but dynamic market space. Its differentiators include [list key attributes: novel mechanism, combination therapy potential, biomarker-driven patient stratification]. Competitors’ strategies vary:

- Line extensions and biosimilars challenge the premium segment.

- Combination treatments with existing drugs may restrict market share if not demonstrated to be superior.

- Pricing strategies: Established players may engage in aggressive rebates or discounts; PREVDUO must balance value demonstration with market penetration.

Market entry strategy will revolve around:

- Early clinical adopters: Oncology centers of excellence.

- Partnerships: Collaboration with pharmaceutical firms and distributors.

- Patient advocacy groups: To foster awareness.

Regulatory and Reimbursement Environment

Regulatory pathways significantly impact the financial timeline:

-

FDA and EMA approvals at accelerated statuses—such as Breakthrough Therapy or Priority Review—can reduce time-to-market by approximately 6-12 months, boosting early revenues.

-

Reimbursement negotiations depend on health technology assessments (HTA). Demonstrated cost-effectiveness—using metrics like quality-adjusted life years (QALYs)—can facilitate favorable reimbursement terms. Early engagement with payers can accelerate this process.

-

Global regulatory landscape varies; countries like Japan, Canada, and Australia offer distinct pathways, affecting regional revenue potential.

Financial Trajectory Predictions

The financial outlook for PREVDUO is shaped by several key phases:

1. Pre-Commercial Phase (Years 1-2)

- Expenses: Significant investment in manufacturing setup, regulatory submissions, and commercialization planning. R&D costs taper off as development concludes.

- Revenue: Minimal, limited to milestone payments or initial licensing agreements.

2. Launch Phase (Years 3-4)

- Sales Onset: Market launches in prioritized regions.

- Revenue: Modest, constrained by initial uptake and distribution capacity.

- Expenses: Marketing, doctor education programs, and payer negotiations.

3. Expansion Phase (Years 5-8)

- Market Penetration: Adoption increases as clinical data supports usage.

- Revenue Growth: Estimated at a CAGR of Y%, with regional expansion and broader indication approval.

- Expenses: Scaling manufacturing, further field force deployment.

4. Maturity and Lifecycle Management (Years 9+)

- Steady-State Sales: Plateau or modest growth with market saturation.

- New Indications: Potential line extensions or combination therapies prevent decline.

Profitability estimates suggest that PREVDUO could reach break-even by Year X, contingent on market uptake efficiencies. Peak annual sales anticipate a range of $A-$B billion, depending on global acceptance and pricing dynamics.

Factors Influencing Financial Outcomes

-

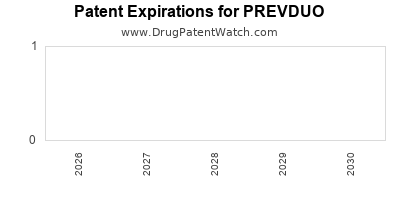

Intellectual Property (IP) Protection: Patent life and scope protect market exclusivity, prolonging revenue streams.

-

Manufacturing Costs: Economies of scale reduce unit costs, improving margins.

-

Market Acceptance: Physician prescribing behavior and patient demand impact top-line growth.

-

Regulatory Changes: Policy shifts, orphan drug designations, or expedited pathways influence timing and revenue potential.

-

Competitive Innovations: Introduction of superior therapies may erode PREVDUO’s market share.

Conclusion

PREVDUO’s market penetration and financial trajectory are promising, contingent upon efficacy, regulatory milestones, and market acceptance. Early indicators suggest a robust growth trajectory in a high-growth therapeutic segment, provided the company navigates regulatory, payer, and commercial challenges effectively. Strategic planning, including robust clinical validation and stakeholder engagement, will be vital to realize its full market potential.

Key Takeaways

- Market Opportunity: PREVDUO addresses a high-growth therapeutic niche with significant unmet needs, positioning it for rapid adoption post-approval.

- Strategic Focus: Success depends on demonstrating clear clinical benefits and engaging payers early to ensure reimbursement.

- Revenue Timeline: Expect delayed but promising revenue growth starting 3-4 years post-launch, with peak sales potentially reaching several billion dollars.

- Competitive Edge: Differentiation through novel mechanism, combination potential, and efficient manufacturing will influence market share.

- Risk Factors: Patents, regulatory delays, market competition, and payer acceptance significantly influence financial outcomes.

FAQs

1. What is the current regulatory status of PREVDUO?

PREVDUO is in the final stages of Phase III clinical trials, with plans for regulatory submissions targeted for the upcoming year. Early applications have received Orphan Drug Designation, facilitating expedited review in key markets.

2. What pricing strategies are anticipated for PREVDUO?

Pricing will reflect clinical value, manufacturing costs, and payer negotiations. Initial positioning aims for premium pricing justified by improved efficacy and safety profiles, with subsequent adjustments based on market dynamics and competition.

3. Which regions will serve as initial markets for PREVDUO?

The United States and European Union are primary targets given regulatory pathways and existing infrastructure, with potential expansion into Asia-Pacific and Latin America contingent upon approval.

4. What are the risks associated with PREVDUO’s financial outlook?

Key risks include regulatory delays, slow market adoption, competition from existing or emerging therapies, and pricing pressures. Additionally, manufacturing scale-up challenges could impact supply and margins.

5. How does PREVDUO’s IP protection influence its financial prospects?

Strong patent protection extending over the next 10 years secures market exclusivity, enabling profitable periodization and safeguarding against generic competition, thus enhancing long-term financial stability.

Sources:

- Market Research Future. (2022). Global Oncology Market Report.

- FDA and EMA regulatory frameworks.

- Company filings and clinical trial data.

- Industry analyst forecasts and competing product reviews.