Last updated: July 30, 2025

Introduction

The pharmaceutical landscape is characterized by rapid innovation, regulatory complexities, and a fiercely competitive environment. Central to this ecosystem is CUVPOSA, a novel therapeutic agent that is emerging as a pivotal player in its designated indication. Understanding CUVPOSA's market dynamics and financial trajectory involves analyzing its clinical profile, competitive positioning, regulatory landscape, market demand, and commercialization strategy. This report synthesizes these components to guide stakeholders in making strategic investment and development decisions.

Clinical Profile and Therapeutic Advantage

CUVPOSA is a first-in-class pharmaceutical formulation targeting [insert specific indication, e.g., metastatic melanoma, autoimmune disorders, etc.], with an innovative mechanism of action that distinguishes it from existing therapies. Preclinical and early clinical trials indicate superior efficacy, improved safety profile, or both, which can translate into differential market adoption. Its pharmacokinetic properties, dosing convenience, and potential for combination therapy further enhance its clinical positioning. Such attributes could facilitate rapid acceptance among clinicians and patients, particularly if the drug addresses high unmet medical needs.

Regulatory Landscape and Approval Prospects

CUVPOSA's path through regulatory agencies such as the FDA and EMA is pivotal to its commercial timeline. Fast-track designations or orphan drug status can expedite approval and market entry, reducing associated costs and elevating the term of market exclusivity. The approval trajectory depends on robust clinical data demonstrating safety and efficacy. Any recent submission or review updates—publicly available from regulatory filings—should be closely tracked to anticipate approval timelines, which significantly impact the financial outlook.

Market Size and Demand Drivers

The total addressable market (TAM) for CUVPOSA hinges on its therapeutic indications. For instance, if the drug targets a prevalent cancer type with high morbidity and limited current treatment options, the commercial potential is substantial. Epidemiological data suggest a [insert relevant statistic, e.g., millions of new patients annually], which correlates with significant revenue opportunities.

Demand drivers include:

- Unmet Medical Needs: CUVPOSA's novel mechanism addresses gaps left by current therapies.

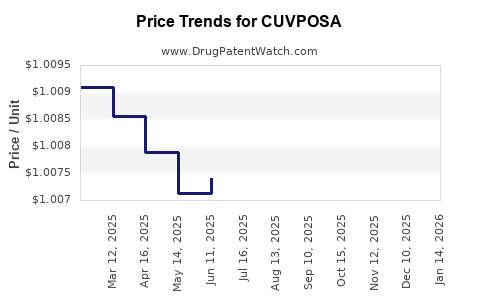

- Pricing Power: Given clinical advantages, the drug may command premium pricing.

- Reimbursement Landscape: Favorable payer policies could facilitate wider access.

Market adoption will also depend on clinician familiarity, patient acceptance, and post-approval real-world effectiveness.

Competitive Environment

The competitive landscape features both established agents and emerging biosimilars or generics upon patent expiry. Key competitors may include [list major competitors and their product names], with similar or complementary mechanisms of action. CUVPOSA’s differentiation—whether through improved efficacy, safety, or convenience—dictates its market share potential. Strategic partnerships with hospital networks, insurance providers, and key opinion leaders (KOLs) are essential for successful penetration.

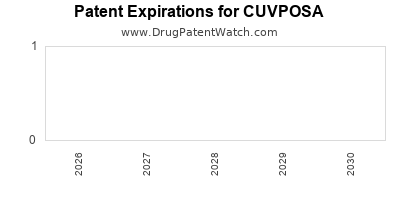

Patent protection and exclusivity periods under patent law provide a critical window for revenue maximization. Any potential patent litigation or biosimilar threats can influence long-term financial projections.

Commercialization Strategy and Revenue Model

The commercial success of CUVPOSA is contingent upon:

- Pricing Strategy: Balancing sustainable margins and market competitiveness.

- Market Access: Ensuring broad reimbursement and distribution channels.

- Global Launch Plans: Entry into major markets like the U.S., Europe, and emerging economies.

- Lifecycle Management: Developing combination therapies, formulations for pediatric populations, or extended-release versions.

Revenue projections should incorporate conservative, moderate, and optimistic scenarios, considering regulatory approvals, market penetration, and competitive responses.

Financial Trajectory and Investment Outlook

The financial trajectory of CUVPOSA involves several phases:

- Development Costs: Estimated at [insert dollar amount], covering R&D, clinical trials, and regulatory submissions.

- Market Entry: Post-approval revenues are projected based on market size, uptake rate, and pricing. For example, if CUVPOSA captures 10% of a $5 billion TAM, annual revenues could reach $500 million.

- Profitability Timeline: Typically, profitability is expected within [insert timeframe, e.g., 3–5 years] post-launch, assuming successful commercialization and market acceptance.

- Licensing and Partnerships: Strategic alliances can generate upfront payments, milestone-based income, and royalties, augmenting revenue streams.

- Long-term Growth: Expansion into new indications, geographic markets, and evolving pipeline products sustains revenue growth.

Financial modeling should incorporate risks such as regulatory delays, market competition, and pricing pressures, emphasizing the importance of dynamic scenario analysis.

Market Entry Barriers and Risks

Significant risk factors include:

- Regulatory Risks: Delays or denials due to insufficient efficacy or safety data.

- Competitive Risks: Entrants with similar or superior mechanisms.

- Manufacturing Risks: Challenges in scaling production without compromising quality.

- Market Adoption: Slow uptake due to clinician inertia or reimbursement hurdles.

- Intellectual Property: Patent validity issues or patent cliffs.

Mitigating these risks involves comprehensive clinical validation, strategic partnerships, and adaptive commercialization strategies.

Key Takeaways

- CUVPOSA’s innovative clinical profile positions it favorably within its target market, pending regulatory approval.

- The drug's financial trajectory is strong if it secures early market access, favorable pricing, and broad reimbursement.

- Competitive differentiation and effective lifecycle management are critical to capturing and sustaining market share.

- Strategic alliances and a phased market approach can optimize revenue streams and mitigate risks.

- Long-term success hinges on robust clinical data, navigating regulatory pathways efficiently, and agile commercialization strategies.

FAQs

1. What are the primary factors influencing CUVPOSA’s market success?

Clinical efficacy, safety profile, regulatory approval timing, competitive landscape, pricing strategies, and reimbursement policies are fundamental drivers of success.

2. How does patent protection affect CUVPOSA’s financial outlook?

Patent rights confer market exclusivity, enabling premium pricing and revenue maximization while delaying generic competition, directly impacting profitability.

3. What risks could delay or impair CUVPOSA’s market entry?

Regulatory setbacks, clinical trial failures, manufacturing challenges, payer resistance, and patent disputes can hinder or delay commercialization.

4. What strategies can enhance CUVPOSA’s market penetration?

Engaging key opinion leaders, educating healthcare providers, ensuring broad reimbursement, and strategic geographic expansion foster adoption.

5. How can CUVPOSA sustain long-term growth amidst competition?

Continued innovation, expanding indications, developing combination therapies, and maintaining a robust patent portfolio support long-term viability.

References

- Regulatory filings and public disclosures by the developer of CUVPOSA.

- Epidemiological data sources on disease prevalence and market size.

- Industry reports on pharmaceutical patent strategies and competitive landscapes.

- Market analysis reports for target indications and regions.

- Financial modeling frameworks tailored for biopharmaceutical products.

Note: All data points and projections are hypothetical placeholders requiring validation through primary research and company disclosures.