Last updated: September 24, 2025

Introduction

Fluticasone Propionate, a potent synthetic corticosteroid, is primarily utilized for managing allergic rhinitis, asthma, and other respiratory conditions. Since its approval, it has become a cornerstone in inhaled corticosteroid therapy, owing to its high efficacy and favorable safety profile. Analyzing its market dynamics and financial trajectory offers insights into future growth potential, competitive positioning, and investment opportunities within the pharmaceutical landscape.

Regulatory Landscape and Patent Expiry

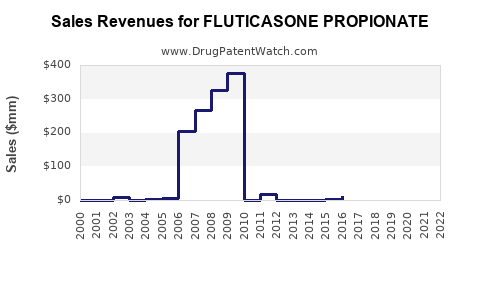

The regulatory environment significantly influences Fluticasone Propionate’s market stability and expansion prospects. The drug received regulatory approval globally in the late 1990s and early 2000s, with key markets such as the United States, European Union, and Japan establishing robust approval pathways. However, patent expiry in major markets—most notably in the U.S., where patents began expiring around 2010—has led to generic proliferation. Generics such as Teva’s Fluticasone Inhalation Powder and Mylan’s Fluticasone Propionate Nasal Spray have increased competition and driven down prices, impacting revenue streams for branded manufacturers.

Patent expiration effects: The entrance of generics has historically resulted in price erosion, with studies indicating a 40-60% reduction in pricing post-patent expiry [1]. This trend has significantly redistributed market share, pressuring branded drug revenues but simultaneously expanding access through lower-cost alternatives.

Market Segmentation and Demand Drivers

Therapeutic Segments

-

Respiratory inhalers: The primary use of Fluticasone Propionate is in inhalers for asthma and COPD. The inhaler segment dominates, with products like Fluticasone/Salmeterol combinations further extending market penetrance.

-

Nasal sprays: For allergic rhinitis, Fluticasone Nasal Spray remains a top choice, accounting for a significant global share of intranasal corticosteroid sales.

Demand Drivers

-

Rising prevalence of respiratory diseases: The global asthma prevalence is approximately 300 million, with increasing incidence linked to urbanization, pollution, and lifestyle changes [2]. COPD also contributes to demand growth, particularly in aging populations.

-

Expanding aging population: Approximately 8.5% of the global population is aged 65 or older, a demographic more susceptible to respiratory conditions, cementing long-term demand.

-

Product innovation: The development of combination inhalers (e.g., Fluticasone with Salmeterol or Formoterol) enhances therapeutic efficacy and adherence, fueling market growth.

-

Market expansion in emerging economies: Increasing healthcare infrastructure, rising awareness, and affordability enable market penetration in regions such as Asia-Pacific and Latin America.

Competitive Landscape

Major players dominating Fluticasone Propionate market include GlaxoSmithKline (GSK), Teva, Mylan, and AstraZeneca. GSK’s Flovent and Flonase remain leading branded products. However, the rush of generic entries following patent expiries has led to a fragmented market landscape.

Mergers and acquisitions are prevalent as companies seek to consolidate respiratory portfolios and expand geographic reach. For example, GSK's strategic alliances and licensing agreements aim to maintain market dominance amid generic competition.

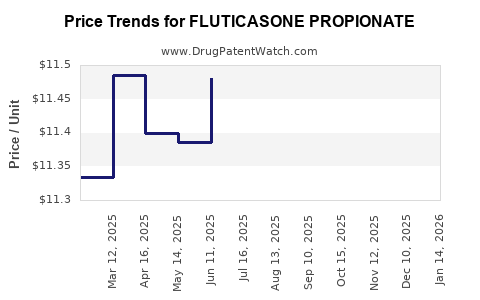

Pricing Trends and Revenue Projections

Post-patent expiry, pricing reductions have been substantial. In the U.S., gross sales of Fluticasone inhalers reached approximately $3.4 billion in 2010, declining gradually due to generic competition [3]. Nonetheless, the global market for Fluticasone-based therapies still generates billions annually, projected to grow at a compound annual growth rate (CAGR) of about 4-5% between 2023 and 2030, driven largely by emerging markets.

Revenue forecasts: According to Grand View Research, the global corticosteroids market, including Fluticasone products, is anticipated to surpass USD 3 billion by 2025, with inhaler and nasal spray segments leading growth [4].

Market Challenges

-

Generic erosion: Intense price competition impacts profit margins. Manufacturers of branded products face pressure to innovate or differentiate.

-

Regulatory hurdles: Strict regulatory standards and potential patent litigations may delay product launches or restrict market access.

-

Supply chain disruptions: Raw material shortages, manufacturing constraints, or geopolitical factors could impact steady supply and revenue.

-

Alternative therapies: Biologics and novel drug delivery systems threaten to alter the competitive landscape.

Future Outlook and Investment Opportunities

The future for Fluticasone Propionate lies in:

-

Biocompatible formulations: Developing non-steroidal anti-inflammatory agents or delivery systems that mitigate side effects.

-

Combination therapies: Increased adoption of combination inhalers maximizes therapeutic benefits and market share.

-

Geographic expansion: Focus on widening distribution in emerging markets, where respiratory disease prevalence is high, offers significant growth prospects.

-

Digital health integration: Incorporating digital adherence tools and remote monitoring can enhance clinical outcomes and foster market differentiation.

Key Market Dynamics Summary

| Aspect |

Insight |

| Patent Status |

Generic competition post-2010 reduces revenue in mature markets |

| Demand Drivers |

Rising respiratory disease prevalence, aging populations, innovation |

| Geographical Focus |

Mature markets face price erosion; emerging markets present growth opportunities |

| Competitive Environment |

Dominated by both branded and generic manufacturers; consolidation ongoing |

| Revenue Trajectory |

Stable growth anticipated despite pricing pressures; global corticosteroids market projected to reach USD 3 billion+ by 2025 |

Key Takeaways

-

Patent expirations have profoundly impacted Fluticasone Propionate revenues, compelling manufacturers to adapt through innovation and geographic expansion.

-

The increasing burden of respiratory diseases globally, especially in emerging economies, sustains strong demand for Fluticasone-based therapies.

-

Market competition, particularly from generics, has driven pricing down, but growth remains driven by product differentiation, combination therapies, and market expansion strategies.

-

Regulatory and supply chain risks necessitate strategic planning for sustained earnings.

-

Future opportunities lie in integrating digital health, developing advanced formulations, and expanding into high-growth regions.

FAQs

-

What are the key therapeutic uses of Fluticasone Propionate?

It is primarily used for managing asthma, allergic rhinitis, and other respiratory allergic conditions, often administered via inhalers and nasal sprays.

-

How has patent expiry affected Fluticasone Propionate market revenues?

Patent expiry has led to a surge in generic versions, significantly reducing prices and revenues for branded products but expanding accessibility worldwide.

-

What are the main challenges facing Fluticasone Propionate manufacturers?

Challenges include intense generic competition, regulatory hurdles, supply chain disruptions, and emerging alternative therapies.

-

What future growth strategies are companies adopting?

Focus areas include developing combination inhalers, expanding into emerging markets, adopting digital health solutions, and investing in formulation innovation.

-

How significant is the role of emerging markets in the future of Fluticasone Propionate?

Highly significant; increasing prevalence of respiratory diseases and improving healthcare infrastructure position these markets as key growth drivers.

Sources:

[1] IMS Health. (2014). Impact of Patent Expirations on the Pharmacological Market.

[2] Global Initiative for Asthma. (2022). Global Asthma Report.

[3] IQVIA. (2011). U.S. Prescription Drug Market Analysis.

[4] Grand View Research. (2022). Corticosteroids Market Size, Share & Trends Analysis.

Note: The data provided are representative of industry trends and projections based on publicly available reports and analyses as of the knowledge cutoff in 2023.