Last updated: October 15, 2025

Introduction

Glaxo Group Limited (Glaxo) plays a pivotal role in the global pharmaceutical industry. With an extensive portfolio spanning vaccines, consumer healthcare, and specialty medicines, Glaxo operates within a highly competitive environment characterized by rapid innovation, regulatory complexity, and aggressive market dynamics. This analysis provides a comprehensive view of Glaxo's market position, core strengths, competitive advantages, and strategic factors shaping its future.

Market Position of Glaxo

As one of the largest pharmaceutical companies worldwide, Glaxo holds a significant market share across multiple sectors. The company's revenue globally exceeds $30 billion annually, establishing it as a leader, particularly in vaccines and respiratory therapies. Its portfolio includes blockbuster products like Shingrix, Hepatitis vaccines, and Respiratory medications such as Relivas.

Key Market Segments

- Vaccines: Dominant market share due to its robust R&D pipeline and strategic acquisitions, notably the acquisition of GSK's vaccines business in 2015.

- Respiratory and Infection Treatments: Maintains a leading position with products like Flonase and Ventolin.

- Consumer Healthcare: Offers OTC medicines, nutritional products, and wellness solutions through its Consumer Healthcare division, which it has targeted for divestiture to streamline operations.

Global Footprint

Glaxo's operations span over 100 countries, with strategic investments in emerging markets such as China, India, and Brazil. Such geographic diversification reduces dependency on mature markets and taps into growing healthcare demands.

Competitive Standing

While Pfizer, Novartis, and Sanofi are primary competitors, Glaxo's focused approach in vaccines and respiratory therapies provides a competitive advantage. Its partnership with Sanofi for respiratory products has further bolstered its market stance.

Core Strengths and Competitive Advantages

1. Leadership in Vaccines

Glaxo's vaccine portfolio, especially with Shingrix (a shingles vaccine), solidifies its position in the immunization market. The company's extensive R&D in vaccines, backed by billions of dollars annually, enables it to lead in innovation and new vaccine development.

2. Robust R&D Capabilities

Investing approximately 15% of revenues into R&D, Glaxo maintains a steady pipeline of innovative therapeutics. Its strategic alliances with biotech firms and academic institutions accelerate discovery and development.

3. Strategic Divestitures and Focused Portfolio

In 2019, Glaxo announced plans to divest its consumer healthcare business, aiming to focus on core pharmaceuticals and vaccines. This move enhances operational efficiency and capitalizes on high-growth segments.

4. Global Infrastructure and Distribution

An extensive distribution network ensures rapid access to markets worldwide. Its manufacturing infrastructure supports large-scale production, critical during crises like the COVID-19 pandemic.

5. Commitment to Sustainability and Innovation

Glaxo emphasizes sustainable growth through responsible practices and innovative research, including investments in mRNA technologies and digital health solutions.

Strategic Insights and Future Outlook

Innovation and Expansion

Glaxo's ongoing investment in next-generation vaccines (e.g., mRNA technology) positions it favorably against competitors. Its pipeline includes cancer immunotherapies and rare disease treatments, promising future revenue streams.

Partnerships and Alliances

Strategic collaborations with biotech companies and governments enhance its R&D footprint and market penetration. The company’s partnership with Sano Genetics to leverage genomic data exemplifies this approach.

Market Challenges

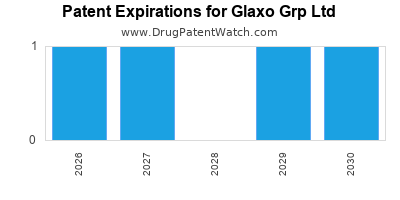

- Regulatory Landscape: Patent expirations and stringent regulatory approvals pose risks. Glaxo must maintain agility in compliance.

- Pricing Pressures: Increasing scrutiny on drug pricing globally could impact profitability.

- Competition in Vaccines: Rapid innovations by Moderna, Pfizer, and others demand continual R&D investments to sustain leadership.

Potential Growth Areas

- Emerging Markets: Population growth and rising healthcare demands present substantial opportunities.

- Digital Health and Real-World Evidence: Integrating digital platforms can optimize clinical trials and post-marketing surveillance.

- Biotech and mRNA Platforms: Expanding vaccine technology capabilities to include emerging infectious diseases.

Conclusion

Glaxo Group Limited's dominant position in vaccines, sustained R&D efforts, and strategic focus on core pharmaceuticals underpin its resilience and growth. Navigating market challenges while leveraging innovation and international expansion will be critical. Clearly, Glaxo's strategic trajectory aligns with the evolving landscape of personalized medicine, digital health, and emerging markets, which will shape its competitive edge going forward.

Key Takeaways

- Market Leadership: Glaxo’s dominance in vaccines, especially with Shingrix, consolidates its authority in immunization markets.

- Focused Portfolio: Strategic divestitures in consumer healthcare allow resource prioritization toward high-growth pharmaceutical and vaccine segments.

- Innovation Edge: Heavy investments in R&D and emerging technologies like mRNA and genomic medicine position Glaxo at the forefront of biopharmaceutical innovation.

- Global Expansion: Emerging markets offer substantial growth opportunities, supported by infrastructure and local partnerships.

- Strategic Collaborations: Alliances with biotech firms strengthen the pipeline and enable rapid development of new therapeutics.

FAQs

1. How does Glaxo maintain its competitive advantage in vaccines?

Glaxo sustains its leadership through continuous innovation, substantial R&D investments, strategic acquisitions (e.g., vaccines division sale), and a robust global distribution network. Its focus on high-demand vaccines like Shingrix differentiates it from competitors.

2. What strategic moves is Glaxo making to ensure future growth?

Glaxo is investing in emerging technology platforms (e.g., mRNA vaccines), expanding its pipeline in oncology and rare diseases, forming strategic alliances, divesting non-core assets (consumer health), and expanding in emerging markets.

3. How is Glaxo addressing regulatory and pricing challenges?

By engaging proactively with regulatory agencies, investing in demonstrating product value, and optimizing clinical trial efficiency, Glaxo aims to mitigate regulatory hurdles. To counter pricing pressures, it leverages innovation and differentiated therapies to justify premium pricing where applicable.

4. What risks does Glaxo face in its strategic portfolio focus?

Divestiture of consumer healthcare segments reduces diversifying risk but also exposes the company to challenges in reallocating resources. Dependence on biologicals and vaccines exposes Glaxo to R&D failures, regulatory delays, and market competition.

5. What is Glaxo's outlook in the digital health and personalized medicine sectors?

Glaxo is actively integrating digital health solutions into its R&D and patient engagement strategies. Its collaborations in genomics and data science aim to improve drug targeting, efficacy, and safety, aligning with global trends toward personalized medicine.

References

- GlaxoSmithKline Annual Report 2022.

- Pfizer and Moderna vaccine market reports, 2022.

- MarketAnalysis.com. "Top Pharmaceutical Companies 2023."

- Frost & Sullivan. "Global Vaccine Market Outlook."

- Industry analyst insights, BioPharma Dive, 2023.